This guide covers essential strategies, fee structures, and the psychological discipline required for successful leveraged trading.

While understanding Leveraged Crypto Trading is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What is leveraged crypto trading?

Leveraged crypto trading allows traders to control larger positions with a relatively small amount of their own capital. It essentially provides a loan from the exchange, enabling traders to amplify their exposure to cryptocurrency price movements.

This means that even small price changes can lead to significant profits or losses, making it a high-risk, high-reward strategy.

The Basics: Amplifying Your Crypto Positions

Leverage is the core concept in leveraged crypto trading, acting as a financial tool to increase buying or selling power. Traders borrow capital from a crypto exchange to open positions much larger than their initial investment. For example, 10x leverage means a $100 investment controls a $1,000 position. While this amplifies potential gains, it proportionally increases the risk of loss, underscoring the necessity of a sound risk management strategy.

How Leveraged Crypto Trading Works?

Leveraged crypto trading operates through a system of collateral and borrowed funds, allowing traders to take larger positions. It involves several key terms and mechanisms that dictate how positions are opened, maintained, and closed. Understanding these components is fundamental to engaging in leveraged trading effectively.

Margin: Your Collateral for Leveraged Positions

Margin refers to the collateral a trader must deposit with an exchange to open and maintain a leveraged position. It acts as a good-faith deposit, making sure that the trader can cover potential losses. Initial margin is the amount required to open a trade, while maintenance margin is the minimum equity needed to keep the position open. If your position’s value drops and your margin falls below the maintenance level, it triggers a liquidation.

Two primary types of margin exist: Cross Margin and Isolated Margin. Cross margin uses the entire available balance in your futures wallet as collateral, meaning all your positions draw from a single pool. This offers greater flexibility but increases the risk of liquidating your entire balance if one trade goes significantly wrong.

In contrast, isolated margin allocates a specific amount of capital to an individual position. This limits potential losses to only that allocated amount, making it easier to manage risk on a per-trade basis, though requiring more active management.

| Margin Type | Collateral Source | Liquidation Impact | Risk Profile |

| Cross Margin | Entire futures wallet | Affects all positions | Higher, but flexible |

| Isolated Margin | Specific allocated funds | Affects only one position | Lower, more controlled |

The Threat of Liquidation: When Your Position Closes Automatically

Liquidation is the automatic closing of a leveraged position by a crypto exchange when a trader’s margin balance falls below the required maintenance margin. This typically happens rapidly during periods of high market volatility, as the market moves against the trader’s position.

The exchange forcefully closes the position to prevent the trader’s losses from exceeding their available collateral, protecting the exchange from bad debt. Many users have reported losing all their money with high leverage, and liquidation is the direct mechanism for such losses.

This process often results in the loss of the entire margin dedicated to that position. The higher the leverage used, the smaller the price movement required to trigger liquidation. For instance, a 100x leveraged position can be liquidated by a mere 1% price swing against the trade, leaving no room for error.

Futures Contracts & Perpetual Swaps: The Vehicles of Leverage

Futures contracts are derivative financial contracts that obligate parties to transact an asset at a predetermined future date and price. In crypto, these are the primary instruments for leveraged trading. Unlike traditional futures, perpetual swaps are a type of futures contract without an expiry date, allowing traders to hold positions indefinitely. This “perpetual” nature makes them highly popular in the crypto market.

Leading crypto exchanges like Binance and Bybit offer up to 125x leverage on certain perpetual swap contracts, though such high leverage is generally discouraged for beginners. The mechanism keeping the price of a perpetual swap close to the underlying spot price is the funding rate. This rate adjusts based on market sentiment and supply/demand.

