The Aroon Oscillator is a technical analysis indicator that measures the strength of a trend and the likelihood of its continuation or reversal. It helps forex traders identify the beginning of a new uptrend or downtrend, gauge the momentum behind price movements, and pinpoint potential turning points in currency pairs.

Developed by Tushar Chande, this tool offers a unique perspective on market dynamics by focusing on the time elapsed since a period high or period low.

Understanding the Aroon Oscillator is crucial for forex traders aiming to improve their trend identification and timing. This guide will explore its mechanics, optimal settings, advanced strategies, and common pitfalls, providing a holistic view for its effective application in the dynamic forex market.

While understanding Aroon Oscillator is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is the Aroon Oscillator and How Does it Work in Forex?

The Aroon Oscillator is a momentum indicator that helps traders determine if a financial asset is trending and how strong that trend is. It works by measuring the number of periods since the highest high or lowest low occurred within a specified lookback period.

This provides insights into the directional strength of the market, which is particularly useful in dynamic forex trading.

The Genesis of Aroon: Tushar Chande’s Innovation

The Aroon indicator was developed by Tushar Chande in 1995. His innovation aimed to identify the beginning of new trends and the end of old ones by focusing on time rather than price. The name “Aroon” comes from the Sanskrit word for “dawn’s early light,” symbolizing its function in spotting the early stages of a trend.

Deconstructing the Aroon Up and Aroon Down Lines

The Aroon Oscillator is derived from two primary components: the Aroon Up Line and the Aroon Down Line. Both lines oscillate between 0 and 100. The Aroon Up Line measures the number of periods since the highest price within the lookback period, while the Aroon Down Line measures the number of periods since the lowest price.

When the Aroon Up Line moves towards 100, it indicates that a new period high was recently made, suggesting strong buying pressure and an emerging uptrend. Conversely, when the Aroon Down Line approaches 100, it signifies a recent period low, indicating strong selling pressure and a developing downtrend.

The interplay between these two lines forms the basis of the Aroon Oscillator. When one line is high and the other is low, a strong trend is typically present. If both lines are low, the market is likely in a consolidation phase.

Interpreting the Aroon Oscillator: Early Trend Signals

The Aroon Oscillator itself is calculated by subtracting the Aroon Down Line from the Aroon Up Line, resulting in a value that fluctuates between -100 and +100. A reading above zero suggests an uptrend, with values closer to +100 indicating a strong new uptrend.

Conversely, a reading below zero points to a downtrend, with values near -100 signaling a strong new downtrend.

When the oscillator hovers around the zero line, it often indicates a ranging market or a consolidation phase, where neither buyers nor sellers are dominant. This tool provides crucial insights into trend identification and momentum, helping traders anticipate shifts before they become widely apparent.

Its ability to signal early trend signals makes it a valuable component of technical analysis, particularly for identifying potential entry and exit points in fast-moving currency pairs.

Applying Aroon: Best Settings, Trend Identification, and Reversal Signals

Effective application of the Aroon Oscillator involves selecting appropriate settings and understanding how to interpret its signals for trend identification and reversal signals. The indicator’s utility varies across different market conditions and trading styles, making proper configuration essential for forex traders.

What are the best Aroon Oscillator settings for forex?

The best Aroon Oscillator settings for forex are often cited between 14 and 25 periods for swing trading, though this varies by asset and timeframe.

A shorter period, such as 10, makes the indicator more sensitive to recent price changes, potentially generating more signals but also more noise. A longer period, like 25, smooths out the signals, reducing false positives but potentially leading to delayed indications.

Traders must adjust the timeframe and period settings based on their specific trading style and the volatility of the currency pair. For instance, a scalper might use a shorter timeframe (e. g. , 5-minute chart) with a 10-period setting, while a swing trader might prefer a daily chart with a 25-period setting.

Addressing the common forum pain point regarding the best timeframe for swing trading, the daily chart with a 14-25 period setting often provides a balanced approach, capturing significant moves without excessive lag.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow do you identify trends and reversals with the Aroon Oscillator?

