So, the other major type of candlestick signal you need to master is the bullish pattern. It shows when buyers start building momentum and price begins turning upward. But there’s so much to grasp—each pattern looks slightly different, forms in unique conditions, and tells you something specific about trader sentiment.

Let us help you understand and leverage bullish candlestick patterns. You’ll see how it changes the way you approach every entry and exit.

While understanding Bullish Candlestick Patterns is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is a Bullish Candlestick Pattern?

A bullish candlestick pattern is a price chart formation that suggests buyers may take control of the market. You can spot it after a downtrend or within a pullback phase during an uptrend. Its main purpose is to hint that prices could rise next.

Japanese traders first used bullish patterns centuries ago. Now, Forex and stock traders rely on them to time long entries, validate reversals, and read momentum shifts. Because each bullish candlestick pattern reflects how buying pressure overcomes selling within a set period.

For example:

- A Hammer shows sellers drove the price down, but buyers pushed it back near the open.

- A Bullish Engulfing pattern means a large green candle covers the previous red candle completely, flipping the sentiment.

- A Morning Star forms across three candles, marking a change from weakness to strength.

It is worth noting that bullish patterns do not guarantee prices will rise. But when confirmed using support zones, volume, or trendlines, bullish candles help improve trade decisions.

Key Bullish Candlestick Patterns

The major Bullish candlestick patterns you can use in Forex trading includes:

Hammer

The hammer usually appears after a downtrend and hints that selling pressure has started to fade. It shows a small body near the top of the range and a long lower shadow, which tells us that sellers pushed prices down, but buyers came back with strength before the candle closed. This sudden shift often signals a potential reversal.

For example, in GBP/USD, when a hammer forms near a key support zone and is followed by a bullish candle, traders see that as a strong long setup, especially if volume confirms buyer interest.

Bullish Engulfing

A bullish engulfing pattern forms when a small bearish candle is followed by a larger bullish one that fully covers the previous candle’s body. It indicates a clear shift in control from sellers to buyers. This pattern gains strength when it shows up after an extended decline, especially on the 4H or daily chart.

For instance, in AUD/USD, if price drops for several days and then prints a bullish engulfing near a demand zone, many traders look for a break above the engulfing high to enter a long position.

Morning Star

The morning star is a three-candle pattern that often marks the beginning of an uptrend. The first candle is bearish and large, followed by a small-bodied candle showing indecision, and then a strong bullish candle that closes well above the midpoint of the first. It signals that the bearish momentum has weakened and bulls are regaining control.

For example, Iin EUR/JPY, this pattern often shows up after a rapid sell-off. When the third candle pushes up near resistance and RSI shifts upward, it adds more confidence to a long trade.

Piercing Line

The piercing line appears at the end of a downtrend and sends a clear message that buyers are fighting back. The first candle is bearish, while the second opens lower but closes at least halfway into the body of the first. This sudden rebound suggests that the sentiment is shifting. In the USD/CAD pair, if a piercing line shows up near a round number like 1.3000, and price holds above that level in the next session, many traders see it as a sign to go long.

Three White Soldiers

The three white soldiers pattern shows strong, consistent bullish pressure. It consists of three long bullish candles, each opening inside the previous one’s range and closing higher. This formation is powerful because it shows that buyers are not only stepping in, but staying in control. Traders often look for this setup after a pullback in a broader uptrend.

For example, in gold (XAU/USD), three white soldiers forming just above the 50-day moving average often mark the start of a new bullish wave.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesAdvanced Pattern Variations

There are different variations of bullish candlestick patterns, which means that the structure may change a bit, but the message stays the same—buyers are gaining control. Some show extra confirmation. Some appear stronger or earlier.

Let’s break down what each advanced variation of bullish candlestick patterns looks like and how to spot it in real trades.

Three Inside Up

Three Inside Up is a bullish reversal pattern that builds on the bullish engulfing setup. It appears after a downtrend and adds a third candle to confirm the shift in momentum. When the third candle closes above the second, it shows buyers are stepping in with continued strength.

- The first candle is bearish, continuing the previous trend.

- The second candle is bullish and completely covers the first candle’s body.

- The third candle closes higher than the second, confirming the reversal.

- This pattern often forms at swing lows or demand zones in Forex pairs like USD/CAD.

- Traders usually enter after the third candle closes with stops below the pattern.

Rising Three Methods

Rising Three Methods is a bullish continuation pattern that signals a healthy pause in an ongoing uptrend. It shows temporary selling pressure before the trend resumes. This pattern allows traders to rejoin the move with more confidence.

