The Financial Information eXchange (FIX) API is a crucial communication protocol enabling direct, high-speed connectivity for institutional traders. It standardizes the electronic exchange of trading information, from orders to executions, across global financial markets. This allows firms to achieve ultra-low latency and granular control over their trading strategies, forming the backbone of modern electronic trading.

What is FIX API and Why is it Essential?

FIX API, or Financial Information eXchange Application Programming Interface, is a standardized messaging protocol for electronic trading. It enables financial institutions to communicate trade-related messages, such as orders, executions, and market data, directly and efficiently.

FIX Protocol has been the industry standard for electronic trading since the early 1990s, facilitating billions of transactions daily, according to OnixS.

Its essential nature stems from its ability to provide speed, reliability, and a universally understood language for market participants.

What is FIX Protocol?

FIX Protocol refers to the underlying set of messaging specifications that define the structure and content of electronic communications in financial markets. It provides a common framework, making sure that diverse trading systems can seamlessly interact. This protocol has evolved significantly since its inception, continually adapting to the increasing demands of electronic trading and becoming the de facto language for institutional market interactions.

Who Uses FIX API?

Financial institutions of various sizes leverage FIX API for market access due to its robust capabilities. Institutional traders, hedge funds, proprietary trading firms, brokers, and market data vendors are primary users. They rely on FIX API for its ability to provide direct access to liquidity, execute algorithmic trading strategies, and receive real-time market data, all crucial for competitive advantage in fast-moving markets.

How FIX API Works?

FIX API operates on a two-layer architecture, comprising the Session Layer and the Application Layer, fundamental to its operation.

The Session Layer manages the physical connection, handling tasks like logon, logout, sequence number management, and heartbeats to maintain connectivity.

The Application Layer, conversely, is responsible for the actual business messages, such as new orders, order cancellations, and execution reports, making sure the correct messaging protocol is followed for trade-related data.

FIX Message: Tags, Values, and Structure

A FIX message is structured as a series of tag=value pairs, separated by a delimiter. Each FIX Tag is a numeric identifier representing a specific field, while its associated value provides the data for that field. For example, Tag 8 (BeginString) identifies the FIX protocol version, and Tag 35 (MsgType) specifies the message’s purpose, such as ‘D’ for a New Order Single. This standardized, compact structure makes sure efficient processing and minimal data overhead in the messaging protocol.

The Role of a FIX Engine in Streamlined Communication and Low Latency

A FIX engine is a software component designed to handle the complexities of FIX Protocol communication. It manages session-level details, parses incoming messages, validates outgoing messages, and handles error conditions. By automating these intricate processes, a FIX engine significantly contributes to achieving low latency and high throughput in FIX API communication. The primary benefit of FIX API is its high speed and low latency, crucial for algorithmic and high-frequency trading, according to FXCM Markets.

What are the benefits of FIX API?

FIX API offers numerous benefits for institutional trading, primarily centered around speed, control, and standardization. It enables direct access to markets, facilitates advanced trading strategies, and provides comprehensive support for the entire trade lifecycle. These advantages collectively contribute to more efficient and transparent trade execution.

Achieving Direct Market Access (DMA) and Superior Execution

Direct Market Access (DMA) is a core benefit of FIX API, allowing institutions to bypass intermediaries and send orders directly to exchanges or liquidity providers.

FIX API enables direct market access (DMA) and allows institutions to connect directly to liquidity providers, exchanges, and other market participants, as stated by FINXSOL.

This direct route results in faster trade execution, reduced slippage, and greater control over order placement, which is critical for competitive trading environments.

Empowering Algorithmic and High-Frequency Trading Strategies

FIX API serves as the backbone for sophisticated algorithmic trading and high-frequency trading (HFT) strategies. Its low latency capabilities allow algorithms to react to market changes in milliseconds, executing complex order types and managing large volumes of transactions efficiently.

This speed is indispensable for strategies that capitalize on fleeting market opportunities.

Consolidated Liquidity and Real-time Market Data

Through FIX API, institutions can connect to multiple liquidity providers simultaneously, aggregating pricing and depth from various sources into a single view. This consolidated liquidity enhances pricing transparency and improves execution quality.

