By understanding order types, risk management, and the role of exchanges, traders can build a secure and diversified digital portfolio based on actual asset possession.

While understanding Crypto Spot Trading is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What is crypto spot trading?

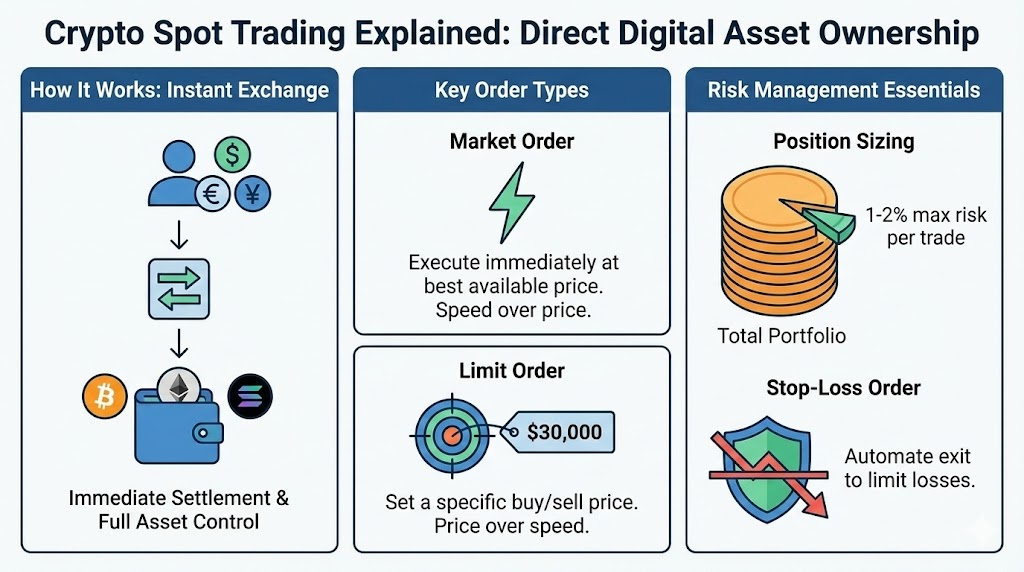

Spot trading involves the immediate exchange of cryptocurrencies for fiat or other cryptocurrencies, with ownership transferred directly to the buyer’s wallet, according to Coinbase. This means when you engage in spot trading, you are buying or selling the actual digital asset. The transaction settles almost instantly, and the asset is moved between buyer and seller.

What ‘Spot’ Truly Means?

The term “spot” in spot trading refers to the current market price at which an asset can be bought or sold for immediate settlement. This contrasts with futures or options, which involve agreements for future delivery or the right to buy/sell later. In crypto, spot trading means acquiring direct ownership of assets like Bitcoin (BTC), Ethereum (ETH), or Solana (SOL) without any complex contracts. This direct digital asset ownership is a key differentiator, providing full control over the purchased cryptocurrency.

What are crypto spot markets?

Crypto spot markets are platforms where the immediate exchange of digital assets occurs. These markets facilitate transactions between buyers and sellers, determining the spot price of various cryptocurrencies. Centralized exchanges (CEXs) like Coinbase and Binance.US facilitate the majority of crypto spot trading volume, offering high liquidity but typically requiring KYC verification, as noted by Coinbase and Binance.US. Participants in these markets place orders to buy or sell specific trading pairs, such as BTC/USDT or ETH/USD, aiming to profit from price fluctuations.

How does crypto spot trading work?

Crypto spot trading works by connecting buyers and sellers on a crypto exchange to facilitate the immediate exchange of digital assets. Users deposit funds, select a trading pair, and then place an order to buy or sell. The exchange then matches these orders, leading to the direct transfer of ownership.

The Role of a Crypto Exchange

A crypto exchange acts as the intermediary in spot trading, providing a platform where buyers and sellers can meet and execute trades. These platforms manage the order book, make sure secure transactions, and often provide tools for analysis. Centralized exchanges (CEXs) like Coinbase and Binance.US facilitate the majority of crypto spot trading volume, offering high liquidity but typically requiring KYC verification. This verification process typically involves submitting personal identification documents to comply with regulatory standards.

What is a crypto spot market order (and other order types)?

A market order is an instruction to buy or sell a cryptocurrency immediately at the best available current price. This order type prioritizes speed over a specific price. Slippage, the difference between an order’s expected execution price and its actual execution price, is a common occurrence in volatile or illiquid crypto spot markets, according to Axi. This can result in a slightly different fill price than anticipated, especially for large orders.

Limit Orders: Price Control

A limit order allows traders to specify the maximum price they are willing to pay for a buy order or the minimum price they are willing to accept for a sell order. These orders are not executed immediately but rather wait on the order book until the market reaches the specified price. For example, a trader might place a limit buy order for ETH/USDT at $2,000, making sure they do not pay more than that amount. Limit orders are crucial for price control and executing trades at desired levels.

