Identifying hidden market strength and anticipating shifts is crucial for any forex trading professional. The Accumulative Swing Index (ASI) offers a unique lens to view market momentum, providing insights often missed by simpler indicators.

This guide will empower you to understand, apply, and optimize ASI for a significant edge in your trading decisions.

What is the Accumulative Swing Index (ASI)?

The Accumulative Swing Index (ASI) is a momentum indicator designed to reveal the “true market” by accounting for current and previous price action. It accumulates the values of the Swing Index (SI) over time, creating a line that oscillates around a zero level.

This tool helps traders assess underlying buying and selling pressure, offering a nuanced perspective on price action.

While understanding Accumulative Swing Index (ASI) is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Who developed the Accumulative Swing Index?

The Accumulative Swing Index (ASI) was introduced by **J. Welles Wilder Jr. ** in his seminal 1978 book, “New Concepts in Technical Trading Systems” (Wilder, J. W. , 1978). Wilder, a pioneer in Technical Analysis, also developed other now-famous indicators such as the Relative Strength Index (RSI), Average True Range (ATR), and Parabolic SAR.

His theory behind ASI aimed to create an indicator that could cut through market noise and reflect the actual momentum and sentiment, giving traders a clearer picture of market direction. This foundational understanding, often referred to as Wilder’s Theory, emphasizes the psychological aspect of price movement.

Deconstructing ASI: The Swing Index (SI) Formula & Calculation

The Accumulative Swing Index (ASI) is built upon its foundational component, the Swing Index (SI). This core element aims to quantify the ‘true range’ of price movement, comparing current price action to previous close and open, providing a more nuanced view than simple high-low range, as explained by Investopedia.

Understanding the Swing Index (SI) formula is critical to grasping how ASI effectively measures underlying market pressure in forex trading.

How is ASI calculated?

The Swing Index (SI) formula is complex, taking into account the current open, high, low, and close, as well as the previous period’s close. A crucial parameter in the calculation is the ‘limit move’ setting. This setting, often between 10-15 points depending on asset volatility and timeframe, is vital for scaling the indicator’s sensitivity (Trading platform documentation).

It prevents extreme swings and allows for more readable analysis, especially when dealing with high volatility in forex trading. The SI value for each period is then summed to form the Accumulative Swing Index (ASI).

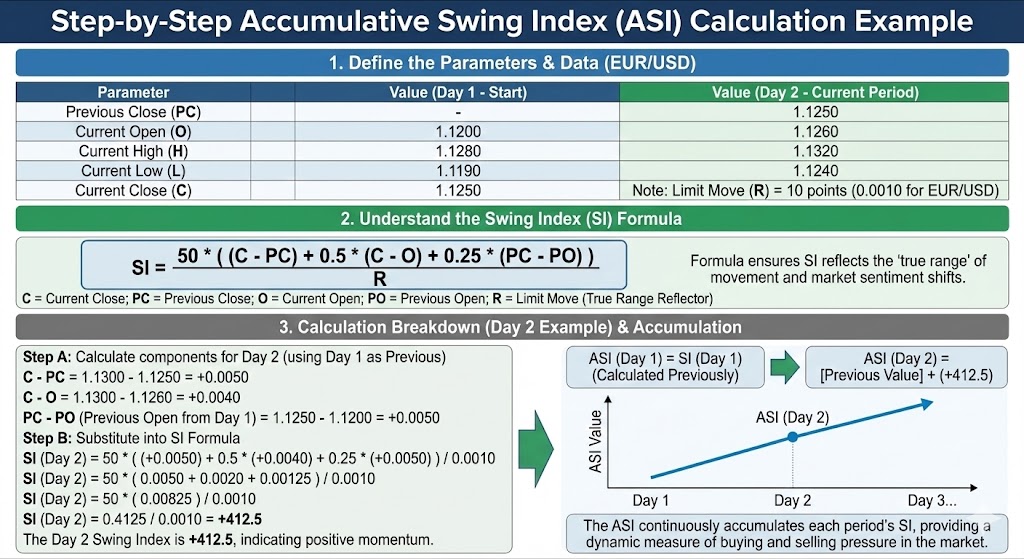

Step-by-Step ASI Calculation Example

To illustrate the Swing Index (SI) calculation, let’s consider a simplified example. Imagine a currency pair (e. g. , EUR/USD) with specific price points over a few periods. The SI formula involves comparing the current closing price to the previous close, the current high to the previous close, and the current low to the previous close.