- The pattern begins with a strong bullish candle.

- Two or three small bearish or neutral candles follow, staying within the range of the first.

- A final bullish candle breaks above the range and continues the trend.

- It often appears in trending pairs like USD/JPY or AUD/USD during a pullback.

- Traders may enter on the breakout candle with a stop below the small consolidation.

Bullish Kicker

Bullish Kicker is a powerful signal of a sudden shift in sentiment. It usually happens after major economic news or surprise market events. The price gaps up and rallies, showing a complete rejection of prior bearish pressure.

- The first candle is bearish, often part of a previous downtrend.

- The next candle opens at or above the first candle’s open and moves upward sharply.

- There is little to no overlap between the two candles.

- The shift in price often follows central bank news or strong data releases.

- Traders wait for confirmation through volume or additional price continuation.

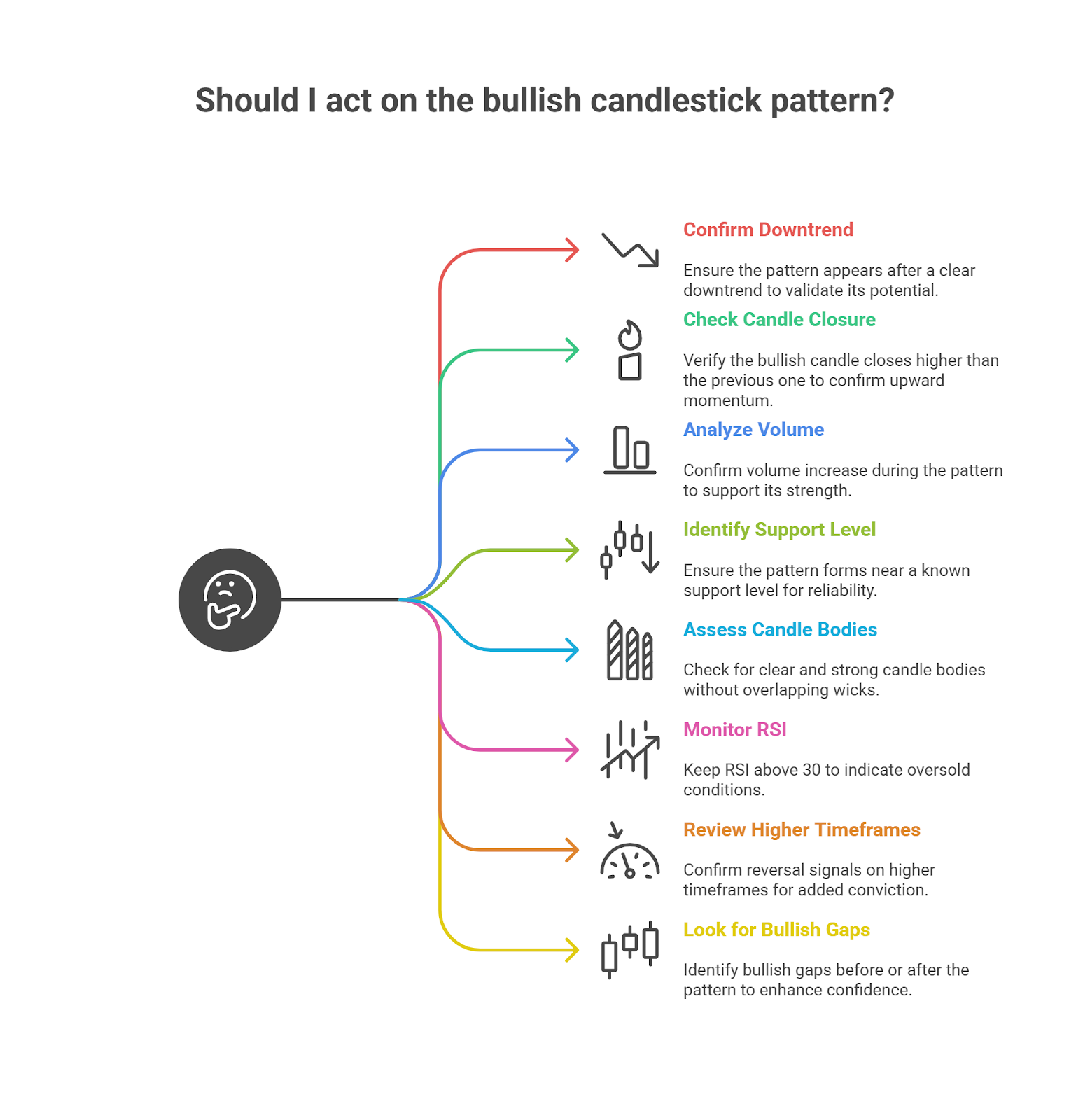

Rules for Confirmation and Timing

Certain bullish candlestick patterns only make sense when the right market conditions exist.