Beyond Basics: Stop-Loss and Take-Profit Orders

Beyond basic market and limit orders, traders use advanced order types to manage risk and secure profits. A stop-loss order is designed to limit potential losses by automatically selling an asset if its price falls to a predetermined level. Conversely, a take-profit order automatically closes a position when an asset reaches a specified profit target. These tools are vital for automating trading strategies and protecting capital.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesSpot trading vs futures trading crypto.

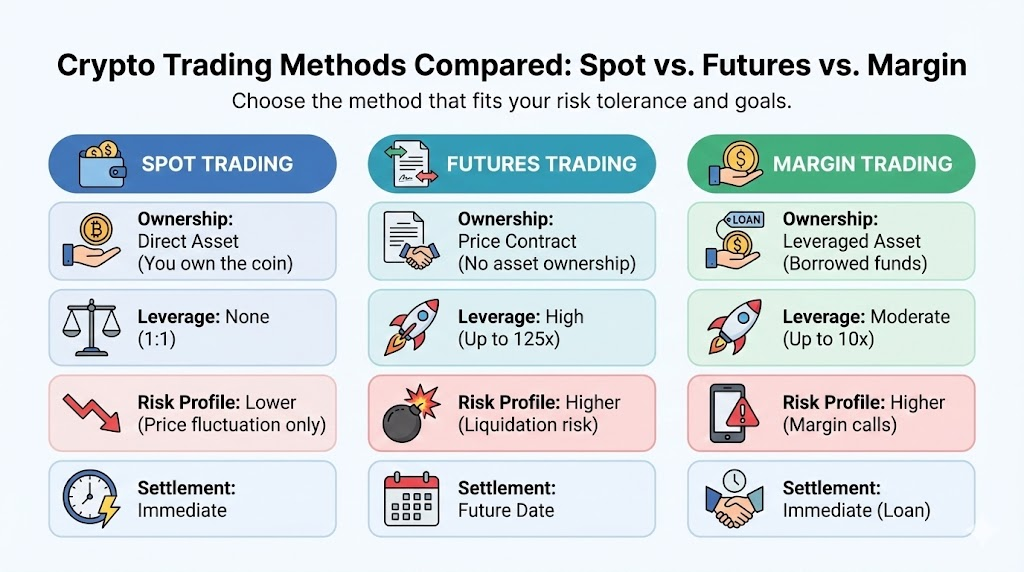

Spot trading involves the direct exchange of actual cryptocurrencies for immediate ownership, making it a straightforward way to participate in the market. In contrast, futures trading deals with contracts that obligate a buyer and seller to transact an asset at a predetermined future date and price. The fundamental difference lies in asset ownership and the nature of the transaction.

Direct Ownership vs. Derivatives

The core distinction between spot trading and futures trading lies in direct ownership. In spot trading, you acquire the actual cryptocurrency, which is then transferred to your wallet. This provides complete control and responsibility over the digital asset. Futures trading, however, involves derivatives, which are financial contracts whose value is derived from an underlying asset. Traders in futures markets do not own the actual cryptocurrency; instead, they speculate on its future price movement using contracts. This often involves leverage, amplifying both potential gains and losses.

Spot Trading, Futures, and Margin Trading: A Comparison

What are the risks of spot trading crypto?

The risks of spot trading crypto primarily revolve around market volatility and the potential for rapid price changes. Other risks include security vulnerabilities of exchanges and the psychological pitfalls that lead to poor decision-making. Effective risk management is essential to mitigate these challenges.

Understanding Volatility: The Double-Edged Sword

Volatility is a defining characteristic of the cryptocurrency market, meaning prices can fluctuate dramatically within short periods. This inherent instability presents both significant opportunities for profit and substantial risks for loss. Rapid price swings can quickly erode capital if trades are not managed effectively. Understanding and preparing for this high volatility is a fundamental aspect of successful crypto spot trading.

Essential Risk Management Strategies

Effective risk management is paramount in the volatile crypto market. A widely accepted principle in risk management is to never risk more than 1-2% of your total trading capital on a single trade to protect against significant losses, as highlighted by Gemini. This means if you have $10,000 in capital, you should risk no more than $100-$200 on any single trade. Implementing stop-loss orders is another critical strategy, automatically limiting losses if a trade moves against your position. Diversification across different assets also helps spread risk.

Is crypto spot trading safe?