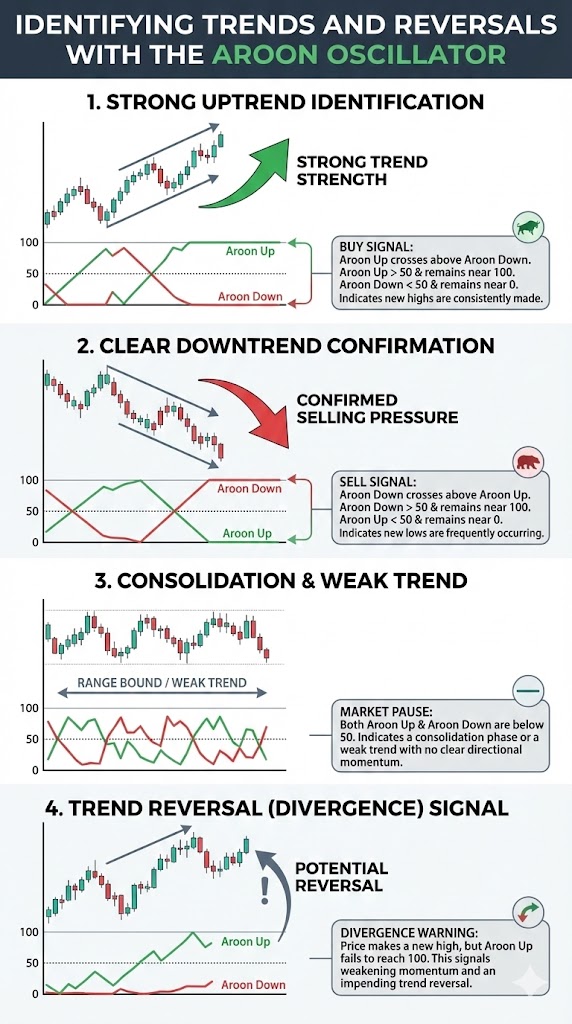

Identifying trends and reversals with the Aroon Oscillator involves observing the position and crossovers of the Aroon Up and Aroon Down lines, as well as the oscillator’s value. A strong new uptrend is indicated when the Aroon Up Line crosses above the Aroon Down Line and remains near 100, while the Aroon Down Line stays near 0.

This suggests that new highs are consistently being made, signaling strong trend strength.

Conversely, a clear new downtrend emerges when the Aroon Down Line crosses above the Aroon Up Line and stays near 100, with the Aroon Up Line remaining close to 0. This pattern indicates that new lows are frequently occurring, confirming selling pressure.

When both lines are below 50, the market is typically in a consolidation phase or a weak trend. Divergence between the Aroon Oscillator and price action can also signal potential reversal signals. For example, if price makes a new high but the Aroon Up Line fails to reach 100, it may indicate weakening momentum and an impending trend reversal.

Advanced Aroon Oscillator Strategies & Confluence with Other Indicators

Integrating the Aroon Oscillator into a robust trading strategy requires more than basic signal interpretation. Advanced approaches emphasize confluence—combining Aroon with other indicators to improve reliability and address its inherent limitations. This helps traders gain a clearer picture of market dynamics and potential entry points and exit points.

How to combine the Aroon Oscillator with other indicators?

Combining the Aroon Oscillator with other indicators for confluence significantly improves signal reliability.

If the Aroon Up Line crosses above the Aroon Down Line, indicating a potential uptrend, a trader might wait for the price to also cross above a 50-period moving average before entering a long position. This dual confirmation helps filter out late signals, a common pain point for traders in choppy markets.

Another effective combination involves using Support and Resistance levels. Aroon signals become more potent when they occur near established support or resistance zones. An Aroon Up Line crossing above the Aroon Down Line near a major support level, for instance, provides a stronger buy signal than an isolated Aroon crossover.

This confluence helps validate potential entry points and identify strategic exit points when combined with profit targets or stop-loss placements.

Aroon Oscillator vs. MACD: A Comparative Analysis

When comparing the Aroon Oscillator with the Moving Average Convergence Divergence (MACD), it is clear both are momentum indicators, but they measure different aspects. The Aroon Oscillator focuses on the time component—how long since a new high or low.

The MACD, however, focuses on the relationship between two moving averages, highlighting changes in price momentum and trend strength.

Neither indicator is inherently “better”; their utility depends on the trader’s preference and market conditions. Aroon can be useful for early trend identification, while MACD is often better for identifying momentum shifts and potential divergences. Many traders use both in conjunction, with Aroon signaling a potential trend start and MACD confirming its momentum.

Can the Aroon Oscillator predict price movements?

The Aroon Oscillator, like other technical indicators, cannot predict future price movements with certainty.

Instead, it serves as a probabilistic tool, indicating the likelihood of trend continuation or reversal based on historical price action.

It reflects current trend strength and momentum, helping traders make informed decisions rather than speculative guesses. Relying solely on the Aroon Oscillator for prediction can lead to false signals, especially in range-bound markets.

Its true power lies in its ability to quantify how recently price highs and lows occurred, providing a unique perspective on market dynamics that complements, but does not replace, comprehensive analysis.