Funding rates for perpetual swaps typically adjust every 8 hours, influencing the cost of holding leveraged positions based on market supply and demand. If the perpetual swap price is higher than the spot price, longs pay shorts, and vice versa. This means holding a leveraged position can incur ongoing costs or even earn a small income, depending on the market’s direction and the funding rate.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesMastering Risk Management in Leveraged Crypto Trading

Risk management is the single most critical factor differentiating successful leveraged crypto traders from those who fail. The amplified nature of leverage means that uncontrolled risks can lead to rapid and substantial capital loss. It is not merely a suggestion but a mandatory framework for sustainable trading.

Why Risk Management is Non-Negotiable?

Approximately 80% of retail traders using leverage lose money within the first year, primarily due to poor risk management and emotional trading, according to Forex Broker Review. This stark statistic highlights the inherent dangers of amplified exposure, especially in the highly volatile cryptocurrency markets.

Without a structured approach, leverage can quickly turn minor market fluctuations into catastrophic losses. The inherent market volatility of cryptocurrencies further exacerbates these risks, making disciplined risk management an absolute necessity.

Core Tools for Limiting Losses: Stop-Losses and Position Sizing

Implementing a Stop-Loss Order is arguably the most fundamental risk management tool. A stop-loss order automatically closes a position when the asset price reaches a predefined level, effectively limiting potential losses on a trade.

Traders can place these as market orders (executing at the next available market price) or limit orders (executing only at the specified price or better). For instance, if you buy Bitcoin at $30,000 with a stop-loss at $29,000, your position will close if Bitcoin drops to that level, preventing further downside.

Position sizing complements stop-loss orders by determining the appropriate amount of capital to allocate to any single trade.

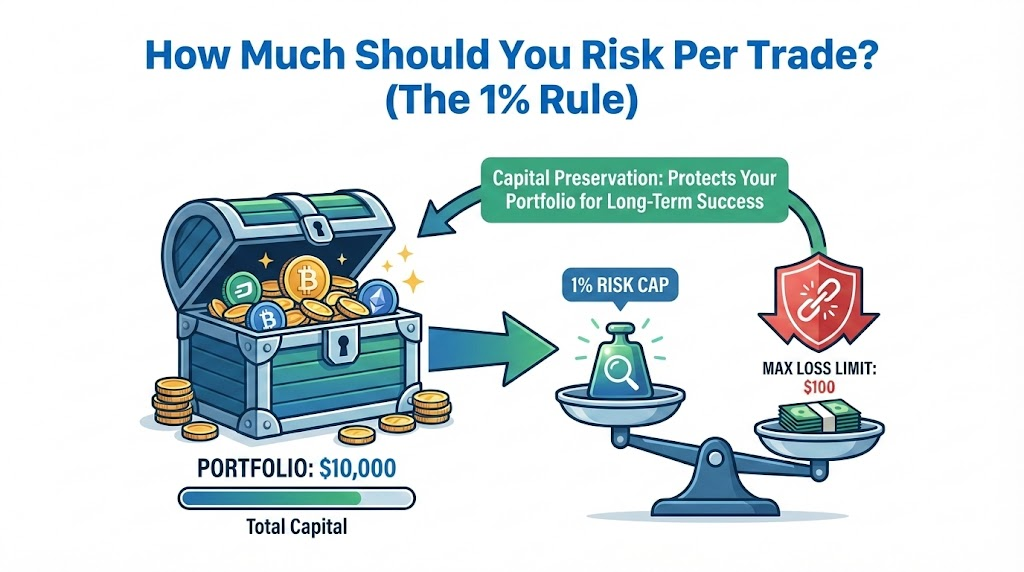

A common rule of thumb is the “1% or 2% rule,” where a trader risks no more than 1% or 2% of their total trading capital on any given trade.

For example, with a $10,000 portfolio, you would risk a maximum of $100-$200 per trade. This strategy makes sure that even a string of losing trades does not significantly deplete your capital, allowing for long-term survival in the market.

Choosing Your Leverage Ratio: What’s Right for You?

