A Decentralized Exchange (DEX) facilitates direct, peer-to-peer cryptocurrency swaps using smart contracts without intermediaries, offering non-custodial trading and enhanced user control over assets.

What Is a Decentralized Exchange (DEX) in Crypto?

A Decentralized Exchange (DEX) is a peer-to-peer marketplace facilitating cryptocurrency trades directly between users. It operates on a blockchain through smart contracts, removing the need for a central authority or intermediary. DEXs prioritize non-custodial trading, meaning users retain control of their private keys and assets throughout the entire exchange process. This architecture significantly reduces counterparty risk and enhances security by eliminating single points of failure.

While understanding Decentralized Exchange (DEX) is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

The Meaning of “DEX” in Cryptocurrency Markets

The term “DEX” in cryptocurrency markets signifies a trading platform where “decentralized” applies to its operational structure. Unlike traditional financial institutions or centralized exchanges (CEXs) like Coinbase, DEXs do not hold user funds. Instead, they rely on self-executing code, known as smart contracts, to manage transactions and enforce trading rules. This fundamental design ensures transparency and censorship resistance, as no single entity controls the network or its data.

The Role of Smart Contracts in Peer-to-Peer Trading

Smart contracts play a pivotal role in enabling peer-to-peer trading on DEXs. These self-executing agreements automate transaction execution and eliminate the need for third-party verification. When a user initiates a trade on a DEX, the relevant smart contract automatically processes the order, matches it with available liquidity, and facilitates the asset swap. This automation ensures efficient and trustless exchanges, directly connecting buyers and sellers without human intervention. Smart contracts operate on various blockchains, including Ethereum, Solana, and Binance Smart Chain.

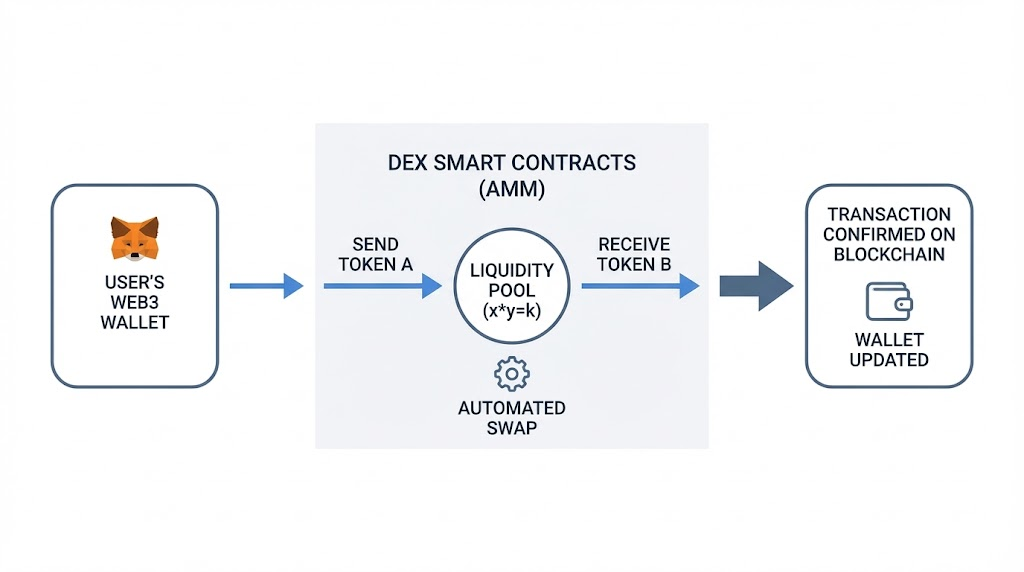

How Does a DEX Work?

A DEX operates by using smart contracts to automate the matching and clearing of trades between users, often leveraging specialized mechanisms like Automated Market Makers (AMMs) and liquidity pools. This contrasts sharply with centralized exchanges, which depend on traditional order books and intermediaries. The underlying technology ensures that funds never leave the user’s wallet until the transaction executes directly on the blockchain. This method provides greater security and control for traders.

Automated Market Makers (AMMs) and Pricing Algorithms

Automated Market Makers (AMMs) drive the majority of modern DEX operations. AMMs replace traditional order books with mathematical formulas and liquidity pools to determine asset prices. Users trade against a collective pool of assets rather than directly against other individuals. The most common formula is x * y = k, where ‘x’ and ‘y’ represent the quantities of two tokens in a pool, and ‘k’ is a constant. This algorithm automatically adjusts token prices based on the supply and demand within the pool, ensuring continuous liquidity and efficient swaps. Uniswap, for example, primarily uses this AMM model.

