This guide analyzes its structure, reliability, and practical application within a comprehensive technical analysis framework.

What is an in neck candlestick pattern?

The In Neck candlestick pattern is a two-candle bearish continuation formation that typically occurs during an established downtrend. It signals that despite a brief bullish attempt, the market remains under bearish control, making it a crucial component of candlestick chart patterns. This pattern suggests that the downtrend is likely to persist after a temporary pause.

Its composition involves two candles. The first candle is a large bearish (dark) candle, representing strong selling pressure. The second candle is a smaller bullish (light) candle that opens below the first candle’s close, often with a gap down.

Crucially, the second candle’s close is at or slightly above the prior bearish candle’s low, but it does not penetrate significantly into the first candle’s body. This specific closing position, forming a “neckline” with the previous low, defines the pattern.

While understanding In-Neck Candlestick Pattern is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

How to identify an in neck pattern?

Identifying an In Neck pattern requires careful observation of price action within an existing downtrend. Traders look for specific characteristics:

- Prior Downtrend: The pattern must form within an established downward price movement.

- Large Bearish Candle: The first candle is long and dark, indicating strong selling.

- Gap Down: The second candle opens below the close of the first candle.

- Small Bullish Candle: The second candle is relatively small and light, showing a weak attempt by buyers.

- Close Near Prior Low: The bullish candle’s closing price aligns horizontally with or is slightly above the low of the first bearish candle.

Is an in neck pattern bullish or bearish?

The In Neck pattern is generally considered a bearish continuation pattern, not a reversal. Despite the presence of a bullish second candle, the pattern’s overall implication is that the downtrend will likely resume.

The bullish candle’s inability to close significantly higher or penetrate deep into the prior bearish candle’s body indicates a lack of strong buying conviction. This suggests that the brief upward movement is merely a pause, and the bearish momentum will continue, rather than signaling a potential reversal signal.

How does technical analysis relate to candlestick patterns?

Technical analysis is a methodology for evaluating investments and identifying trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Candlestick patterns are a fundamental visual tool within this framework, offering immediate insights into market psychology and potential future price direction. They provide a structured way to interpret raw price action.

Candlestick Patterns as Part of Technical Analysis

Candlestick patterns are visual representations of price action over a specific period, making them a core component of technical analysis tools. Each candle conveys four key pieces of information: open, high, low, and close prices.

When these individual candles combine into patterns, such as the In Neck pattern, they tell a story about market sentiment, supply, and demand dynamics. They help traders understand who is in control – buyers or sellers – at a given moment, providing insights into potential future price movements when viewed within the larger technical analysis framework.

The Importance of Trend and Momentum

Identifying the prevailing trend is crucial for interpreting candlestick patterns like the In Neck. The In Neck pattern typically appears within an established downtrend. Trading against the trend generally carries higher risk, as the larger market force is working against the trade. Momentum, which measures the rate of price change, can also supplement pattern analysis. A strong bearish momentum preceding the In Neck pattern reinforces its continuation signal, indicating sustained selling pressure.

Support & Resistance: Context for Pattern Significance

Support and resistance levels are critical in technical analysis. They represent price points where buying or selling interest is strong enough to temporarily halt or reverse a price movement. The formation of an In Neck pattern near a minor support level can be particularly insightful.

If the pattern forms at support and then breaks below it, this provides additional confirmation of the bearish continuation, strengthening the signal derived from the candlestick pattern itself. These levels provide essential context for the pattern’s significance.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow reliable is the in neck pattern?

The In Neck pattern is considered a moderate to low-reliability pattern when used in isolation. It is a bearish continuation signal rather than a strong reversal pattern, meaning it suggests the existing downtrend will persist.

Its reliability significantly improves when confirmed by other technical indicators or subsequent price action, such as a lower close on the following candle. Without additional confirmation, the pattern can be susceptible to market noise and produce false signals.

Assessing the Reliability of the In Neck Pattern

The In Neck pattern is not a high-reliability pattern on its own. It serves as a bearish continuation signal rather than a strong bearish reversal pattern. Its effectiveness largely depends on the context of the market and the presence of confirmation from other technical indicators.

For instance, if the market is in a strong downtrend and the pattern appears, it might be more reliable. However, without further bearish price action, such as a subsequent close below the pattern’s low, its predictive power diminishes. This pattern is often a minor pause, not a definitive potential reversal signal.

What timeframe is best for neck patterns?

Generally, patterns are more reliable on higher timeframes, such as daily or weekly charts. On these longer timeframes, the signals tend to filter out more market noise and represent more significant shifts in supply and demand.

Lower timeframes, like hourly or minute charts, can produce more frequent false signals due to increased volatility and random price fluctuations. While traders may use the In Neck pattern on any timeframe, higher timeframes often offer more robust and trustworthy signals, aligning with long-term market trends.