Selecting an appropriate leverage ratio is a critical risk management decision that depends heavily on individual experience, capital, and tolerance for market volatility. While exchanges may offer up to 125x leverage, such high ratios are extremely risky and rarely suitable for anyone but the most experienced, well-capitalized traders.

For beginners, starting with very low leverage, such as 2x to 5x, is strongly advisable.

This lower leverage allows new traders to understand the mechanics of amplified positions without exposing their capital to extreme liquidation risks. As experience grows and a robust risk management strategy is consistently applied, traders might gradually consider slightly higher leverage. However, the goal remains capital preservation, not simply maximizing exposure.

Leveraging Technical Analysis for Better Risk Control

Technical analysis provides tools and methodologies to forecast future price movements based on historical price and volume data. In leveraged crypto trading, it becomes crucial for identifying optimal entry and exit points, setting effective stop-loss orders, and managing overall risk. Traders use indicators like moving averages, Relative Strength Index (RSI), and MACD to gauge market sentiment and potential reversals.

Understanding support and resistance levels, trend lines, and chart patterns helps in defining areas where price is likely to react, thus informing strategic trade placement. Additionally, analyzing the Order Book can offer insights into immediate liquidity and potential price pressure points, further aiding in more precise risk management decisions.

Choosing the Best Crypto Exchange for Leveraged Trading

Selecting the right crypto exchange is foundational for a safe and effective leveraged crypto trading experience. Different platforms offer varying levels of leverage, fee structures, and security protocols. A thorough evaluation of these factors makes sure that your chosen exchange aligns with your trading strategy and risk appetite.

Key Factors for Exchange Selection

When choosing a crypto exchange for leveraged trading, several factors require careful consideration. The maximum leverage offered is often a primary draw, with some platforms like Binance and Bybit providing up to 125x leverage, although this is generally discouraged for new traders.

Asset variety is another crucial point; a good exchange should offer a wide range of trading pairs, including major cryptocurrencies and popular altcoins. Security features, such as two-factor authentication (2FA), cold storage for funds, and insurance funds, are paramount to protect your assets.

The user interface and overall user experience also play a significant role, especially for those new to complex trading. Finally, the exchange’s reputation and regulatory compliance are essential for trust and peace of mind.

Trading Fees: Maker, Taker, and Funding

Trading fees are an unavoidable component of leveraged crypto trading and can significantly impact overall profitability, especially for active traders. Exchanges typically employ a maker-taker fee model. Makers add liquidity to the order book by placing limit orders, often paying lower fees (or even receiving rebates). Takers remove liquidity by executing market orders, generally incurring higher fees. These fees can range from 0.01% to 0.1% or more per trade.

Beyond maker and taker fees, the funding rate for perpetual swaps also represents a recurring cost or benefit. As discussed, this rate adjusts every 8 hours and is paid between long and short positions to keep the perpetual swap price anchored to the spot price.

Understanding these various fee structures is vital for calculating potential profitability and managing the costs associated with holding leveraged positions.

Top Leveraged Crypto Trading Platforms

Choosing from the numerous crypto exchange options requires a clear understanding of their offerings. The following table compares some leading platforms, focusing on key attributes relevant to leveraged trading. This overview helps in identifying a platform that matches your specific trading needs and preferences.

| Exchange | Max Leverage | Maker/Taker Fees | Supported Assets | KYC Required | Key Features |

| Binance | 125x | 0.015% / 0.035% | 350+ | Yes | Largest volume, wide features |

| Bybit | 100x | 0.02% / 0.055% | 300+ | Yes | User-friendly, copy trading |

| OKX | 100x | 0.02% / 0.05% | 300+ | Yes | Advanced tools, robust API |

| KuCoin | 100x | 0.02% / 0.06% | 700+ | Optional (limited) | Altcoin variety, low fees |

Understanding KYC and Regulatory Compliance

Know Your Customer (KYC) is a mandatory process for most reputable crypto exchanges, requiring users to verify their identity by submitting personal documents. This process is crucial for preventing fraud, money laundering, and terrorist financing, aligning with global anti-money laundering (AML) regulations. While it may seem inconvenient, KYC enhances the security and integrity of the trading platform.

