What are Camarilla pivot points?

Camarilla pivot points are a set of eight specific support and resistance levels derived from the previous day’s high, low, and closing prices. They were developed by Nick Stott in the late 1980s to provide tighter, more immediate price action analysis for intraday trading, according to Defcofx and TrendSpider. These levels help traders anticipate where price might reverse or break out, offering clear targets and stop-loss placements in the forex market.

While understanding Camarilla pivot points is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

How do you use Camarilla pivot points in forex?

Traders use Camarilla pivot points in forex to identify high-probability trading opportunities by observing how price interacts with these calculated levels. The core principle suggests that price tends to revert to the mean (R1/S1) 80-90% of the time, especially in intraday trading, as noted by LiteFinance and Capital.com. This allows for both mean-reversion (range) and breakout (trend continuation) strategies, offering a versatile framework for daily market analysis.

How to Calculate Camarilla Pivot Point?

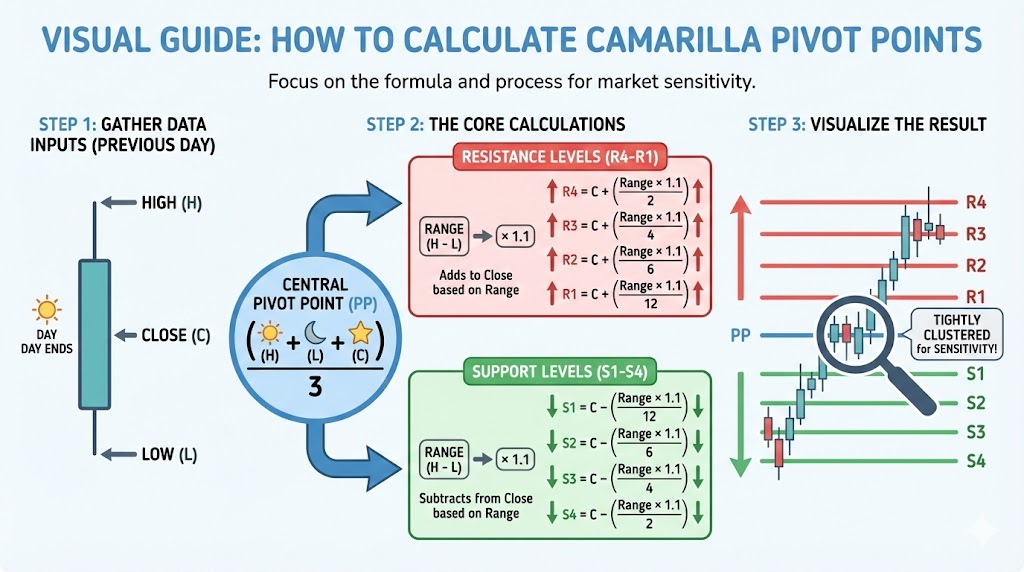

Understanding the calculation of Camarilla pivot points is fundamental to trusting and effectively applying them in forex trading. These levels are derived using a simple yet powerful formula that incorporates the previous day’s high, low, and closing prices.

The central pivot (PP) is often less emphasized in Camarilla, with focus shifting to the four resistance (R1-R4) and four support (S1-S4) levels.

What is the formula for Camarilla pivot points?

The formula for Camarilla pivot points uses the previous day’s High (H), Low (L), and Close (C) prices to generate eight specific levels. These levels are clustered more tightly around the closing price than traditional pivots, highlighting their sensitivity to recent price action. The calculation involves specific multipliers to define each support and resistance level.

| Level | Formula |

| R4 | Close + ((High − Low) × 1.1 / 2) |

| R3 | Close + ((High − Low) × 1.1 / 4) |

| R2 | Close + ((High − Low) × 1.1 / 6) |

| R1 | Close + ((High − Low) × 1.1 / 12) |

| PP (Pivot Point) | (High + Low + Close) / 3 |

| S1 | Close − ((High − Low) × 1.1 / 12) |

| S2 | Close − ((High − Low) × 1.1 / 6) |

| S3 | Close − ((High − Low) × 1.1 / 4) |

| S4 | Close − ((High − Low) × 1.1 / 2) |

Understanding Broker and Timeframe Discrepancies

Traders sometimes observe that their broker’s pivot points look different from what they calculate manually or see on other platforms. This discrepancy often arises from variations in server times or data feeds used by different brokers. The previous day’s high, low, and close prices can differ slightly depending on when the “day” officially ends for a particular data provider. It is important to maintain consistency in your data source to prevent calculation errors.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesCamarilla Levels: Support, Resistance & Price Action

Interpreting Camarilla levels involves understanding the distinct roles of each support and resistance zone in predicting price action. These levels are not merely static lines; they represent dynamic areas where market psychology and order flow are likely to shift. Analyzing how price interacts with R1-R4 and S1-S4 provides clear insights into potential reversals or breakouts.