Furthermore, FIX API efficiently streams real-time market data, providing traders with immediate access to quotes, trades, and other vital information for informed decision-making.

Improved Control, Customization, and Full Trade Lifecycle Support

FIX API offers granular control and extensive customization options, allowing institutions to tailor their trading workflows precisely to their needs.

It supports the entire trade lifecycle, from pre-trade analytics and risk checks to trade execution and post-trade confirmations and allocations. This comprehensive support makes sure a seamless and integrated trading operation.

FIX API vs REST API: Which is better?

Choosing between FIX API and REST API depends heavily on the specific trading needs and infrastructure of a firm. Both serve as connectivity standards, but they are optimized for different use cases and operational requirements. While FIX API prioritizes ultra-low latency and stateful connections, REST API offers simplicity and stateless communication, often preferred for general web services.

Understanding the Fundamental Differences

FIX API and REST API represent distinct approaches to electronic communication in financial markets. FIX API is a binary-optimized, stateful protocol designed for persistent, high-throughput connections, making it ideal for real-time trading. In contrast, REST API is a stateless, text-based protocol typically operating over HTTP, commonly used for request-response interactions and less critical latency applications.

Performance, Complexity, and Use Cases: A Comparison

The differences between FIX API and REST API extend to their performance characteristics, implementation complexity, and typical use cases. FIX API excels in scenarios requiring ultra-low latency and high message throughput, such as algorithmic and high-frequency trading.

REST API is simpler to implement and more versatile for general web applications, data retrieval, and lower-frequency trading where latency is less critical. The real distinction beyond speed lies in their standardization, message granularity, and ecosystem support.

| Feature | FIX API | REST API |

| Primary Use Case | High-frequency, institutional trading | General web services, lower-frequency trading |

| Latency | Ultra-low | Higher (due to HTTP overhead) |

| Data Format | Tag=Value (binary-optimized) | JSON/XML (text-based) |

| Connection Type | Persistent, stateful TCP/IP | Stateless HTTP requests |

| Complexity | High (requires specialized FIX Engine) | Lower (standard web protocols) |

| Market Data | Real-time streaming | Request/response (polling) |

| Typical Users | Hedge funds, brokers, prop firms | Retail platforms, mobile apps |

When to Choose FIX API (and When Not To)?

Choose FIX API when low latency trading, direct market access, and standardized institutional communication are paramount. It is the preferred choice for hedge funds, prop firms, and large institutions engaging in algorithmic trading systems or high-frequency strategies. Avoid FIX API if your needs are simpler, latency is not a critical factor, or if you prefer easier integration with standard web development tools, where a REST API might suffice.

What are the challenges of FIX API implementation?

Implementing FIX API effectively comes with several challenges, primarily related to technical complexities and integration. These include making sure correct parsing of diverse FIX messages, maintaining stable session management, and achieving seamless integration with existing Order Management System (OMS) platforms. Implementing FIX API effectively requires careful attention to session management, message parsing, and error handling to maintain stable, high-performance connections, notes OnixS.

How to connect to FIX API?

Connecting to FIX API involves establishing a TCP/IP connection to the liquidity provider or exchange, followed by a FIX session handshake. This typically requires a FIX engine to manage the session layer (logon, heartbeats) and handle the application layer messages. Configuration details, such as IP addresses, port numbers, and FIX credentials, are provided by the connectivity partner.

What’s the difference between FIX 4.2 and FIX 4.4?

FIX Protocol has evolved through various versions, with common distinctions between versions like FIX 4.2 and FIX 4.4. These versions primarily differ in the number of supported message types and fields, reflecting advancements in financial products and trading practices. Newer versions, such as FIX 4.4, often introduce additional functionalities for complex order types and improved post-trade processing, while older versions like 4.2 remain widely used due to established integrations.

What are the security concerns with FIX API?

Security is a paramount concern in FIX API connections, given the sensitive nature of trading data. Key security considerations include making sure data encryption using protocols like TLS/SSL, implementing robust authentication mechanisms, and configuring firewalls to restrict unauthorized access. These measures are crucial components of a comprehensive risk management strategy to protect against unauthorized access and data breaches.