Liquidity Pools and Liquidity Providers (LPs)

Liquidity pools are crucial to the AMM model, providing the capital necessary for trades. These pools consist of two or more token assets locked into a smart contract. Users, known as Liquidity Providers (LPs), deposit equivalent values of these token pairs into the pool. In return, LPs receive a share of the trading fees generated by the pool, typically ranging from 0.01% to 1.0% per transaction. Providing liquidity offers earnings but carries specific risks.

Order Book Models (On-chain vs. Off-chain)

Some DEXs still utilize order book models, similar to centralized exchanges, but implement them in a decentralized manner. On-chain order book DEXs store all orders, cancellations, and transactions directly on the blockchain. This method offers maximum transparency and censorship resistance but results in higher gas fees and slower transaction speeds due to network congestion. dYdX, for instance, previously operated a fully on-chain order book for certain assets.

Off-chain order book DEXs keep order matching off the blockchain, only settling the final trade on-chain. This approach significantly reduces gas fees and increases transaction speed. However, it introduces a degree of centralization, as a trusted third party often manages the off-chain order book. While more efficient, it slightly deviates from the pure decentralized ethos. Serum, a DEX built on Solana, utilizes an off-chain order book with on-chain settlement.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesKey Differences Between DEX and CEX

DEXs and CEXs represent two fundamentally different approaches to cryptocurrency trading, primarily diverging in asset custody, regulatory compliance, and listing procedures. Understanding these distinctions helps users choose the appropriate platform for their needs. A key difference lies in who controls the user’s funds during trading operations. This impacts security, privacy, and accessibility.

Custody of Assets (Non-Custodial vs. Custodial)

The most significant difference between DEXs and CEXs relates to asset custody. DEXs are non-custodial, meaning users retain full control of their private keys and funds at all times. Trades execute directly from a user’s Web3 wallet, such as MetaMask or Phantom, without transferring assets to the exchange itself. This design eliminates the risk of exchange hacks or insolvency impacting user holdings. In contrast, CEXs like Coinbase are custodial, requiring users to deposit funds into the exchange’s wallets before trading. The exchange then controls these assets, creating a single point of failure and potential vulnerability to hacks or regulatory seizures. Coinbase is a centralized exchange and does not operate as a DEX.

KYC and Anonymity Requirements

DEXs generally operate without Know Your Customer (KYC) requirements, offering a higher degree of anonymity to users. This absence of personal data collection aligns with the decentralized ethos of privacy. Users simply connect their wallets and begin trading, without submitting ID documents or proof of address. CEXs, however, must adhere to strict KYC and Anti-Money Laundering (AML) regulations due to their centralized nature. They require extensive personal identification from users to prevent financial crime, often linking user accounts to real-world identities. This regulatory burden provides a degree of consumer protection but sacrifices user privacy.

Listing Processes and Asset Availability

Asset availability and listing processes also differ dramatically. On a DEX, anyone can list a new token by providing initial liquidity to a smart contract, usually without permission or extensive vetting. This open-door policy provides broad access to emerging and niche projects but also carries significant risks of scams or illiquid tokens. CEXs employ a rigorous, often expensive, listing process, involving legal checks, technical audits, and market analysis. This selective approach provides a curated selection of reputable assets but limits the variety of available tokens, sometimes excluding promising smaller projects.

