No, You cannot trade forex directly on Webull in 2026. Webull does not offer currency pairs, but users can gain forex exposure through ETFs or currency-related assets. Dedicated forex brokers like OANDA, 7102.com, and 22 Brokers provide access to 24-hour currency markets with specialized tools and direct forex trading.

While understanding Trading Forex on Webull is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

At Volity, we help traders make smarter decisions with clear, practical insights into today’s evolving trading platforms. If you’re exploring forex trading options in 2026, this guide breaks down what Webull offers, what it doesn’t—and which alternatives can give you full currency market access.

Key Takeaways

- You cannot directly trade forex currency pairs like EUR/USD on Webull as of 2026.

- Webull is regulated for stocks and options, not for forex, which requires different licenses and compliance under NFA/CFTC rules.

- You can gain indirect forex exposure on Webull by trading currency-tracking ETFs or the stocks of global companies.

- To trade forex directly, you must use a dedicated forex broker like OANDA, FOREX.com, or IG Markets.

- Webull is best for commission-free stock and ETF trading, while forex brokers offer higher leverage and specialized tools like MetaTrader.

- The platform’s paper trading feature lets you track currency prices, but it does not simulate real forex trading.

What is Webull?

Webull is a commission-free trading platform that offers access to stocks, ETFs, options, and cryptocurrencies. It provides real-time market data, advanced charting tools, and mobile-friendly trading. Webull is regulated by the SEC and FINRA, making it a secure platform for U.S.-based retail traders.

Does Webull Offer Forex Trading?

Webull does not support direct forex trading. You cannot buy or sell currency pairs like EUR/USD or GBP/JPY on the platform. Forex brokers specialize in currency markets, but Webull focuses on stocks, ETFs, options, and cryptocurrencies. Some traders get confused when they see forex prices on Webull. The platform provides real-time forex exchange rates, but they are for informational purposes only. You can track currency movements, but you cannot place trades. And even if Webull were to support currency pairs, you would still need to understand forex order types to execute trades effectively—something the platform does not currently provide.

Why doesn’t Webull offer forex trading? Regulations play a major role. Forex trading requires a different set of licenses and compliance measures. Webull operates under SEC and FINRA regulations, which focus on securities and options. Forex brokers, on the other hand, follow NFA and CFTC rules in the U.S.

You might wonder if Webull will add forex trading in the future. The platform continues to expand its offerings, but no official statements suggest forex plans. If you need direct forex trading, you must use a dedicated forex broker.

What Are The Alternatives to Forex Trading on Webull?