What are the limitations of the neck pattern?

The In Neck pattern has several limitations that traders must consider. It can be easily misinterpreted, especially by beginners, due to the bullish appearance of the second candle.

The pattern requires strong confirmation from subsequent price action or other indicators to validate its bearish continuation signal. Without this, it is highly susceptible to market noise and false signals, which can lead to premature or incorrect trading decisions.

Furthermore, low volume on the second candle might indicate a lack of conviction from buyers, further reducing the pattern’s significance and predictive power. It is primarily a continuation pattern, not a strong reversal indicator.

In neck vs on neck pattern?

The In Neck pattern and the On Neck pattern are two distinct two-candle candlestick patterns that often cause confusion due to their similar names and appearance. Both patterns signal bearish continuation within a downtrend.

However, a subtle but critical difference in the closing price of the second candle differentiates them, impacting their signal strength and interpretation. Understanding this distinction is crucial for accurate chart analysis and effective trading decisions.

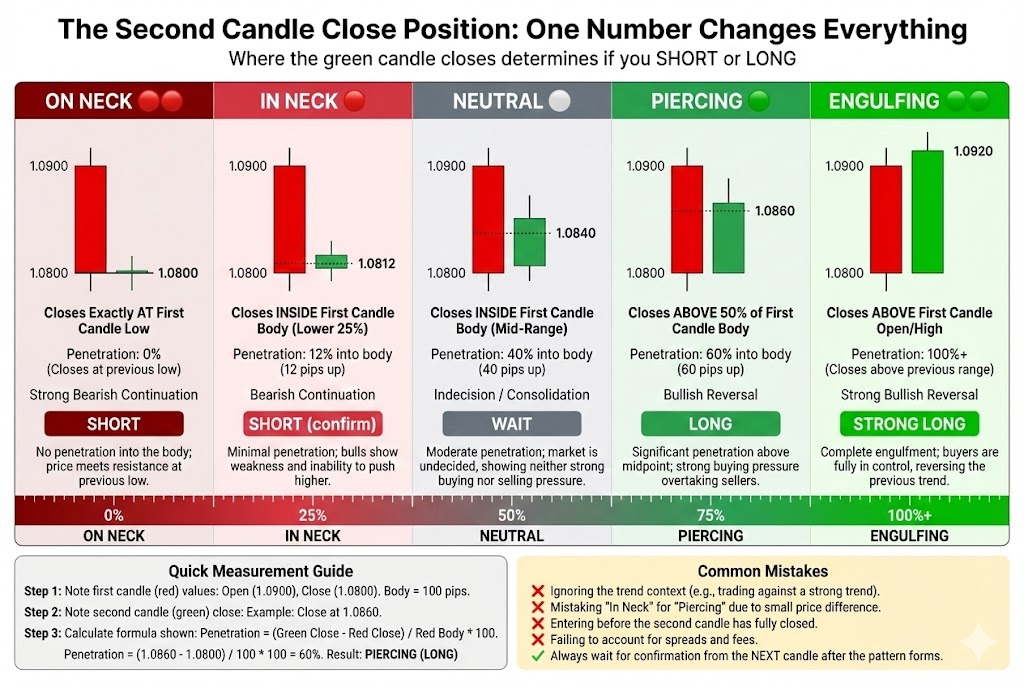

In Neck vs. On Neck Pattern: A Subtle but Critical Distinction

The primary difference between the In Neck pattern and the On Neck pattern lies in the closing price of the second (bullish) candle relative to the first (bearish) candle’s low. In the In Neck pattern, the second candle closes at or slightly above the low of the first bearish candle.

This indicates a minor attempt by buyers that fails to gain significant traction. Conversely, the On Neck pattern sees the second bullish candle close exactly at the low of the first bearish candle. This precise alignment suggests that buyers could not push prices even slightly higher, indicating a slightly stronger bearish resolve.

How In Neck Differs from Piercing and Dark Cloud Cover

The In Neck pattern is a bearish continuation pattern, which sets it apart from reversal patterns like the Piercing pattern and Dark Cloud Cover.

The Piercing pattern is a bullish reversal signal, where a large bearish candle is followed by a bullish candle that opens lower but closes more than halfway into the body of the first candle.

Dark Cloud Cover is a bearish reversal pattern, featuring a large bullish candle followed by a bearish candle that opens higher but closes more than halfway into the body of the first candle.