Aroon Oscillator Trading Strategies: Practical Applications

Developing effective Aroon Oscillator trading strategies involves understanding how to integrate its signals into a structured plan. These strategies often focus on identifying strong trends or potential reversals, always emphasizing confirmation with other tools to optimize entry points and exit points.

Trend-Following Strategies with Aroon

A common trend-following strategy involves using the Aroon Oscillator to confirm the direction of a prevailing trend. For an uptrend, a trader might look for the Aroon Up Line to be consistently above 70, with the Aroon Down Line remaining below 30. This indicates strong buying pressure and a clear new uptrend.

A buy signal can be generated when the Aroon Up Line crosses above the Aroon Down Line, and both are moving upwards, confirming the trend.

Entry points could be established on a pullback within the confirmed trend, while exit points might be triggered if the Aroon Up Line begins to dip below 50, signaling weakening momentum. This strategy works best in clearly trending markets, helping traders capitalize on sustained price movements in currency pairs.

Reversal Trading Strategies using Aroon Crossovers

Reversal trading with the Aroon Oscillator focuses on identifying shifts in market direction. A potential sell signal (for a reversal from an uptrend) occurs when the Aroon Down Line crosses above the Aroon Up Line, and the Aroon Down Line then rises towards 100, while the Aroon Up Line falls towards 0.

This suggests a strong new downtrend is emerging.

For a buy signal (reversal from a downtrend), the Aroon Up Line crossing above the Aroon Down Line, with the Aroon Up Line rising towards 100, indicates a potential new uptrend. Caution is paramount with reversal strategies, as false signals are common.

Traders should always seek confirmation from other indicators, such as candlestick patterns or volume analysis, before acting on Aroon reversal signals. Backtesting any strategy is crucial before live trading.

Comparison of Aroon Strategies

| Strategy | Signal | Best For | Risk/Reward | Confirmation |

| Trend-Following | Aroon Up > 70, Aroon Down < 30 | Strong Trends | Moderate | Moving Averages, Price Action |

| Reversal Trading | Aroon Up/Down Crossover, approaching 0/100 | Trend Shifts | High | Candlestick Patterns, Support/Resistance |

| Range-Bound | Both Aroon lines < 50, oscillating | Sideways Markets | Low to Moderate | Bollinger Bands, Oscillators (RSI/Stochastics) |

Navigating Aroon’s Pitfalls: Avoiding False Signals and Whipsaws

While the Aroon Oscillator is a valuable tool, it is not without its limitations. Forex traders must learn to navigate its pitfalls, particularly avoiding false signals and whipsaws, which can lead to significant losses if not managed properly. Understanding these challenges is key to improving signal reliability.

Understanding Whipsaws and Choppy Market Behavior

A whipsaw occurs when an indicator generates a buy signal, only to quickly reverse and generate a sell signal, or vice versa, leading to losses in both directions. The Aroon Oscillator is particularly prone to whipsaws in range-bound markets or periods of high volatility.

In such choppy market behavior, the Aroon Up and Aroon Down lines can frequently cross each other, giving conflicting signals and causing frustration for traders. Many traders get whipsawed constantly using Aroon for reversals because the market lacks a clear directional bias, leading to frequent shifts in the period high and period low that the indicator tracks.

This constant oscillation between potential uptrends and downtrends without a clear follow-through can deplete trading capital rapidly. Recognizing when the market is not trending is as important as identifying a strong trend, and during these times, relying solely on Aroon for signals can be detrimental.

How to avoid false signals with the Aroon Oscillator?

To avoid false signals with the Aroon Oscillator, traders should implement several filtering techniques. First, using longer timeframes can help smooth out the indicator’s readings and reduce noise. A signal on a daily chart, for example, is generally more reliable than one on a 15-minute chart.

Second, combining Aroon with other indicators for confluence is crucial.

Waiting for confirmation from price action, such as a breakout above a resistance level following an Aroon Up crossover, also enhances signal validity. Furthermore, defining clear consolidation phase ranges and avoiding Aroon-based trades when both lines are below 50 can prevent whipsaws.

Implementing these techniques allows traders to filter out less reliable signals, leading to more confident and potentially profitable trades.

The Human Element: Overcoming Psychological Biases in Aroon Trading

Even with perfect technical analysis, emotional biases can undermine trading success, particularly when dealing with the Aroon Oscillator’s inherent false signals.

Unlike most guides that stop at mechanics, understanding the psychological biases that impact trading decisions is crucial for consistent profitability.

The Aroon Oscillator, with its occasional late signals in choppy markets and propensity for whipsaws, can easily trigger fear and greed. A series of false signals might lead a trader to abandon a valid strategy prematurely (fear), or a strong, confirmed signal might encourage over-leveraging (greed).