Best practices for FIX API development.

Best practices for FIX API development focus on robustness, reliability, and maintainability. These include implementing comprehensive error handling and logging, thorough regression testing, and continuous monitoring of connection stability and message flow. using specialized tools like FIXate from the FIX Trading Community for validation and compliance testing is also highly recommended to make sure proper implementation and adherence to the FIX Protocol standard.

Common User Challenges & Troubleshooting FIX API

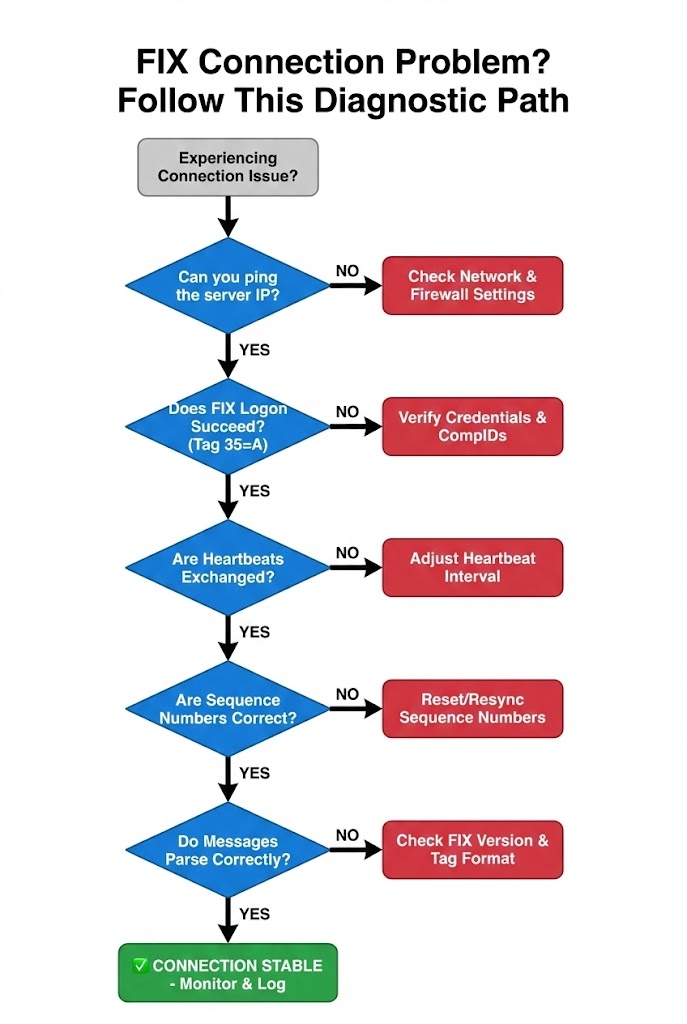

Unlike most high-level guides, this section provides actionable solutions to frequently encountered FIX API issues, drawing directly from real user experiences and expert insights. Users consistently ask about unexpected FIX connection drops and parsing errors, which can severely impact trading operations.

Effective troubleshooting relies on a deep understanding of FIX Protocol mechanics and proper diagnostic tools.

Diagnosing Persistent FIX Connection Drops and Latency Issues

Persistent FIX connection drops are a frequent pain point for users. Common causes include network instability, incorrect heartbeat intervals, or invalid login credentials at the Session Layer. To diagnose, check network logs for packet loss, verify heartbeat settings match the counterparty’s, and confirm login details are accurate. A well-configured FIX engine can often mitigate these issues by automatically attempting reconnections and logging session events, thereby reducing low latency trading disruptions.

Resolving FIX Message Parsing Errors and Data Inconsistencies

FIX message parsing errors often arise from malformed FIX Tags or incorrect interpretations of the messaging protocol. This can happen when a message contains an unexpected tag, a value in the wrong format, or an incorrect sequence number.

Debugging involves detailed logging of raw FIX messages, comparing them against the FIX specification, and using a FIX engine’s validation capabilities. Tools that visualize the tag=value pairs can quickly highlight discrepancies, making sure data consistency for algorithmic trading systems.

