Forex signal providers are experts or companies that deliver trade recommendations in the forex market. They analyze price trends, economic news, and technical indicators to identify profitable entry and exit points. Traders use their signals to improve accuracy, reduce analysis time, and make more informed trading decisions.

Finding the right forex signal provider is a crucial step for any trader. This guide breaks down 10 of the top options for 2026, giving you a clear framework to choose the one that best fits your trading style and risk tolerance.

What Is a Forex Signal Provider?

A forex signal provider is a service that gives you trading recommendations or “signals.” Think of them as a scout who does the market research for you and then sends you a simple alert with instructions on a potential trade.

These signals are typically sent in real-time through platforms like Telegram, email, SMS, or a dedicated app. A complete signal will usually include:

- Currency Pair: The specific pair to trade (e.g., EUR/USD).

- Action: Whether to Buy or Sell.

- Entry Price: The exact price at which to open the trade.

- Stop-Loss (SL): A price level to automatically close the trade to limit potential losses.

- Take-Profit (TP): A price level to automatically close the trade once it hits a certain profit target.

Essentially, they provide a shortcut to trading opportunities, which can be especially helpful for beginners or those with limited time to analyze the markets.

What to Consider When Choosing a Signal Provider

Choosing a reliable signal provider is crucial, as your capital is on the line. Here’s what to look for:

- Verified Track Record & Win Rate: Don’t just trust the advertised “win rate.” Look for a verified history of performance on third-party sites like Myfxbook. A high win rate is meaningless without a good risk-to-reward ratio. A provider who wins 9 small trades but has 1 huge loss isn’t profitable.

- Delivery Method: Signals must be delivered quickly and reliably. Telegram and dedicated mobile apps are often faster than email. Make sure the method works for you so you don’t miss opportunities.

- Cost: Services range from free to hundreds of dollars per month. Free signals can be a good starting point, but they often lack support and may be less reliable. A premium service should justify its cost with high-quality signals, detailed analysis, and good customer support.

- Regulation and Transparency: While most signal providers are not officially regulated, those that are (or are run by regulated analysts) offer a higher level of trust. A transparent provider will openly share both their winning and losing trades. Be wary of any service that only shows wins.

- Real User Reviews: Look for independent reviews on platforms like Trustpilot or forex forums. Avoid relying solely on testimonials found on the provider’s own website, as they can be curated.

Top 10 Forex Signal Providers in 2026

Let’s explore the top 10 Forex signal providers in 2026, including their features, pros, and cons to help you make an informed decision:

| Provider | Overall Rating | Total Reviews | Pricing Model |

| forexgdp.com | 4.9/5 | 549 | Free & Premium subscription |

| 1000pip Builder | 4.7/5 | 284 | Subscription (£77/mo; discounts for longer terms) |

| Forex Indicator Non Repaint Signals Cashpower | 4.6/5 | 53 | One-time fee (lifetime license) |