The Power of R1-R4 and S1-S4

The eight Camarilla levels—R1, R2, R3, R4 (resistance) and S1, S2, S3, S4 (support)—each carry specific implications for trading strategies. R1/S1 typically define the normal trading range for the day, with price often reverting to these mean levels, as highlighted by LiteFinance and Capital.com.

R2/S2 represent stronger reversal zones, while R3/S3 and R4/S4 are critical levels for trend continuation or strong reversals, often indicating extreme price movements and potential for significant breakouts or fades, according to ActionForex and FXCC.

What is the difference between Camarilla and standard pivot points?

Camarilla pivot points differ from standard pivot points primarily in their calculation and intended application. Camarilla levels are much tighter and more responsive to recent price action, making them ideal for intraday trading strategies. Standard pivots, by contrast, are wider and often used for broader market context or swing trading over longer timeframes. The clustering of Camarilla levels around the previous day’s close provides more precise entry and exit points for day traders.

Top Camarilla Pivot Point Trading Strategies for Forex

Camarilla pivot points offer a versatile framework for developing robust trading strategies in the forex market. These strategies leverage the inherent tendency of price to either revert to its mean or break out into a new trend. Professional traders use these levels to identify high-probability reversal and breakout trades due to their responsiveness to recent price action, as noted by Medium and InsiderFinance.io.

What are the best Camarilla pivot point trading strategies?

The best Camarilla pivot point trading strategies include mean reversion (range) and breakout approaches. The mean reversion strategy focuses on price reversals between S1/R1 and S2/R2, while breakout strategies target moves beyond R3/S3 or R4/S4. Each strategy requires specific entry, exit, and stop-loss rules, tailored to the unique characteristics of Camarilla levels and current market conditions.

The Mean Reversion (Reversal) Strategy (S1-S2 & R1-R2)

The mean reversion strategy, also known as a range trading strategy, capitalizes on the tendency for price to stay within the R1/S1 or R2/S2 boundaries. Traders look to enter a long position when price tests S1 or S2 and shows signs of reversal, aiming for R1 or the central pivot as a take profit target.

Conversely, a short position is entered when price tests R1 or R2 and reverses, targeting S1 or the central pivot. Stop loss for these trades is typically placed just beyond S2/R2 or a recent swing high/low.

The Breakout Strategy (R3/S3 & R4/S4)

The breakout strategy focuses on significant price movements beyond the R3/S3 and R4/S4 levels, indicating strong trend continuation. When price breaks and holds above R3/S3, traders enter a long position, anticipating a move towards R4 or even higher. For short positions, a break below S3/R3 signals a potential move towards S4. The dilemma of fading versus breaking R4/S4 often depends on market momentum and volume confirmation.

Stop losses are placed just below the breakout level, and take profit targets can be the next pivot or a measured move.

Can Camarilla pivot points be used for day trading?

Yes, Camarilla pivot points are highly effective for day trading due to their dynamic nature and sensitivity to intraday price action. Many professional day traders use Camarilla pivots to identify high-probability reversal and breakout trades due to their responsiveness to recent price action, according to Medium and InsiderFinance.io. Their tighter clustering provides more frequent and precise signals, making them suitable for scalping and short-term directional trades within a single trading session in the forex market.

Essential Risk Management with Camarilla Pivot Points

Robust risk management is paramount when trading with Camarilla pivot points, just as it is with any trading strategy. Even with clear technical levels, market volatility and unforeseen events can lead to unexpected price movements. Successful trading with pivots requires robust risk management, typically risking no more than 1-2% of capital per trade, as advised by Capital.com and MTrading.

How do you set stop loss and take profit with Camarilla pivot points?

Setting stop loss and take profit with Camarilla pivot points depends on the chosen strategy. For reversal trades, a stop loss is typically placed just outside the S2/R2 levels or below a recent swing low for long trades, and above a swing high for short trades. If you are consistently getting stopped out, you might be placing stops too tight or failing to account for market noise and volatility.