It also incorporates the current open and a predefined limit move value.

Here’s a simplified breakdown for a single period, assuming a ‘limit move’ (R) of 10 points:

| Parameter | Value (Day 1) | Value (Day 2) |

| Previous Close | – | 1.1250 |

| Current Open | 1.1200 | 1.1260 |

| Current High | 1.1280 | 1.1320 |

| Current Low | 1.1190 | 1.1240 |

| Current Close | 1.1250 | 1.1300 |

| Swing Index | Calculated | Calculated |

The actual SI formula is:

SI = 50 * ( (C – PC) + 0. 5 * (C – O) + 0. 25 * (PC – PO) ) / R

Where:

- C = Current Close

- PC = Previous Close

- O = Current Open

- PO = Previous Open

- R = Limit Move

This formula makes sure that the SI value reflects the “true range” of price movement. Once the SI is calculated for each period, these values are then accumulated to form the Accumulative Swing Index (ASI) line, providing a continuous measure of market sentiment and momentum.

This granular approach helps traders in forex trading understand the subtle shifts in buying and selling pressure.

How to interpret ASI signals?

Interpreting Accumulative Swing Index (ASI) signals involves recognizing patterns for Trend Confirmation, potential Divergence, and imminent reversals. As a sophisticated Technical Analysis tool, ASI provides Trading Signals that require careful observation. These signals often need confirmation from other indicators, helping traders understand the market’s underlying strength.

ASI for Trend Confirmation and Strength

The Accumulative Swing Index (ASI) confirms existing trends (uptrends, downtrends) by moving in the same direction as the price. When the ASI line consistently trends upwards alongside rising prices, it signals strong bullish Trend Confirmation. Conversely, a declining ASI with falling prices indicates a robust bearish trend.

The significance of ASI crossing the zero line is also important; a move above zero often reinforces bullish sentiment, while a move below suggests bearish dominance. This alignment provides confidence in the prevailing market direction for forex trading.

Spotting Reversals with ASI Divergence

Divergence between price and the Accumulative Swing Index (ASI) is a powerful Trading Signal for potential reversals. Bullish divergence occurs when price makes a lower low, but ASI makes a higher low, suggesting underlying buying pressure is building despite falling prices. Bearish divergence happens when price makes a higher high, but ASI makes a lower high, indicating waning bullish momentum. Identifying true divergence requires careful observation and confirmation, as False Signals can occur. Confirming these signals with other tools, such as Candlestick Patterns, improves their reliability in forex trading.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow to combine ASI with other technical analysis tools?

Combining the Accumulative Swing Index (ASI) with complementary indicators is essential for filtering out False Signals and improving overall reliability. While ASI is effective in identifying trends and divergences, studies suggest its raw form can generate a higher percentage of false signals (up to 30-40% in volatile markets) compared to smoothed indicators (Various academic papers).

Therefore, integrating ASI with tools like Moving Averages can provide stronger Trend Confirmation. For instance, a bullish ASI divergence confirmed by a key moving average crossover or a bullish Candlestick Pattern offers a more robust Trading Signal. This multi-indicator approach strengthens the validity of the analysis.

Advanced ASI Strategies: Filtering Noise & Optimizing Settings

Sophisticated Technical Analysis demands more than basic indicator application; it requires optimized settings and strategic comparisons. This section explores how to fine-tune the Accumulative Swing Index (ASI) for various market conditions and how it stands against other popular momentum tools. These advanced strategies help traders define precise Entry and Exit Points with greater confidence.

What are the best settings for ASI in forex?

Optimizing Accumulative Swing Index (ASI) settings is crucial for tailoring its sensitivity to specific currency pairs and Timeframes in forex trading. The ‘limit move’ parameter, often between 10-15 points depending on asset volatility and timeframe, is particularly important (Trading platform documentation). This setting scales the indicator’s responsiveness, preventing extreme swings and making the analysis more readable.

For example, a 4-hour timeframe might require a different ‘limit move’ than a 15-minute chart. Traders should test various settings on platforms like MetaTrader to find the optimal balance for their chosen assets and trading style. Adjusting this parameter dynamically can significantly improve the indicator’s utility.

ASI vs. other indicators (e.g., RSI, MACD)?

Comparing the Accumulative Swing Index (ASI) with other popular momentum indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) highlights its unique strengths. While RSI measures the speed and change of price movements and MACD identifies trend and momentum changes through moving average crossovers, ASI focuses on the ‘true range’ of price.