Unlike these strong reversal signals, the In Neck pattern‘s second bullish candle only closes near the low of the first candle, showing weak buying interest and signaling continued downside, not a reversal.

| Aspect | Details |

| Pattern | Two-candle pattern |

| Pattern Description | Forms after a downtrend. The first candle is bearish, followed by a smaller bullish candle whose close is at or slightly above the low of the first candle. |

| Signal | Bearish continuation |

| Reliability | Moderate to low; requires strong confirmation |

| Key Difference | Second candle closes at or slightly above the first candle’s low |

Trading the In Neck Pattern: Strategies, Confirmation, and Risk Management

Trading the In Neck pattern effectively requires a structured approach that combines pattern identification with robust trading strategy development, strict confirmation protocols, and diligent risk management principles.

While the pattern itself signals bearish continuation, its moderate reliability means that it should rarely be traded in isolation. Instead, traders must integrate it into a broader trading plan that accounts for market context and capital preservation.

Studies suggest that patterns traded without proper risk management (e.g., stop-loss) lead to a 70% higher probability of significant account drawdowns for retail traders, according to Independent Trading Research.

How to trade the neck pattern? [Best strategies]

Developing an In Neck trading strategy involves several steps to maximize its effectiveness.

- First, identify the pattern within an established downtrend.

- Second, wait for confirmation that the bearish momentum is continuing.

- Third, determine a suitable entry point for the trade, often after a decisive break below the pattern’s low.

- Fourth, set a clear stop loss to limit potential losses.

- Finally, plan an exit strategy by identifying potential profit targets or conditions for closing the trade.

This systematic approach helps manage trades efficiently.

What confirmation is needed for the neck pattern?

Confirmation is essential when trading the In Neck pattern due to its moderate reliability. A common confirmation signal is a subsequent bearish candle that closes below the low of the In Neck pattern. This demonstrates renewed selling pressure and validation of the continuation.

Other forms of price action confirmation include a break below a significant support level, or bearish readings from technical indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). Combining multiple confirmation signals can significantly improve the probability of a successful trade.

Essential Risk Management: Stop Loss Placement

Risk management is paramount when trading any candlestick pattern, especially the In Neck pattern. A stop loss is a non-negotiable tool for capital preservation. For the In Neck pattern, a logical stop loss placement is typically above the high of the first (bearish) candle of the pattern.

Alternatively, it can be placed above a recent swing high, providing a wider buffer. This placement makes sure that if the market unexpectedly reverses and moves against the bearish expectation, the loss is contained. Position sizing, based on individual risk tolerance, is also crucial to avoid over-exposure.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBeyond the Charts: Psychology, Backtesting, and Common Pitfalls

Many traders ask: “Why did my In Neck pattern fail?” This common query often stems from factors beyond simple pattern identification. While technical analysis provides a framework, the human element and empirical validation are crucial yet frequently overlooked. Emotional trading accounts for up to 40% of retail trader losses, regardless of pattern knowledge. Understanding trading psychology and the importance of backtesting can significantly improve success rates, offering a deeper understanding of common pitfalls that competitors often miss.

One major reason for pattern failure is psychological bias. Fear of missing out (FOMO) can lead to premature entries without proper confirmation. Conversely, fear of losing can cause traders to hold onto losing trades longer than planned, ignoring their stop loss.

Overconfidence, another bias, might lead to over-leveraging or neglecting risk management, assuming the pattern will always work. These biases interfere with objective decision-making, turning a potentially valid signal into a losing trade.

Another critical, often neglected aspect is backtesting. This involves applying a trading strategy to historical data to see how it would have performed. Traders frequently fail because they haven’t empirically validated the In Neck pattern‘s effectiveness in the specific market or timeframe they are trading.

Backtesting provides empirical evidence of a pattern’s historical reliability, allowing traders to understand its win rate, average profit, and maximum drawdown. Without this step, traders are essentially speculating, rather than executing a statistically sound strategy.

Key Takeaways

- Bearish Continuation Pattern: The In Neck pattern is a two-candle bearish continuation formation, not a reversal signal.

- Confirmation Required: Its reliability improves significantly when confirmed by other indicators or subsequent price action.

- Timeframe Matters: Higher timeframes tend to produce more reliable In Neck pattern signals compared to lower timeframes.

- Risk Management Is Essential: Accurate stop loss placement and disciplined risk control are critical when trading this pattern.

- Common Failure Causes: Psychological biases and insufficient backtesting are frequent reasons traders misinterpret or misuse the pattern.

Bottom Line

The In Neck candlestick pattern is a valuable tool for traders, signaling the continuation of a bearish trend. Its identification requires recognizing a large bearish candle followed by a smaller bullish candle closing near the prior low.

While a useful candlestick pattern, it possesses moderate reliability and mandates strong confirmation from other technical indicators or subsequent price action. Effective trading of this pattern relies heavily on a structured trading strategy, meticulous stop loss placement, and robust risk management.

Critically, understanding trading psychology and performing diligent backtesting differentiate successful application from common pitfalls, offering a holistic approach to leveraging this pattern in diverse market conditions.