A margin call is a formal notification from a broker that a trader’s margin level has fallen below the required maintenance margin, signaling a need for action. In contrast, a stop out level is an automatic threshold, typically 20% to 50% of the margin level, where open positions are forcibly closed to prevent further losses.

Understanding these distinct events is crucial for effective risk management and preserving capital in margin trading.

Navigating the complexities of margin trading demands a clear understanding of the mechanisms designed to protect both traders and brokers. Two such critical concepts, often confused, are margin calls and stop out levels.

While understanding Margin Call vs Stop Out Level is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Understanding the Fundamentals of Margin Trading

Margin trading allows traders to open positions larger than their available capital by borrowing funds from their broker. This amplifies potential gains but also significantly increases exposure to losses. Understanding the core concepts of margin and leverage is fundamental to navigating this high-stakes environment safely.

Many traders misunderstand how margin levels are calculated, leading to unexpected stop-outs.

How does margin trading work?

Margin trading is a practice where traders use borrowed funds from a broker to increase their trading capital, enabling larger position sizes in the market. This method allows for greater market exposure and amplified potential profits from favorable price movements.

However, it also means that any adverse market movements can lead to magnified losses, making robust risk management essential. Margin acts as a form of collateral for the borrowed funds.

Key Margin Concepts: Initial, Maintenance, and Free Margin

To engage in margin trading, traders must understand several key margin concepts that govern the safety and management of their positions. Initial margin is the amount of capital required to open a new leveraged position, serving as a good-faith deposit. As positions fluctuate, the equity in a trading account changes, directly impacting the margin level.

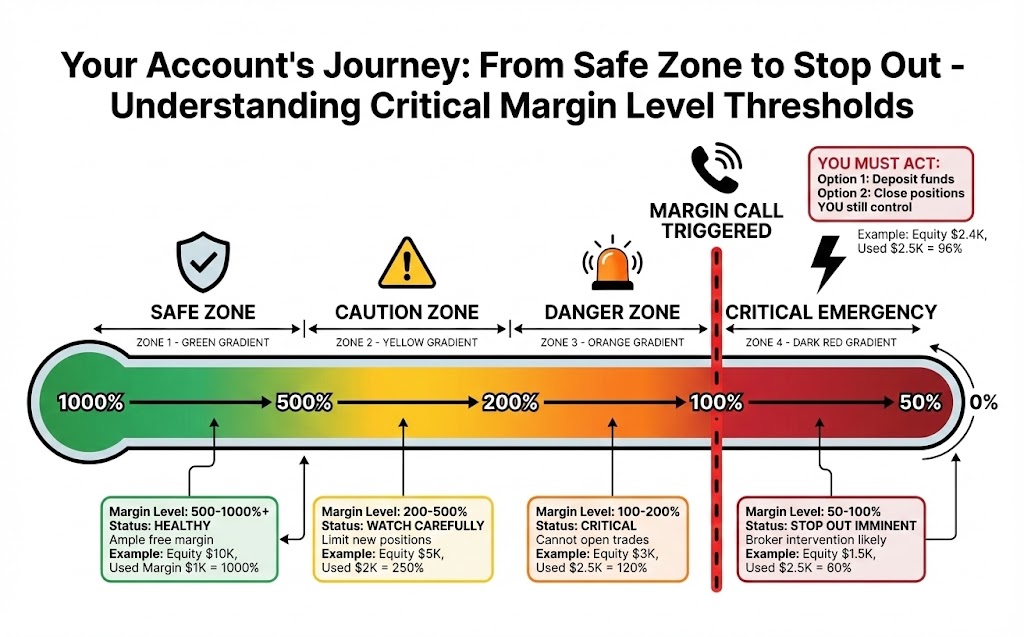

Maintenance margin is the minimum equity percentage required to keep an open position active, acting as a crucial threshold set by the broker. If the margin level (Equity / Used Margin * 100%) falls below this, a margin call is triggered.

Free margin represents the funds available in a trading account that are not currently used as margin for open positions and can be used for new trades or to absorb losses. The account balance reflects the total capital in the account, while equity is the real-time value of the account, including profit/loss from open positions.

What is a Margin Call and How Does It Work?

A margin call is a formal notification from a broker, alerting a trader that their margin level has fallen below the required maintenance margin (Investopedia). This event signals that the equity in the trading account is no longer sufficient to support the open positions, based on the broker’s set requirements.