These emotional responses can override objective analysis, leading to impulsive decisions that contradict a well-planned trading strategy.

To overcome these biases, traders must cultivate discipline and emotional resilience. This involves strictly adhering to a predefined trading plan, including clear entry points and exit points, and never risking more than a small percentage of capital on a single trade. Practicing mindfulness and regularly reviewing trading journals can help identify recurring emotional patterns.

By acknowledging and actively managing these psychological aspects, traders can use the Aroon Oscillator more effectively, turning its signals into opportunities rather than sources of emotional distress.

Setting Up and Automating Aroon Oscillator Alerts in Trading Platforms

Effectively using the Aroon Oscillator in forex trading also involves practical setup and automation within popular trading platforms. This helps traders stay informed about potential opportunities without constantly monitoring charts, making sure timely action on crucial signals.

Adding Aroon Oscillator to MetaTrader 4 (MT4)

To use the Aroon Oscillator in MetaTrader 4 (MT4), follow these steps:

- Open your MT4 platform.

- Navigate to “Insert” in the top menu.

- Select “Indicators,” then “Oscillators.”

- Choose “Aroon Oscillator.”

- A dialog box will appear. Here, you can adjust the “Period” (default is often 14 or 25).

- Click “OK.”

The Aroon Oscillator will now appear in a separate window below your main price chart.

You can customize the colors and line styles by right-clicking on the indicator window and selecting “Aroon Oscillator Properties.” This allows for a clear visual representation of the Aroon Up and Aroon Down lines, as well as the oscillator itself.

Using Aroon Oscillator on TradingView

Adding the Aroon Oscillator to TradingView is a straightforward process:

- Open your TradingView chart.

- Click on the “Indicators” button at the top of the chart (it looks like fx).

- In the search bar, type “Aroon Oscillator.”

- Select “Aroon Oscillator” from the results (make sure it’s the built-in one).

- The indicator will be added to your chart.

- To adjust settings, hover over the Aroon Oscillator name on the chart and click the “Settings” gear icon. Here, you can change the length (period) and customize its appearance.

TradingView’s intuitive interface makes it easy to modify the indicator to suit individual preferences, providing a clear visual representation of trend strength and potential reversals.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountHow to set up alerts for Aroon Oscillator signals?

Setting up alerts for Aroon Oscillator signals is a powerful way to automate monitoring and make sure timely action. Both MetaTrader 4 (MT4) and TradingView offer robust alert functionalities.

On MT4, you can set alerts by right-clicking on the chart, selecting “Trading,” then “Alerts.” You can configure alerts for specific conditions, such as when the Aroon Oscillator crosses a certain level (e. g. , the zero line) or when the Aroon Up Line crosses the Aroon Down Line.

These alerts can be set to trigger sound notifications, email, or push notifications to your mobile device.

On TradingView, click the “Alert” icon (bell icon) on the toolbar. You can create alerts for various Aroon Oscillator conditions, such as a crossover strategy between the Aroon Up and Aroon Down lines, or when the oscillator value crosses above/below a specific threshold (e. g. , 50, 0, -50).

TradingView offers flexible alert options, including pop-ups, sounds, email, and mobile app notifications. For more advanced automation, traders can explore integrating Aroon signals into simple algorithmic trading scripts or Expert Advisors (EAs) in MT4, allowing for automated trade execution based on predefined Aroon conditions, further reducing emotional trading.

Key Takeaways

- Time-Based Trend Detection: The Aroon Oscillator measures the time since recent highs and lows to identify trend strength and potential reversals.

- Buying vs Selling Pressure: Aroon Up and Aroon Down lines reflect bullish and bearish pressure, oscillating between 0 and 100.

- Flexible Settings: Optimal Aroon periods typically range from 14 to 25, depending on timeframe and trading style.

- Confirmation is Essential: Combining Aroon with Moving Averages or Support and Resistance helps reduce false signals.

- Psychology Matters: Managing psychological biases and understanding market behavior are as critical as technical accuracy.

Bottom Line

The Aroon Oscillator is a powerful technical analysis tool for forex traders, offering unique insights into trend identification and trend strength. Its ability to signal the beginning of a new uptrend or new downtrend by tracking the time since a period high or period low makes it an invaluable asset.

However, its effectiveness is maximized when used in confluence with other indicators and robust trading strategy. Overcoming psychological biases and understanding its limitations, such as susceptibility to whipsaws in range-bound markets, is crucial for consistent success.

By optimizing settings, combining with complementary tools, and implementing practical algorithmic trading alerts, traders can leverage the Aroon Oscillator to navigate the complex forex market more effectively.