Types of Decentralized Exchanges

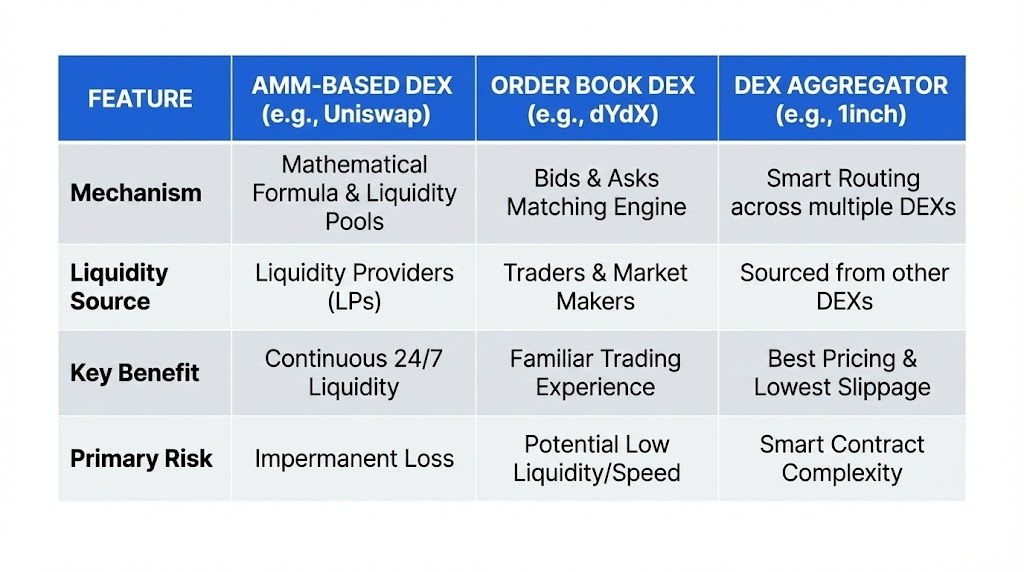

The decentralized exchange ecosystem includes various models, each designed to optimize specific aspects of trading. Understanding these classifications helps users navigate the diverse landscape of DeFi. These models mainly differ in their underlying liquidity provision and order matching mechanisms. The growth of DeFi continuously introduces new types.

AMM-Based DEXs (e.g., Uniswap, SushiSwap)

AMM-based DEXs represent the most prevalent type, exemplified by platforms like Uniswap and SushiSwap. These exchanges rely on liquidity pools and mathematical algorithms to facilitate token swaps. They offer continuous, 24/7 liquidity and generally feature transparent fee structures. Users trade directly against the smart contract’s liquidity pool, and prices adjust automatically based on the constant product formula. This model thrives on blockchain networks like Ethereum, supporting thousands of token pairs.

Order Book DEXs (e.g., dYdX, Serum)

Order book DEXs mimic traditional stock exchanges by using an order book to match buy and sell orders. dYdX, a perpetual futures DEX, and Serum, built on Solana, are prominent examples. While some maintain fully on-chain order books, others, like Serum, utilize an off-chain order book for speed and lower fees, with final settlements occurring on-chain. These platforms often cater to more experienced traders seeking advanced trading features like limit orders and margin trading. Transaction speeds vary significantly depending on the underlying blockchain’s capabilities.

DEX Aggregators (e.g., 1inch, Jupiter)

DEX aggregators enhance user experience by sourcing liquidity and optimal pricing across multiple decentralized exchanges. Platforms like 1inch on Ethereum and Jupiter on Solana scan various DEXs to find the best swap rates and minimize slippage for users. They essentially act as a smart routing layer, breaking down large orders into smaller chunks across different pools to secure the most favorable execution. This optimizes trading efficiency and can reduce transaction costs, providing a significant advantage for active traders.

Is a DEX Crypto Exchange Safe?

A DEX crypto exchange offers a high degree of security against certain risks due to its non-custodial nature, but it presents other distinct vulnerabilities. Users retain control of their funds, reducing the risk of centralized hacks. However, the reliance on smart contracts and open-source code introduces different types of security challenges. Understanding these risks is crucial for any participant.

Smart Contract Vulnerabilities and Audits

DEXs depend entirely on smart contracts, which can harbor vulnerabilities if not meticulously coded and audited. Bugs, exploits, or logical flaws in these contracts can lead to significant financial losses. High-profile incidents of smart contract hacks have resulted in millions of dollars being stolen from liquidity pools or exploited through reentrancy attacks. Reputable DEXs undergo multiple independent security audits by firms like CertiK or PeckShield. Users should always verify audit reports before engaging with a new DEX.

Impermanent Loss for Liquidity Providers

Impermanent loss is a specific risk faced by liquidity providers (LPs) in AMM-based DEXs. It occurs when the price of deposited assets changes relative to when they were deposited. If one asset in a pair significantly outperforms or underperforms the other, LPs can incur a financial loss compared to simply holding the assets in their wallet. This “loss” is only realized if the LP withdraws their liquidity before prices revert. Studies indicate that a 100% price divergence between assets can lead to an impermanent loss of approximately 5.7%.

📌 REMEMBER: Impermanent loss is an opportunity cost, not a direct loss of funds. It only becomes permanent upon withdrawal from the liquidity pool.