This means ASI attempts to filter out intraday noise by considering open, high, low, and previous close, aiming to represent market pressure more accurately.

Here is a comparison of these indicators:

| Feature | Accumulative Swing Index (ASI) | Relative Strength Index (RSI) | MACD (Moving Average Conv. Div.) |

| Core Focus | True market pressure/momentum | Overbought/Oversold levels | Trend direction & momentum |

| Calculation | Based on Swing Index (SI) | Price change magnitude | Exponential Moving Averages |

| Primary Use | Trend strength, divergence | Reversal signals (extremes) | Crossovers, divergence |

| Key Parameter | Limit Move | Lookback period | Fast/Slow EMAs, Signal Line |

| Output Type | Oscillating line (unbounded) | Oscillating line (0-100) | Histogram, Signal Line |

ASI offers a distinct perspective by attempting to quantify the internal strength of price movements, which can sometimes provide earlier divergence signals than its counterparts.

What timeframe is best for ASI?

The best timeframe for using the Accumulative Swing Index (ASI) largely depends on a trader’s strategy. For swing trading, longer timeframes such as the daily or 4-hour charts tend to provide more reliable signals, as they filter out much of the intraday noise. This allows for clearer identification of sustained trends and significant divergences.

For day trading, a 15-minute or 30-minute chart might be used, but with increased awareness of potential False Signals due to higher volatility. Regardless of the timeframe, it is crucial to use multi-timeframe analysis to confirm signals.

For instance, a bullish signal on a 15-minute chart gains more credibility if the ASI on the 4-hour chart also shows underlying strength.

Common User Challenges with ASI (And How to Overcome Them)

Despite its analytical power, traders often encounter specific difficulties with the Accumulative Swing Index (ASI). These challenges range from managing False Signals to understanding the indicator’s relevance in dynamic markets. Overcoming these requires a deeper understanding of the indicator’s nuances and practical application techniques.

I get too many false signals with ASI, any tips?

Receiving too many False Signals is a common pain point for traders using the Accumulative Swing Index (ASI). To mitigate this, advanced filtering techniques are essential. One effective method is to confirm ASI signals with higher timeframe analysis; for instance, a bullish divergence on a 1-hour chart should ideally be supported by a neutral or bullish ASI on a 4-hour chart.

Incorporating volume indicators can also help, as strong volume often validates price action and ASI signals. Furthermore, specific price action setups, such as breakouts from established chart patterns, can provide additional confirmation, reducing the likelihood of acting on misleading signals in forex trading.

ASI seems too volatile, how do I smooth it out?

The inherent volatility of the Accumulative Swing Index (ASI) can sometimes make its signals hard to read. To smooth the indicator for clearer trends, traders can apply a moving average directly to the ASI line itself.

A short-period Simple Moving Average (SMA) or Exponential Moving Average (EMA) on the ASI can help filter out minor fluctuations, making the underlying trend more apparent. Another approach involves adjusting the ‘limit move’ parameter within the ASI calculation, as discussed earlier.

Increasing this value can reduce sensitivity, resulting in a smoother line, though this comes with a trade-off: a less responsive indicator that might lag price action more. Finding the right balance between responsiveness and smoothness is key.

Is ASI still relevant in today’s markets?

Despite being developed in 1978, the Accumulative Swing Index (ASI) remains relevant in today’s fast-paced markets. Its core principle of understanding underlying market pressure, rather than just superficial price movements, is timeless. When combined with real-time Market Sentiment analysis and other modern Technical Analysis tools, ASI can provide valuable insights into hidden strength or weakness.

It helps traders confirm trends and spot divergences that might not be immediately obvious. While market dynamics have evolved, the fundamental human psychology driving price remains, making indicators like ASI, which aim to quantify that psychology, continually useful as a component of a comprehensive trading strategy.

How to implement ASI in a trading strategy?

Integrating the Accumulative Swing Index (ASI) into a forex trading strategy involves combining its Trading Signals with other analytical elements. This defines clear Entry and Exit Points. A well-structured system leverages ASI’s strengths for trend confirmation and divergence. It also incorporates robust Risk Management, helping traders capitalize on market opportunities.

Building a Complete ASI Trading System

A complete Accumulative Swing Index (ASI) trading system often combines ASI’s Trading Signals with price action and other confirmations. For example, a trader might look for a bullish ASI divergence on a currency pair, followed by a bullish engulfing Candlestick Pattern at a support level. This combination provides a high-probability Entry Point.