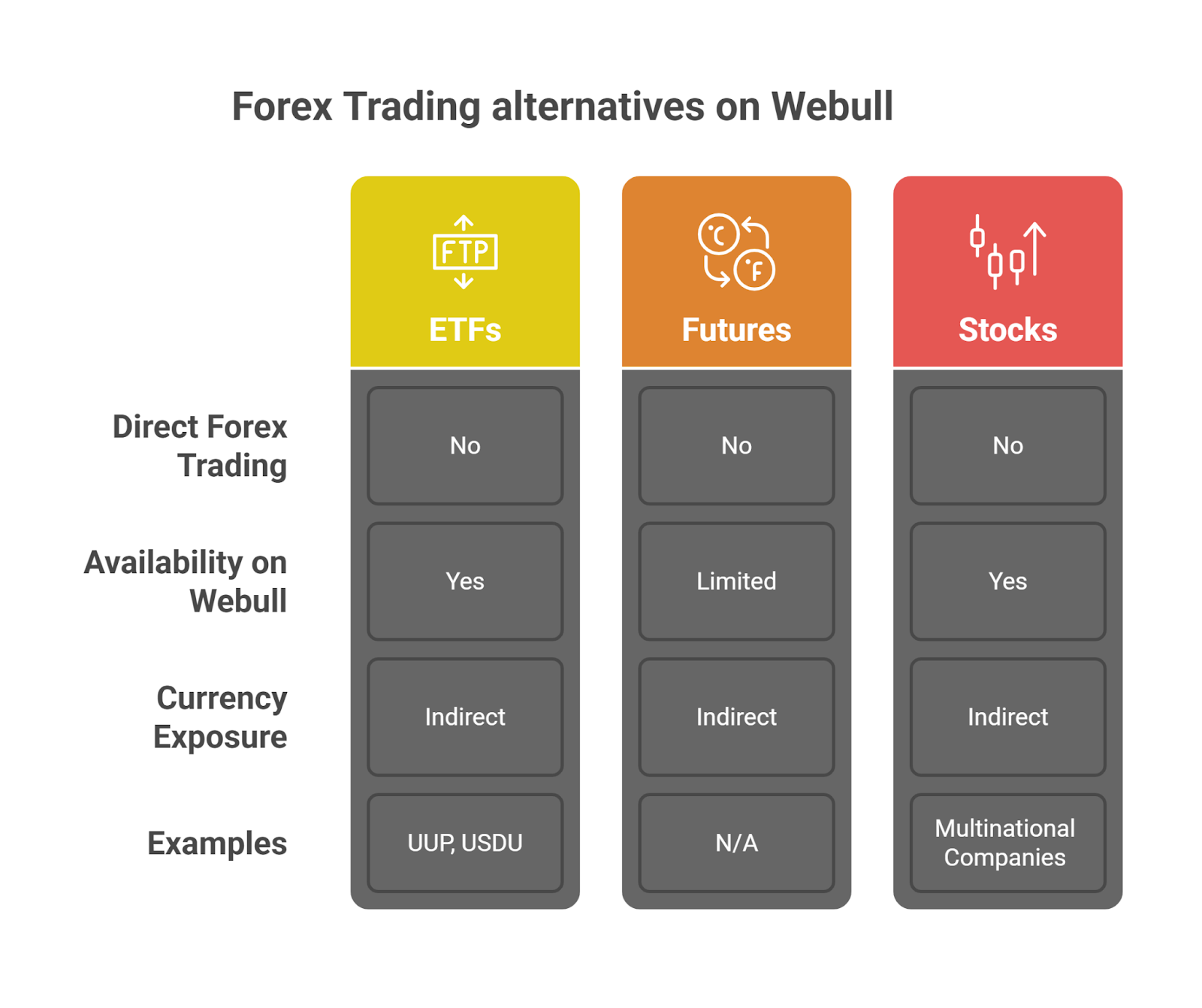

You cannot trade forex directly on Webull, but you have alternatives. The platform offers investment options that provide indirect exposure to currency markets.

- ETFs track currency movements. You can invest in currency exchange-traded funds (ETFs) that follow major forex pairs. Funds like the Invesco DB US Dollar Index Bullish Fund (UUP) or the WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) move based on currency fluctuations.

- Futures offer another way to trade currencies. Webull provides access to some futures products, but forex futures remain unavailable. Platforms like TD Ameritrade or Interactive Brokers offer forex futures trading.

- Stocks from multinational companies react to currency shifts. Companies that operate globally earn revenue in multiple currencies. A strong or weak dollar affects their profits. You can trade stocks of major exporters or international brands to gain exposure to currency movements.

Which option works best for you? That depends on your trading goals. If you want to trade currencies directly, a dedicated forex broker remains the best choice. If you prefer indirect exposure, Webull offers several alternatives.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow Does Webull Compare to Forex Brokers?