It serves as a prompt for the trader to either deposit additional funds or close existing positions to bring the margin level back above the required minimum. Without intervention, further losses can lead to a stop out.

The Margin Call Process: What to Expect

During a margin call, a trader typically receives a notification from their broker, often via email or platform alert. This occurs because the account’s equity has declined, often due to unfavorable market movements or high leverage ratio, reducing the margin level below the maintenance requirement.

At this point, the trader has limited options: either deposit additional funds to increase equity or close open positions to reduce the used margin. Failure to act may lead to the broker automatically closing positions. The account balance remains the same until positions are closed or new funds are added.

Immediate Actions and Recovery from a Margin Call

When faced with a margin call, immediate and strategic action is essential. Traders can choose to deposit additional funds into their trading account to increase their equity and restore the margin level. Alternatively, they can close open positions, especially those incurring the largest losses, to reduce the used margin and free up capital.

Recovery is possible, but it requires disciplined decision-making to avoid emotional trading and prevent further losses. Swift action can help avoid the more severe consequence of a stop out.

What is a Stop Out Level and How to Prevent It?

The stop out level is a pre-defined margin level percentage set by a broker, below which all or some of a trader’s open positions are automatically closed. This automatic closure, known as forced liquidation, happens when a trading account’s equity falls below this critical threshold.

Its purpose is to prevent the account from going into a negative balance, protecting the trader from owing the broker money and the broker from extending unlimited credit. Understanding this automatic trigger is paramount for account safety.

The Stop Out Process and Its Consequences

When the margin level in a trading account reaches the stop out level, the broker’s system automatically initiates forced liquidation of open positions. Typically, the broker starts by closing the least profitable positions first, aiming to raise the margin level back above the stop out threshold.

If the market continues to move unfavorably, more positions will be closed until the margin level is safe. This process aims to protect the account from a negative balance by preserving the remaining free margin and equity. The primary consequence is the irreversible closure of trades, often resulting in significant realized losses.

Proactive Strategies to Prevent Stop Out

Preventing a stop out requires diligent risk management tools and constant monitoring of the margin level. Implementing stop loss orders is a primary strategy, as they automatically close a position at a pre-determined price, limiting potential losses before they trigger a stop out.

Managing position size relative to account equity is also crucial; smaller positions require less margin and offer more buffer against market fluctuations. Regular monitoring of your margin level percentage and avoiding excessive leverage ratio are essential practices to maintain sufficient free margin and prevent the automatic closure of trades.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesMargin Call vs. Stop Out: Key Differences and Why They Matter

Understanding the distinctions between a margin call and a stop out level is vital for any trader using margin. While both relate to insufficient margin in a trading account, their nature and implications differ significantly.

Comparison Table: Margin Call vs. Stop Out Level

| Feature | Margin Call | Stop Out Level |

| Nature | Warning/Notification | Automatic Action |

| Trigger | Equity falls below Maintenance Margin | Equity falls below Stop Out % (broker-specific) |

| Action Req | Deposit funds or close positions | No action possible; positions closed automatically |

| Consequence | Opportunity to recover, potential fees | Forced liquidation, significant realized losses |

| Control | Trader has some control over outcome | Broker system takes full control |

| Goal | Prevent stop out, restore margin level | Prevent negative balance for trader/broker |

Why the Distinction Matters for Traders?

The distinction between a margin call and a stop out level is critical for effective risk management and preserving your trading account. A margin call acts as an early warning, offering a trader the chance to intervene and prevent further losses or even a stop out.

It provides options: either deposit additional funds or close open positions. A stop out, however, represents the final stage where the broker takes automatic control, resulting in forced liquidation of positions without trader input. This often leads to significant, irreversible losses.

Recognizing this difference empowers traders to act proactively rather than reactively, potentially mitigating severe account damage.

Essential Risk Management Strategies to Avoid Margin Events

Effective risk management is the cornerstone of successful margin trading, crucial for reducing the frequency and impact of both margin calls and stop outs (Fidelity Investments). Over-leveraging is a primary cause of margin calls for retail traders (Charles Schwab), highlighting the importance of prudent strategies.

Many traders struggle with determining “how much leverage is too much leverage,” often leading to blown accounts. Implementing a comprehensive risk management plan helps address this.