Stop-loss orders should be placed strategically below the recent swing low (for long positions) or above the recent swing high (for short positions) to manage risk. Take-profit levels can be determined by previous resistance/support, Fibonacci extensions, or a reversal signal from ASI itself.

This systematic approach is suitable for both Day Trading and Swing Trading, with timeframe adjustments.

The Critical Role of Risk Management with ASI

Even with a powerful indicator like the Accumulative Swing Index (ASI), Risk Management remains paramount. Over-reliance on any single indicator, including ASI, without proper risk controls can lead to significant losses, especially given the potential for False Signals.

Traders must implement strict position sizing rules, making sure that no single trade exposes more than a small percentage (e.g. , 1-2%) of their total trading capital. Setting clear stop-loss orders is non-negotiable. This discipline protects capital when signals do not pan out, which is an inherent part of forex trading. Proper risk management transforms ASI from a mere signal generator into a component of a sustainable trading career.

Mastering the Mental Game: Overcoming Psychological Biases

The mental game is as crucial as technical analysis in forex trading, a key differentiator often overlooked. Psychological biases, such as fear of missing out (FOMO) and revenge trading, account for an estimated 40-60% of trading losses among retail forex traders, even when using sound technical indicators like Accumulative Swing Index (ASI) (Forex Broker reports).

Self-doubt, such as questioning one’s own ASI calculations when they differ from others, can also lead to poor decisions. Maintaining discipline, sticking to a predefined trading plan, and managing emotions are vital. A clear understanding of ASI’s mechanics, combined with self-awareness of one’s own biases, allows traders to execute their strategies objectively and avoid emotional pitfalls.

📌 REMEMBER: The most advanced indicator is only as effective as the trader using it. Integrate ASI with strict risk management and a disciplined mindset to maximize its potential.

Where can I find ASI on trading platforms (MT4/MT5)?

Implementing the Accumulative Swing Index (ASI) on popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) is straightforward. ASI is widely available as a custom indicator, easily added to charts. This practical implementation allows traders to visualize ASI’s Trading Signals directly. It facilitates real-time analysis in forex trading.

Adding ASI to MetaTrader 4 & 5 (MT4/MT5)

To add the Accumulative Swing Index (ASI) to your MetaTrader platform, follow these steps:

- Download: Obtain the ASI indicator file (usually an . ex4 or . ex5 file) from a reputable source. Many trading communities and developer forums offer these for free.

- Install: Open your MT4/MT5 platform, go to “File” > “Open Data Folder.” Navigate to MQL4 (or MQL5) > Indicators. Copy and paste the ASI indicator file into this folder.

- Restart: Close and restart your MetaTrader platform to allow it to recognize the new indicator.

- Apply: In MetaTrader, go to “Insert” > “Indicators” > “Custom.” You should find “Accumulative Swing Index” in the list. Select it.

- Customize: A settings window will appear. Here, you can adjust parameters like the ‘limit move’ to optimize the indicator for your specific currency pairs and Timeframes.

Click “OK” to apply it to your chart.

Are there any free ASI indicators for download?

Yes, numerous free Accumulative Swing Index (ASI) indicators are available for download across various trading communities and developer websites. It is crucial to source these from reputable forums to make sure they are coded correctly and are free from malicious software.

These custom indicators often come with adjustable parameters, allowing traders to fine-tune them for their specific needs. For advanced users, integrating ASI into Algorithmic Trading systems is also possible. The quantifiable nature of ASI makes it suitable for automated signal generation, where customized scripts can interpret its movements to execute trades automatically, offering a cutting-edge application in forex trading.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBOTTOM LINE

The Accumulative Swing Index (ASI) stands as a powerful, yet often misunderstood, tool in Technical Analysis. Developed by J. Welles Wilder Jr. , its core strength lies in quantifying the ‘true range’ of price movement, offering a deeper insight into market momentum and underlying pressure than simpler indicators.

Mastering ASI involves not only understanding its unique calculation and how to interpret its Trading Signals for trend confirmation and divergence, but also recognizing its limitations. Effective application demands careful optimization of settings, integration with complementary indicators to filter False Signals, and, crucially, a disciplined approach to Risk Management that acknowledges the impact of Psychological Biases.

By adopting a holistic strategy, traders can use ASI to improve their decision-making and navigate the complexities of forex trading with greater confidence.