Crypto spot trading can be safe if proper precautions are taken, but it is not without risks. The safety largely depends on the security measures of the chosen crypto exchange and the individual’s approach to securing their assets. Using strong, unique passwords, enabling two-factor authentication (2FA), and using secure wallet solutions (like hardware wallets for cold storage) are crucial steps. While exchanges strive for security, self-custody of assets in a personal wallet provides the highest level of control and protection against exchange-specific risks. The CFTC has acknowledged the growing market for spot crypto products, signaling regulatory attention to this asset class, which may lead to improved oversight.

The Psychology of Successful Spot Trading

While understanding market mechanics and order types is crucial, the psychology of trading often represents the missing piece for many aspiring traders. Emotional decisions, such as FOMO (Fear Of Missing Out) and FUD (Fear, Uncertainty, Doubt), are significant factors contributing to trading losses for many retail investors, according to Token Metrics. Overcoming these psychological biases is often more challenging than mastering technical analysis.

This section delves into the human element, providing actionable strategies to cultivate a disciplined mindset. Traders frequently ask “Why do I keep losing money in spot trading even with a strategy?” The answer often lies in emotional responses overriding logical planning. By recognizing and managing emotions, traders can avoid impulsive decisions that derail well-researched strategies.

Developing emotional intelligence and self-awareness is essential for long-term success in volatile markets.

How to start spot trading crypto?

To start spot trading crypto, you typically need to create an account on a reputable crypto exchange, complete identity verification, fund your account, and then navigate the trading interface to place your first trade. This process is designed to be straightforward for beginners.

Best crypto exchanges for spot trading?

Choosing the right crypto exchange is a critical first step for spot trading. Key factors to consider include fees, security features, available cryptocurrencies, user interface, and customer support. For beginners, platforms like Coinbase, Binance.US, and Gemini are often recommended due to their user-friendly interfaces, robust security, and high liquidity. Oanda and Interactive Brokers also offer crypto trading, providing additional options for traders. Always compare maker and taker fees, as these can significantly impact profitability over time.

How do I choose a crypto spot trading platform?

When choosing a crypto spot trading platform, prioritize security, liquidity, and ease of use. A platform with strong security measures, such as 2FA and insurance funds, protects your assets. High liquidity makes sure your orders are filled quickly and at competitive prices, minimizing slippage. A user-friendly interface is vital for beginners to avoid errors and understand the trading process. Consider the range of trading pairs offered and make sure the platform supports the cryptocurrencies you intend to trade.

How to place a spot trade on [specific exchange e.g., Binance/Coinbase]?

Placing your first spot trade involves a few simple steps, generally consistent across most exchanges. First, create and verify your account.

Next, deposit funds (fiat or crypto) into your exchange wallet.

Then, navigate to the trading section, select your desired trading pair (e.g., BTC/USDT), and choose your order type (e.g., market order for instant execution or limit order for a specific price).

Enter the amount you wish to buy or sell, review the details, and confirm the trade.

Common User Challenges & How to Overcome Them

Many new traders face specific challenges that often lead to losses despite having a basic strategy. Addressing these common pitfalls is essential for long-term success in crypto spot trading. Understanding these issues, which are frequently discussed in online forums, allows traders to develop resilience and discipline.

One significant challenge is impulsive trading driven by psychological biases like FOMO. Traders might jump into a rapidly rising asset without research, only to buy at the peak and suffer losses. To overcome this, develop a strict trading plan that includes entry and exit criteria, and stick to it regardless of market hype.

Another common pain point involves neglecting fees. Many beginners ask “How can I avoid high trading fees on exchanges when I’m just starting with small amounts?” High maker and taker fees, especially on frequent small trades, can quickly erode profits.

To mitigate this, choose exchanges with competitive fee structures and consider using limit orders, which often incur lower “maker” fees compared to “taker” fees from market orders.

Finally, unexpected losses due to slippage in volatile markets can be frustrating. Traders expect an order to fill at one price but receive a worse one. To address this, use limit orders instead of market orders in highly volatile conditions or for larger trades.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBOTTOM LINE

Crypto spot trading remains the most essential pillar of the digital economy, providing the only path to true asset ownership without the complexities of derivative contracts. While its accessibility makes it a primary choice for beginners, long-term success is earned through disciplined risk management and emotional fortitude. By strictly adhering to capital preservation rules, utilizing limit orders to combat slippage, and maintaining an objective psychological state, you transform from a reactive speculator into a strategic investor. In a market defined by rapid change, direct possession of your assets is your ultimate security.

Key Takeaways

- Offloading is Key: Crypto engines free your main CPU, boosting performance and efficiency.

- Hardware for Security: Dedicated hardware engines provide superior speed and crucial key isolation, making them far more resistant to attacks.

- Ubiquitous Protectors: From your smartphone’s Secure Enclave to cloud servers, crypto engines are silently safeguarding your data.

- Future-Proofing: The evolution towards post-quantum cryptography will rely heavily on advanced crypto engine designs.