Webull and forex brokers are tailored to different trading needs—while Webull caters to stock and options traders, forex brokers provide tools for currency trading with higher leverage and broader asset exposure. To help you decide which platform aligns better with your strategy, please check the detailed comparison that highlights their features, fees, leverage, tools, and asset access.

| Feature | Webull | Forex Brokers |

| Asset Classes | Stocks, ETFs, Options, Cryptocurrencies | Major, Minor, Exotic Currency Pairs (e.g., EUR/USD) |

| Commission Fees | Commission-free on stocks and ETFs | Earn through spreads; some charge per-trade commissions |

| Leverage | Margin trading available, but lower leverage | High leverage (up to 50:1 in the U.S., higher elsewhere) |

| Forex Trading | Not supported | Core offering with broad currency pair access |

| Trading Platforms | Webull’s proprietary platform with charting tools, while many dedicated brokers also support MetaTrader and a Forex app for trading designed for mobile-first strategies. | MetaTrader 4/5, cTrader – advanced forex-specific tools |

| Automated Trading | Limited or unavailable | Supported via EAs, custom indicators, algorithmic tools |

| Best For | Stock, ETF, and options traders | Traders focused on direct currency markets and leverage |

Can You Use Webull For Forex Paper Trading?

Webull does not support real forex trading. You can track currency movements and test strategies using its paper trading feature. The platform allows risk-free practice, but it does not offer forex execution. Forex prices appear on Webull, but they serve an informational purpose. You cannot place trades on pairs like EUR/USD or USD/JPY. You can, however. You need to use Webull’s charts to analyze trends and monitor price action.

Paper trading helps traders build experience. You can practice with currency-related ETFs or international stocks that react to forex fluctuations. This approach works well if you want to understand market behavior before using a forex broker.

Do you need a full Forex trading simulator? See, dedicated forex broker provides a better option. Platforms like MetaTrader 4 and MetaTrader 5 allow real-time forex simulation. Webull offers useful tools, but it does not replace a true forex trading environment.

Will Webull Offer Forex Trading in the Future?

Webull has not announced plans to add forex trading. The platform focuses on stocks, ETFs, options, and cryptocurrencies. Regulations and business priorities shape its offerings. Forex trading requires specific approvals. Webull operates under SEC and FINRA rules, which cover stocks and options. Forex brokers follow CFTC and NFA regulations in the U.S. If you are expanding into forex it would mean adjusting to a different regulatory framework.

New features continue to roll out. Webull introduced 24-hour stock trading in some regions. Expansions show growth, but no signs point to forex trading becoming available.

Do you need access to forex markets now? A dedicated Forex broker remains the best choice. Brokers like FOREX.com, OANDA, and IG provide full access to currency pairs. Webull works well for stock and options traders, but it does not compete in forex.