Mastering Leverage: A Double-Edged Sword

Leverage amplifies both potential profits and losses, making its management a critical component of risk management. For many traders, the question “How much leverage is too much leverage?” is a significant pain point, often leading to account blow-ups. Prudent traders understand that while high leverage ratio can offer substantial returns, it also dramatically increases the risk of a margin call or stop out level. It’s advisable to use leverage conservatively, especially for beginners, and to align it with your capital, experience, and market volatility. Over-leveraging is a primary cause of margin calls for retail traders (Charles Schwab).

Implementing Stop-Loss and Take-Profit Orders

Stop loss orders are fundamental risk management tools designed to limit potential losses on a trade by automatically closing a position if the price moves against the trader to a pre-determined level. This is a direct answer to “How to set stop loss to prevent stop out?” These orders are vital for preventing a stop out level by capping losses before the equity falls below critical thresholds. Complementing stop losses are take profit orders, which automatically close a position when a pre-set profit target is reached. Together, these tools help define risk and reward, making sure a disciplined approach to trade management.

Position Sizing and Diversification for Capital Preservation

Proper position sizing is a key element of risk management that directly impacts how to avoid a margin call. It involves determining the appropriate amount of capital to allocate to each trade relative to your total trading account size.

A common rule of thumb is to risk no more than 1-2% of your total capital on any single trade. This approach prevents any one losing trade from significantly depleting your equity. While primarily focused on individual trades, broader diversification, if applicable to your margin trading strategy (e. g., across different asset classes or currency pairs), can also help spread risk and preserve capital.

Beyond Mechanics: The Psychology and Proactive Planning for Margin Safety

Successful long-term trading involves not just understanding margin mechanics, but also mastering emotional discipline and having robust contingency plans tailored to your broker’s specific policies. Emotional decisions are a significant factor in trading failures, often leading to poor risk management (General Trading Psychology). This section delves into crucial aspects often overlooked by most guides.

The Psychological Toll of Margin Events: Staying Rational Under Pressure

Margin events can trigger intense emotions like fear, panic, or the urge for revenge trading, severely impacting decision-making. Traders often face decision paralysis, wondering, “Is it better to close trades or deposit more funds during a margin call?”

Emotional decisions are a significant factor in trading failures, often leading to poor risk management (General Trading Psychology). Staying rational under pressure involves having a pre-defined plan and adhering to it, rather than making impulsive choices when equity falls below a critical level.

Recognizing and managing these psychological responses is vital for long-term success and avoiding further losses.

Proactive Contingency Planning: Beyond Just Adding Funds

Effective contingency planning goes beyond simply deciding to deposit additional funds during a margin call. It involves establishing a clear, step-by-step action plan before a margin event occurs.

This includes setting up automated alerts for specific margin level percentage thresholds, pre-determining which positions to partially close in a crisis, and understanding your broker’s specific margin policies. using a margin calculator for stress-testing various market scenarios can also help in proactive planning.

This approach empowers traders to execute decisions calmly, rather than reacting under duress.

Vetting Your Broker: Understanding Margin Policies and Support

Choosing the right broker is a critical, yet often underestimated, aspect of trading account safety, directly influencing how to choose a broker with safe margin practices. Traders should thoroughly vet brokers by examining their published margin level percentage requirements for both maintenance and stop out. Transparency in these policies is paramount.

It is also important to assess the quality of their customer support, especially regarding margin-related inquiries and assistance during margin events. A broker that offers clear policies and responsive support contributes significantly to a trader’s overall confidence and ability to manage risk effectively.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBOTTOM LINE

Mastering margin trading hinges on a clear understanding and proactive management of margin calls and stop out levels.

While a margin call serves as a crucial warning, offering a chance to intervene by depositing additional funds or closing open positions, a stop out represents an automatic, irreversible forced liquidation of positions to prevent a negative balance.

Effective risk management, including prudent leverage ratio use, precise position sizing, and strategic stop loss orders, is indispensable. Furthermore, successful traders integrate contingency planning and emotional discipline into their strategy, alongside careful broker vetting, making sure a holistic approach to account safety beyond just mechanical understanding.

Frequently Asked Questions

Addressing common questions about margin calls and stop outs can further clarify these critical concepts for traders.