Rug Pulls and Token Scams

The open nature of DEX listings creates a fertile ground for rug pulls and token scams. A rug pull occurs when developers create a new token, list it on a DEX, encourage investors to buy it, and then withdraw all liquidity from the pool, leaving investors with worthless assets. These fraudulent schemes exploit the ease of token creation and listing on decentralized platforms. Users must exercise extreme caution, conducting thorough due diligence on new projects and tokens, verifying team credibility, and checking smart contract code where possible.

How to Use a DEX

Using a DEX involves a straightforward process, primarily centered around connecting a Web3 wallet and interacting with the platform’s smart contracts. The initial setup requires minimal technical expertise. This enables quick access to decentralized trading and liquidity provision opportunities.

Connecting a Web3 Wallet (MetaMask, Phantom)

The primary step to using any DEX is connecting a compatible Web3 wallet. Wallets like MetaMask (for Ethereum Virtual Machine-compatible blockchains) or Phantom (for Solana) serve as your gateway to decentralized finance. You typically navigate to the DEX’s website and locate a “Connect Wallet” button. After approving the connection, your wallet establishes a secure link with the DEX’s smart contracts. This allows you to sign transactions, manage your crypto holdings, and participate in trading activities directly from your wallet, without ever depositing funds onto the exchange itself.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountDEX vs. CEX: Understanding the Core Differences

Understanding the fundamental distinctions between Decentralized Exchanges (DEXs) and Centralized Exchanges (CEXs) is crucial for any crypto participant, as these differences impact security, privacy, and control over assets.

| Aspect | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

| Asset Custody | Custodial — users deposit funds; exchange controls private keys | Non-custodial — users retain full control of private keys |

| Control Over Funds | Exchange can freeze, restrict, or manage assets | Full user control at all times |

| Counterparty Risk | High — funds at risk if exchange is hacked, insolvent, or mismanaged (e.g., Mt. Gox, FTX) | Low — no central entity holding user funds |

| Trading Mechanism | Order book–based matching (buyers & sellers) | Smart contracts (AMMs, liquidity pools, or order-book DEXs) |

| Liquidity Model | Centralized liquidity; typically deeper for major pairs | Liquidity pools; consistent but may vary by pair |

| Market Share | Dominates spot trading (often 90%+ of volume) | Smaller but growing share (tens of billions monthly) |

| Execution & Slippage | Generally tighter spreads and lower slippage for major assets | Slippage can be higher, especially for low-liquidity pairs |

| Fiat On-Ramps | Yes (bank cards, wire transfers) | Rare or indirect (via third-party bridges) |

| KYC / AML | Required — identity verification mandatory | Usually not required — pseudonymous trading |

| Privacy | Low — personal data stored by the exchange | Higher — wallet-based trading without identity |

| Regulatory Status | Heavily regulated financial entities | Largely permissionless and less regulated |

| Security Model | Centralized custody creates hacker honeypots | Distributed custody reduces single points of failure |

| Primary Security Risks | Exchange hacks, internal fraud, insolvency | Smart contract bugs, front-end attacks, MEV |

| Downtime Risk | Possible outages, halted trading, withdrawals paused | Protocol runs continuously on-chain |

| Transparency | Limited — internal operations opaque | High — smart contracts and transactions are public |

| Ease of Use | Beginner-friendly interfaces and support | Requires wallet knowledge and on-chain interaction |

| Typical Users | Beginners, institutions, high-frequency traders | DeFi users, privacy-focused traders, self-custody advocates |

| Notable Volume Stats | Binance alone processed $20T+ in 2023 | DEX cumulative volume surpassed $2T by mid-2023 |

Key Takeaways

- DEXs facilitate direct peer-to-peer crypto trades through smart contracts.

- Automated Market Makers (AMMs) drive most DEXs using liquidity pools for pricing.

- Non-custodial trading on DEXs provides greater user control over assets.

- Risks include smart contract vulnerabilities, impermanent loss, and token scams.

- Connecting a Web3 wallet is the primary method for accessing DEX platforms.

Bottom Line

Decentralized Exchanges (DEXs) represent a fundamental shift in market architecture, removing the “middleman” to prioritize user sovereignty and transparency through code-driven trust. While they offer unparalleled control and privacy in the 2026 financial landscape, they also place the full burden of security and risk management on the individual investor. To navigate this space successfully, users must balance the benefits of non-custodial trading with a rigorous commitment to smart contract due diligence and wallet security best practices.