Consider waiting for stronger price action confirmation before entry, or slightly widening your stop loss based on average true range (ATR) to avoid premature exits.

Optimizing Take Profit Targets

Optimizing take profit targets with Camarilla levels involves setting realistic goals based on market conditions and the specific strategy. For mean reversion, the next pivot level (e.g., S1 to R1, or R2 to R1) often serves as a logical target. For breakout strategies, a measured move or the next significant pivot (like R4 for an R3 breakout) can be used. Some traders also employ trailing stops to capture more of a strong trend while protecting profits.

What are the risks of using Camarilla pivot points?

The risks of using Camarilla pivot points include false breakouts, especially in choppy or low-volatility markets where prices may whipsaw around the levels. Over-reliance on any single indicator without confluence from other technical analysis tools or fundamental factors can also lead to suboptimal decisions. Proper position sizing, limiting leverage, and adhering to a strict risk management plan are crucial to mitigating these inherent risks.

Beyond the Basics: Advanced Camarilla Applications & Confluence

Integrating Camarilla pivot points with other technical indicators and advanced analytical tools can significantly improve their effectiveness. While a basic Camarilla pivot strategy, when combined with a trend filter, can improve win rates by 10-15% compared to using pivots alone, according to QuantifiedStrategies.com, deeper confluence offers even greater precision. This approach helps filter noise, confirm signals, and provide a more comprehensive view of market dynamics.

What timeframe is best for Camarilla pivot points?

Camarilla pivot points are most effective for intraday trading, making timeframes like the 15-minute, 30-minute, and 1-hour charts optimal. Their calculation, based on the previous day’s close, makes them particularly relevant for daily price action. While primarily an intraday tool, daily or weekly Camarilla pivots can also provide broader context for swing trading, helping identify key areas where longer-term trends might pause or reverse.

What indicators work well with Camarilla pivot points?

Several indicators work well with Camarilla pivot points to provide stronger confirmation and reduce false signals. Combining Camarilla with Volume Profile is an excellent way to identify high-volume nodes or value areas that align with pivot levels. If a Camarilla R3 or S3 level coincides with a high-volume node, it suggests a stronger support or resistance area, increasing the probability of a successful breakout or reversal. This confluence indicates institutional interest at those price points.

Using Heiken Ashi to Filter Noise and Confirm Trends

Heiken Ashi charts can be a powerful complement to Camarilla pivot points for filtering market noise and confirming trend direction. Unlike traditional candlesticks, Heiken Ashi candles smooth out price action, making trends and reversals more apparent.

When Camarilla levels indicate a potential reversal or breakout, Heiken Ashi can confirm the shift in momentum and trend strength, helping traders avoid false signals and stay in profitable trades longer.

Mastering the Trading Mind: Overcoming Psychological Biases with Camarilla

Even with the precision of Camarilla pivot points, the human element of trading introduces significant challenges. Psychological biases often lead to suboptimal decisions, regardless of clear technical levels. Up to 60% of trading losses are attributed to emotional decision-making, even when traders have access to clear technical levels like Camarilla pivots, highlighting the critical role of mental discipline.

The Impact of Fear and Greed on Camarilla Trades

Fear and greed are powerful psychological biases that can heavily influence trading decisions around Camarilla levels. Fear of missing out (FOMO) can lead traders to chase R4/S4 breakouts without proper confirmation, resulting in late entries and increased risk. Conversely, fear of losing profits can cause premature exits from R1/S1 reversals.

Greed might encourage holding onto losing trades too long or overleveraging. Maintaining strict adherence to a well-defined risk management plan helps to mitigate these emotional pitfalls.

Developing Discipline: Trading Plan and Journaling

Developing discipline is crucial for consistent profitability when using Camarilla pivot points. A robust trading plan, specific to your chosen Camarilla strategies (mean reversion or breakout), outlines entry, exit, stop loss, and position sizing rules. Journaling every trade helps identify patterns in your decision-making, revealing where psychological biases might be impacting your performance. This self-analysis is key to continuous improvement.

Troubleshooting Common Camarilla Challenges

Even experienced traders encounter challenges when applying Camarilla pivot points in live market conditions. Volatile or choppy markets can make these levels difficult to interpret, leading to frustration and potential losses. Proactive troubleshooting and adaptation are crucial for consistent performance, addressing common user pain points.