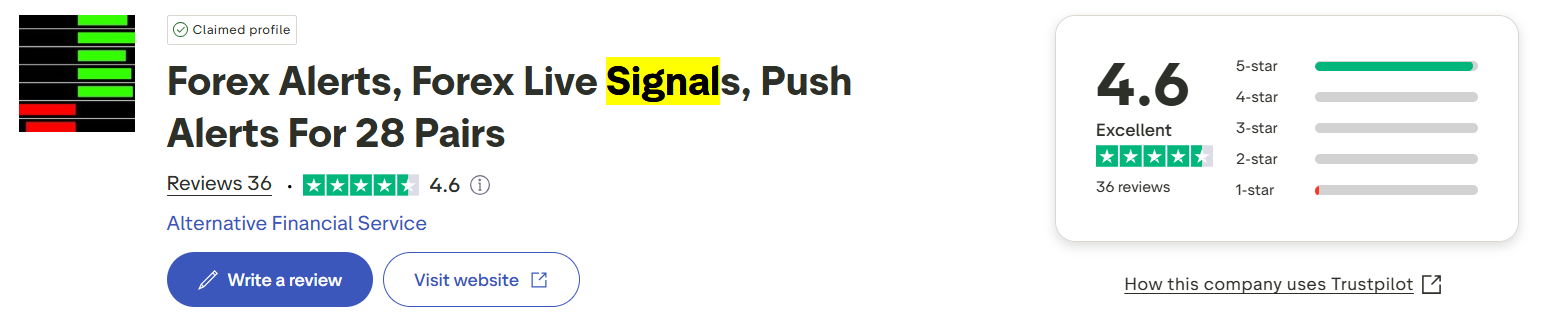

| Forex Alerts / Forexearlywarning | 4.6/5 | 36 | $19.95/month |

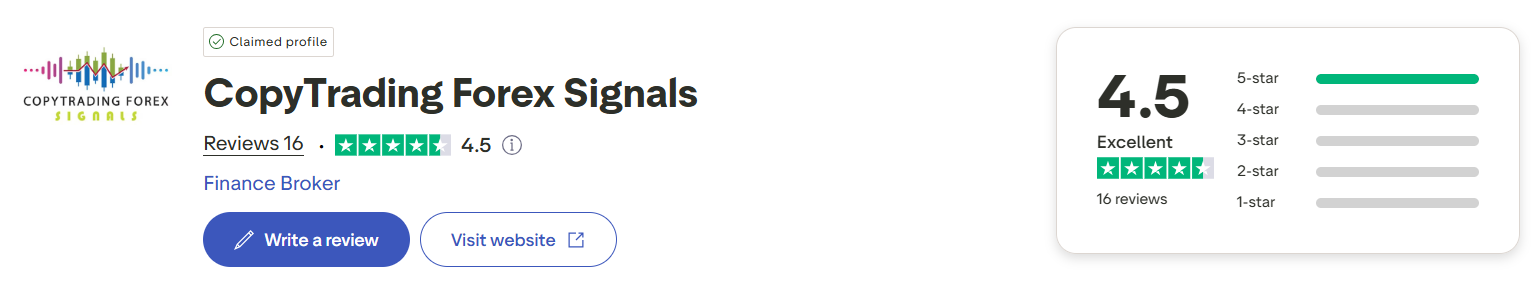

| CopyTrading Forex Signals (CopyFX) | 4.5/5 | 16 | Provider/trader fees; no platform fee |

| Elite Signals | 4.3/5 | 373 | Broker commission-based |

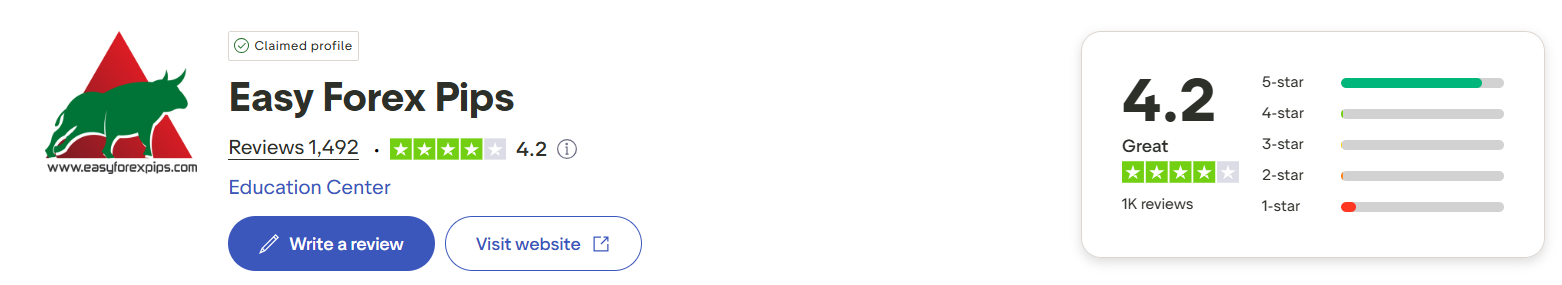

| Easy Forex Pips | 4.2/5 | 1,492 | Broker-integrated |

| SureShotFX | 4.1/5 | 430 | Free & VIP subscription/one-time fee |

| Learn to Trade | 3.9/5 | 1,458 | Paid courses/training |

| SignalStart | 3.6/5 | 97 | Monthly + provider fees |

ForexGDP

Provides both free and premium forex trading signals, market analysis, and trade setups. Premium plans include entry, stop loss, and take profit levels for various forex pairs. The service claims high accuracy rates, though independent verification of results is limited. Offers educational resources alongside signals, making it suitable for traders seeking both guidance and learning material.

1000pip Builder – Trusted Forex Signals

Provides direct forex signals for 15 currency pairs, mainly majors and Yen crosses. Signals are clear, actionable, and suitable for beginners, with delivery via email, Telegram, and push notifications. MyFXbook-verified results exist but cover only a short six-month profitable period, raising questions about long-term consistency. Highly rated on curated review sites but faces skepticism on trading forums. Subscription is relatively expensive and there’s no free trial.

Forex Indicator Non Repaint Signals Cashpower

An MT4 indicator claiming “non-repaint” accuracy between 87% and 96%, covering forex, indices, metals, and more. Offers lifetime licensing with free updates. The non-repaint and non-lagging claims address common indicator flaws, but no independent verification supports performance claims. Community sentiment toward such premium indicators is often skeptical, with warnings about scams and overpromises.

Forex Alerts, Forex Live Signals, Push Alerts For 28 Pairs

Subscription-based service ($19.95/month) offering real-time forex alerts across 28 currency pairs, plus gold and crypto heatmaps. Uses the proprietary Forex Heatmap® to visually display currency strength and weakness. Accessible across devices. Effective for those who can interpret signals but not an automated “set-and-forget” solution, requiring trader input and market knowledge.

CopyTrading Forex Signals

A copy trading platform linked to RoboForex that allows users to automatically replicate trades from experienced traders. No platform fee, but providers may charge performance or volume-based fees. Trader rating systems assist selection, but results vary widely depending on the chosen leader’s skill and risk management.

Elite Signals

Provides TradingView-based signals for forex, cryptocurrencies, gold, and oil, with an included risk profile for trades. Monetized through broker commissions rather than direct subscription fees. The service’s credibility depends heavily on the influencer(s) behind it, with transparency and independent performance verification varying significantly.