- Pattern must appear after a clear downtrend.

- The bullish candle should close higher than the previous one.

- Volume should increase during the pattern.

- Patterns should form near a known support level.

- Candle bodies must look clear and strong without overlapping wicks.

- RSI should stay above 30 when the pattern appears.

- Higher timeframes should also point to a reversal.

- A bullish gap before or after the pattern adds more conviction.

How to Trade Bullish Candles?

You have just spotted a bullish candle. Now what? Don’t jump in blindly as it is important to follow a process.

Let me walk you through it, step by step.

First, check the trend

Ask yourself: has the market been falling or just dipping? Bullish candles matter most when they show buyers fighting back after a drop. If the price was flat or already rising strongly, the candle may not mean much.

Always read the background first.

Now, look at the candle

You’re looking for a candle that tells you, “Buyers showed up.” So, confirm if it is clear and strong or not.

There could be a hammer with a long tail, an engulfing candle that swallows the previous red one, or a piercing line that cuts deep into the last candle.

It should stand out with no confusion.

Then, find where it happened

Is that bullish candle sitting near an old support level? Maybe near a moving average? Maybe at the bottom of a price channel?

You should know that good patterns near key zones speak louder because that’s exactly where buyers often wait.

Don’t forget confirmation

One candle can lie. Confirmation keeps you safe. See if the next candle breaks above the high as it tells you momentum continues or what.

Even better? Add volume. After all, more buyers = more trust.

Plan your entry

Once confirmed, you can enter above the pattern’s high. You’re joining the buyers — but only after they prove they’re serious.

So, no need to chase. Simply wait for the price to give you the green light.

Protect yourself

Place a stop-loss below the pattern’s low. Simple rule: if buyers were real, price won’t drop back under that level.

Remember that you’re not gambling, but rather managing risk.

Set a goal

Think about where the price may go next.

Is there resistance nearby? Use previous highs, Fibonacci levels, or just a clean round number. And always keep a reward that’s at least double your risk.

Stay calm and manage the trade

It should be clear to you that the price may shoot up or it may pull back a little. Stay patient. If it moves in your favour, lock in some gains or shift your stop.

But don’t panic. You made a plan, so just follow it.

See, that’s how you trade bullish candles. You watch, wait, and enter with reason. All while managing it with care.

Multi-Timeframe and Indicator Integration

If you want to increase your win rate with bullish candlestick patterns, don’t rely on one chart alone. Look at how price behaves across timeframes. Bigger timeframes help you find the main trend. Smaller ones help you enter at the right moment. When you combine both, plus a few trusted indicators, your setups become more reliable.

Let’s say you see a bullish engulfing pattern on the 4-hour chart. That tells you buyers may take over. But before jumping in, drop down to the 1-hour chart. You might find a smaller pattern forming, or support building—both can give you a cleaner entry.

Now, in order to make your analysis even sharper, use indicators that align with the candlestick message:

- Look at RSI. If it’s rising from 30 or crossing above 50, momentum may support a bullish move.

- Check MACD. A fresh bullish crossover adds strength to your candle signal.

- Use moving averages. Patterns forming above the 50 EMA or after price bounces from it often suggest continuation.

- Watch volume. If the bullish candle forms on rising volume, that’s a clear sign buyers are committed.

You’ll know that it’s a much stronger setup if or perhaps when the pattern, timeframe, and indicator all agree. So instead of guessing, you’re stacking logic in your favour. That’s how experienced traders work and trade Bullish candles.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountPutting It All Together

Bullish candlestick patterns help you spot possible reversals, trend continuations, or breakout moments.

Why do Bullish candlestick patterns matter? Because they give you clear visual signals of market strength without needing complex tools. When you read them with trend direction, support zones, and volume, you get a clearer trading edge.

How to apply Bullish patterns? Wait for confirmation, check multiple timeframes, add indicators, and manage risk. Enter only when your setup aligns across the board.

Still, you need to note that every setup carries risk. Yes, false signals can happen in low-volume markets or sideways trends. Patterns may form but fail if the broader trend weakens. So always set stop-loss levels and plan exit points.

As a final tip: build a watchlist of patterns that work best in your chosen market. Journal your trades. Over time, you’ll learn which patterns give you the best entries—and when to sit out. That’s how you grow into a disciplined trader.