Best Forex Trading Platforms for Webull Users

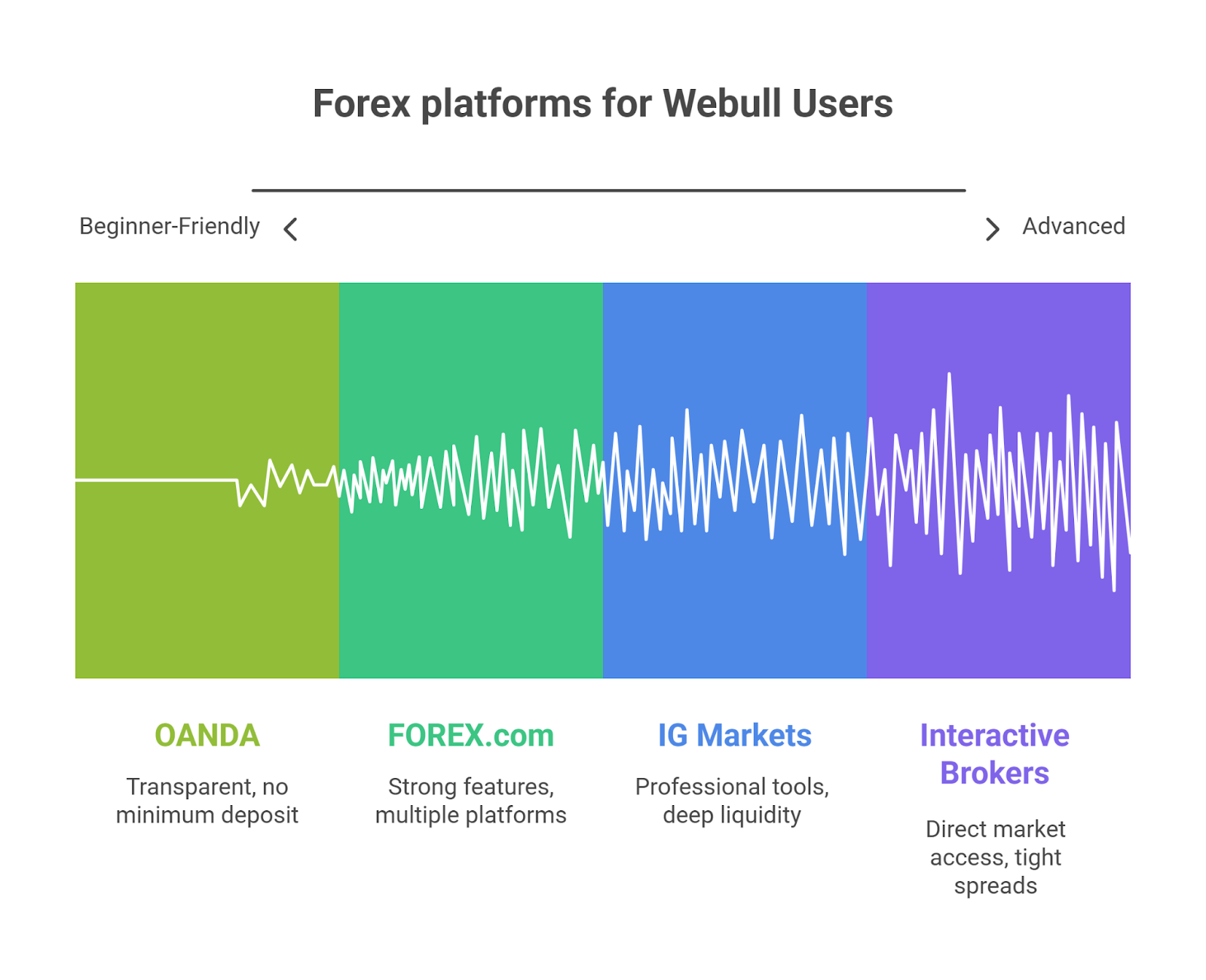

Webull does not offer forex trading. You must use a dedicated forex broker to trade currency pairs. Several platforms provide tight spreads, advanced tools, and high leverage.

FOREX.com

Delivers strong features for all traders. You get access to over 80 currency pairs, low spreads, and powerful charting tools. MetaTrader 4, MetaTrader 5, and a custom trading platform are available.

For example, Invesco DB US Dollar Index Bullish Fund (UUP) and WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) track the performance of the USD against global currencies—helping you gain indirect exposure without trading actual pairs.

OANDA

Focuses on transparency. You can trade without a minimum deposit. The platform offers advanced risk management tools and real-time market data.

IG Markets

Ranks among the top global forex brokers. You get access to many currency pairs, professional charting tools, and deep liquidity. Multiple platforms, including MetaTrader and a web-based interface, are available.

Interactive Brokers

Supports direct market access for forex trading. You get tight spreads and institutional-grade execution. Traders looking for professional forex tools choose IBKR.

Which platform works best for you? You must consider spreads, leverage, platform features, and deposit requirements. A broker that fits your trading goals ensures the best forex trading experience.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

If you’re serious about forex trading, Webull isn’t the right tool—yet. While you can track currency trends and gain indirect exposure via ETFs or global stocks, real currency pair trading requires a dedicated broker.

Platforms like OANDA, FOREX.com, or IG Markets give you access to dozens of pairs, higher leverage, and advanced forex tools like MetaTrader.

At Volity, we recommend choosing a platform based on your goals. Whether you’re optimizing for spreads, automation, or 24/7 access, the right broker sets the foundation for smart, informed forex trading.