How to deal with choppy markets when using Camarilla pivots?

Dealing with choppy markets when using Camarilla pivots requires adaptation. In sideways or highly volatile conditions, prices often whipsaw around the R1/S1 and central pivot levels, generating numerous false signals. Strategies for choppy markets include widening stop losses, reducing position size, or simply stepping aside until clearer trends emerge. Combining Camarilla with a trend-filtering indicator like the ADX or a longer-term moving average can help identify unsuitable market conditions.

Minimizing Premature Stop-Outs

Premature stop-outs are a common frustration when trading with Camarilla levels. This often happens because stops are placed too close to the pivot levels, which act as magnets for price action. To minimize premature stop-outs, consider waiting for stronger price action confirmation (e.g., a clear candlestick pattern or a retest of the level) before entry. Additionally, adjusting stop loss placement slightly beyond the immediate pivot, or using confluence with higher timeframe support/resistance, can provide more buffer against market noise.

My broker’s pivot points look different from what I calculate. Why?

If your broker’s pivot points look different from your manual calculations, it is likely due to discrepancies in the high, low, and close prices used. Brokers may use different server times, leading to variations in the “previous day’s” data. To verify your Camarilla levels, make sure you are using consistent data sources. Cross-referencing with a trusted pivot point calculator or a platform like TradingView that allows you to specify session times can help confirm accuracy.

Implementing Camarilla: Tools, Indicators & Backtesting Your Edge

Implementing Camarilla pivot points effectively involves selecting the right tools, understanding how to integrate them into your trading platform, and rigorously backtesting your strategies. While indicators automate the process, understanding how to backtest and customize your Camarilla strategy is crucial for developing a robust, personalized trading edge.

Where can I find a Camarilla pivot point indicator for MT4/MT5?

Camarilla pivot point indicators are widely available for MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Many can be found in the MQL5 community marketplace, offering both free and paid versions with various customization options. Trading platforms like TradingView and Thinkorswim also have built-in or readily available indicators that automatically calculate and display Camarilla pivot points, providing convenience and saving manual calculation time.

Which brokers support Camarilla pivot points?

Most forex brokers do not directly “support” Camarilla pivot points as a built-in feature. Instead, they provide trading platforms like MT4/MT5 where traders can install custom indicators. The ability to use Camarilla pivots therefore depends on the platform capabilities offered by the broker rather than specific broker features. Traders should make sure their chosen broker’s platform allows for custom indicator installation and reliable data feeds.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountHow to backtest Camarilla pivot point strategy?

To effectively backtest a Camarilla pivot point strategy, define clear entry and exit rules, including specific stop loss and take profit parameters. Select historical data for your preferred currency pairs and timeframes. You can perform manual backtesting by scrolling through charts or use automated backtesting software available in platforms like MT4/MT5. Analyze results for key metrics such as win rate, risk-to-reward ratio, maximum drawdown, and profitability.

Backtesting shows that a basic Camarilla pivot strategy, when combined with a trend filter, can improve win rates by 10-15% compared to using pivots alone, according to QuantifiedStrategies. com.

Key Takeaways

- Dynamic Support/Resistance: Camarilla Pivots are crucial levels for intraday forex trading.

- Calculation Method: They use the previous day’s high, low, and close, providing tighter levels than standard pivots.

- Trading Strategies: Include mean reversion (R1/S1, R2/S2) and breakout (R3/S3, R4/S4) approaches.

- Risk Management: Strategic stop loss and take profit placement is essential for successful application.

- Indicator Confluence: Combining with tools like Volume Profile or Heiken Ashi improves signal reliability.

- Psychological Discipline: Backtesting and managing biases are vital for building a robust trading edge.

Bottom Line

Camarilla pivot points offer forex traders a highly effective and precise tool for navigating the complexities of intraday market movements. By understanding their calculation and the distinct roles of each support and resistance level (R1-R4 and S1-S4), traders can develop robust strategies for both mean reversion and breakout scenarios. Integrating these pivots with complementary indicators, like Volume Profile or Heiken Ashi, further refines entry and exit signals, creating powerful confluence.

Crucially, mastering the psychological aspects of trading and implementing sound risk management principles makes sure that these technical insights translate into consistent profitability. Addressing common challenges through proactive troubleshooting solidifies Camarilla pivots as an indispensable asset for any serious day trader aiming for an edge in the dynamic forex market.