The Regulatory Landscape for leveraged crypto trading is constantly evolving and varies significantly by jurisdiction. Some countries have outright banned or heavily restricted leveraged crypto products, while others have established specific licensing requirements. Traders must be aware of their local regulations, as non-compliance can lead to legal penalties or loss of funds.

Why Most Beginners Fail (And How to Avoid Common Pitfalls)

Successful leveraged trading isn’t just about understanding mechanics; it’s about mastering your mindset and avoiding behavioral biases. Unlike most guides, we delve into the psychology behind trading failures.

Approximately 80% of retail traders using leverage lose money within the first year, primarily due to poor risk management and emotional trading, as reported by Forex Broker Review. This staggering statistic underscores that the biggest enemy in leveraged crypto trading often resides within the trader themselves.

Common pitfalls include unchecked greed, which pushes traders to take excessive leverage or hold onto winning positions for too long, only to see them reverse. Conversely, fear can lead to panic selling at the bottom or missing out on profitable opportunities due to hesitation (FOMO – Fear Of Missing Out).

The forum pain point, “Lost all my money with 100x leverage, how do I avoid this?”, directly implies emotional decision-making overriding sound strategy. Disciplined risk management coupled with emotional control is the cornerstone of consistent profitability, transforming leveraged trading from mere gambling into a strategic endeavor.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountGetting Started with Leveraged Crypto Trading: A Step-by-Step Guide

Embarking on leveraged crypto trading requires a structured approach to minimize initial risks and build confidence. Following a clear, step-by-step process makes sure that you set up your first trade correctly and with appropriate risk management measures in place. It emphasizes starting small and understanding each stage before scaling up.

Your First Leveraged Trade: A Practical Walkthrough

- Choose a Crypto Exchange: Select a reputable crypto exchange that offers leveraged trading, considering factors like fees, security, and available assets (refer to the “Top Leveraged Crypto Trading Platforms” table).

- Complete KYC: Fulfill the KYC (Know Your Customer) requirements to verify your identity. This is a mandatory step for most regulated platforms.

- Deposit Collateral: Fund your futures wallet with the collateral needed to open positions. Start with a small, manageable amount you are prepared to lose.

- Select a Trading Pair: Choose the cryptocurrency pair you wish to trade (e.g., BTC/USDT).

- Choose Leverage: Carefully select your leverage ratio. For beginners, start with very low leverage (2x-5x) to understand the mechanics without excessive risk.

- Place an Order: Decide whether to go long (expecting price to rise) or short (expecting price to fall). Use a limit order or market order to enter the trade. Crucially, always set a Stop-Loss Order immediately to define your maximum acceptable loss.

- Monitor and Manage: Continuously monitor your position and adjust your risk management parameters as needed.

Key Takeaways

- Offloading is Key: Crypto engines free your main CPU, boosting performance and efficiency.

- Hardware for Security: Dedicated hardware engines provide superior speed and crucial key isolation, making them far more resistant to attacks.

- Ubiquitous Protectors: From your smartphone’s Secure Enclave to cloud servers, crypto engines are silently safeguarding your data.

- Future-Proofing: The evolution towards post-quantum cryptography will rely heavily on advanced crypto engine designs.

BOTTOM LINE

Leveraged crypto trading is a high-stakes financial instrument where the potential for amplified gains is matched only by the risk of total capital loss. Survival in this volatile arena depends entirely on replacing emotional impulses with a rigid, mathematical risk management framework. By prioritizing capital preservation through strict position sizing, disciplined stop-loss placement, and the selective use of top-tier exchanges, you shift from gambling to professional speculation. In a market that never sleeps, your mental discipline and respect for the mechanics of leverage are your only true safeguards.