Strategies for Effective Pre-Live Testing and Validation

Going live with FIX API requires thorough pre-live testing to make sure reliability and compliance. Strategies include setting up mock connections to simulate market environments, performing regression testing with historical data, and validating message flows against expected outcomes.

Using tools like FIXate is crucial for verifying that the FIX implementation adheres to the FIX Protocol standard, preventing unexpected issues once connected to live liquidity providers. This proactive approach minimizes risks for proprietary trading models.

How to choose a FIX API provider/broker?

Choosing a FIX API provider or broker requires careful evaluation of several factors. Key criteria include the provider’s reliability, the actual low latency of their connections, access to diverse liquidity providers, quality of technical support, fee structure, and the range of asset classes supported (equities, forex, crypto).

It is essential to select a partner whose infrastructure aligns with your firm’s trade execution and black box trading requirements.

What are the costs associated with FIX API?

The costs associated with FIX API integration are multifaceted and can include initial setup fees, ongoing monthly access charges, and significant internal development and maintenance expenses. While the FIX Protocol itself is an open standard, the implementation, infrastructure, and specialized software like a FIX engine incur costs. These expenditures cover dedicated servers, network infrastructure, and skilled personnel required to manage the complex tag-value pairs and maintain high-performance connections.

What software is needed for FIX API trading?

Essential software for FIX API trading typically includes a robust FIX engine for handling message parsing and session management, an Order Management System (OMS) for managing and routing orders, and a comprehensive market data feed aggregator. Additionally, firms require a strong network infrastructure, monitoring tools for performance and error tracking, and potentially a black box trading system for automated strategies.

Can retail traders use FIX API?

While FIX API is primarily designed for financial institutions due to its complexity and cost, some specialized brokers or platforms may offer limited FIX connectivity to advanced retail or proprietary trading models. However, for most retail traders, the overhead of implementing and maintaining a FIX API connection often outweighs the benefits. Simpler REST API connections or proprietary platforms are typically more viable alternatives for individual traders.

The Future of FIX: Trends, Innovations, and Microstructure Trading

The future of FIX Protocol involves continuous innovation to meet evolving market demands, particularly in low latency trading. Trends include advancements like FIX Latest, which explores Binary Encoding (e.g., SBE) for even greater speed and efficiency.

FIX API is also increasingly vital for Microstructure Trading, allowing deep analysis of market dynamics at the most granular level, offering insights into order book movements and price impact. These innovations aim to further optimize order execution speed and data throughput.

Key Takeaways

- Institutional Standard: FIX API is the industry-standard protocol for institutional electronic trading, providing direct market access and ultra-low latency execution.

- Layered Architecture: FIX API operates through a Session Layer for connection and sequencing, and an Application Layer for trade and market data messages structured with FIX Tags.

- Core Advantages: Key benefits include superior execution quality, support for advanced algorithmic trading, and access to consolidated liquidity providers and real-time market data.

- Implementation Considerations: Successful FIX API deployment requires precise FIX engine configuration, strict version compatibility, and robust security, with tools like FIXate helping validate message integrity.

- Future Evolution: The FIX protocol continues to evolve with innovations such as Binary Encoding and an expanding role in microstructure and high-frequency trading.

Bottom Line

FIX API stands as the indispensable backbone of modern institutional electronic trading, offering unparalleled speed, control, and standardization. Its two-layer architecture, detailed message structure, and reliance on specialized FIX engines collectively enable direct market access and empower sophisticated algorithmic trading strategies.

While its implementation presents challenges, the benefits of low latency trading, consolidated liquidity, and full trade lifecycle support make it a critical component for any serious financial institution seeking a competitive edge. Understanding its intricacies, from FIX Tags to Session Layer management, is key to leveraging its full potential in today’s dynamic markets.

FAQ

References

- FIX Implementation Guide – FIX Trading Community – FIXimate

- Understanding FIX Protocol: The Standard for Securities …

- Switching to Trading FX via a FIX API – Advanced Markets

- Modernizing Financial Services with API-enabled Integration

- Trade at the Speed of Thought with ATFX FIX API

- FIX API vs REST API – What to Choose When Integrating … – CoinAPI