Easy Forex Pips

Regulated broker (CySEC, ASIC, FSA, FSC, FSCA) offering built-in signals from Autochartist and FCA-regulated Signal Centre. Covers forex, CFDs, indices, commodities, cryptocurrencies, and options. Known for fixed spreads and AI-powered predictive analytics. Reliable for those trading within the easy forex pips platform but not usable with external brokers.

SureShotFX

Offers both free and VIP signals for forex, gold, and indices, alongside automated trading tools such as trade copiers and algorithms. Unregulated and lacking independent performance audits, so caution is advised despite its range of features.

Learn To Trade

Learn to Trade offers trading education, coaching, and tools such as SmartCharts and market analysis resources. The program promotes live training sessions, educational content, and in some cases, funded account offers through affiliated brokers. While the presentation is professional and the curriculum structured, the platform’s reputation is poor. Trustpilot scores are low, with many reviews alleging unrealistic promises, high costs, and aggressive upselling. Independent forum discussions often describe it as more of a marketing funnel than a pathway to profitable trading. Prospective users should approach cautiously and seek independent verification before committing funds.

SignalStart

Fully hosted copy trading platform compatible with multiple brokers. Users pay a monthly fee plus provider fees to copy trades. Offers a convenient setup but remains unregulated, and performance depends entirely on the chosen signal provider.

How to Avoid False Signals in Trading

A “false signal” is a trade alert that looks promising but quickly fails. While no signal is 100% perfect, you can filter out low-quality ones and protect yourself with these steps:

- Confirm with Your Own Analysis: Never follow a signal blindly. Do a quick check yourself. Does the signal align with the major trend? Is it near a key support or resistance level? A signal that goes against all other technical signs is highly suspect.

- Check the Economic Calendar: Avoid taking signals generated just before a high-impact news event (like Non-Farm Payrolls or an interest rate decision). Extreme volatility during these times can instantly invalidate a signal’s technical setup.

- Look for Confluence: A good signal is often supported by other indicators. If you receive a “Buy” signal, check if an indicator like the RSI is showing upward momentum or if the MACD is bullish. This “confluence” of factors increases your confidence in the trade.

- Apply Strict Risk Management: This is your ultimate safety net. Even if a signal turns out to be false, having a pre-defined stop-loss ensures that your loss is small and controlled. Good risk management turns a potentially disastrous trade into a minor, manageable setback.

Are AI Forex Signals Accurate?

The accuracy of AI forex signals is a topic of great interest, and the answer isn’t a simple yes or no. They have distinct advantages and significant limitations.

- Data Processing Power: AI can analyze decades of historical data and identify complex patterns that are invisible to the human eye.

- Emotionless Decisions: AI operates purely on data and algorithms, eliminating the costly emotional mistakes of fear and greed that affect human traders.

- 24/7 Market Scanning: An AI can monitor global markets around the clock without fatigue, ensuring no potential opportunity is missed.

- Dependent on Quality: An AI is only as good as its programming and the data it was trained on. A poorly designed algorithm will consistently produce poor signals.

- Struggles with “Black Swan” Events: AI models are trained on past events. They can be completely wrong-footed by unprecedented global situations (like a sudden pandemic or geopolitical crisis) where there is no historical data to draw from.

- Over-Optimization Risk: Some AI systems are perfectly tuned to past data, making them look flawless in backtests. However, they may fail in live, dynamic market conditions that don’t perfectly match the past.

AI signals can be highly accurate in predictable market conditions but are not infallible. Their reliability depends entirely on the sophistication of the model. The best approach is to treat them as a powerful tool, not a magic bullet, and always use them in conjunction with your own judgment and solid risk management.

Common Mistakes to Avoid When Using Forex Signals

Relying too much on forex signals can lead to poor decisions. Signals are helpful tools, but they do not guarantee success. Always pair them with your research and strategies. Ignoring risk management is another mistake. Even the best signals can cause losses if you fail to set proper stop-losses and take-profit levels. Can you afford to lose the amount you’re risking?

It is suggested that—following signals without fully understanding them can be harmful. Analyze why a signal was given. But if you understand the reasoning behind it, it will help you make smarter decisions. Overtrading is a common error. More signals don’t mean more opportunities. So, stick to the ones that fit your strategy. Do you need to act on every signal?

A good forex signal provider is essential to achieving success in your trading. It is important to—keep a record of your trades. Review them regularly to see what’s working and what’s not. Tracking results will help you improve your approach.

Avoid these mistakes to make better use of forex signals. Do you have any strategies in place to complement them?

Bottom LIne

Forex signals can boost your trading strategy, but they are not foolproof. You must use them alongside your research and solid risk management practices. Blindly following signals won’t guarantee success. You should understand all about each signal because it is important. Never skip the step of analyzing the market context before acting. Keep track of your trades. Use past experiences to refine your approach.

Do you have a plan for integrating signals into your strategy? Trading successfully means staying disciplined and consistently learning. Only then can you make informed decisions and improve your results.