Forex scalping is a high-frequency trading strategy designed to generate small, consistent profits from numerous short-term trades. Unlike other trading styles, scalpers hold positions for just minutes or seconds, capitalizing on minor price fluctuations in highly liquid currency pairs like EUR/USD.

This guide explains what scalping is, what a scalper does, and how to apply this fast-paced strategy using actionable setups and strict risk management.

Key Takeaways

- Forex scalping is a fast-paced strategy focused on making many small profits from quick trades that last just seconds or minutes.

- Your success depends on discipline, a fast broker, and strict risk control. Always trade high-liquidity pairs with low spreads, like EUR/USD.

- There’s a wide range of scalping strategies, from simple Moving Average crossovers and Range Trading to more advanced techniques like Order Flow and Correlation Trading.

- Risk management is non-negotiable. Always use a tight stop-loss and never risk more than 1-2% of your account on a single trade.

- Avoid the biggest mistakes: trading without a plan, ignoring transaction costs (spreads), and using a slow or unreliable setup.

- The best time to scalp is during high-liquidity hours, especially the London-New York session overlap. Avoid trading during major news events unless it’s part of your strategy.

- Your technology is your edge. Use a fast internet connection, a reliable ECN/STP broker, and consider automated tools (EAs) for speed and consistency.

What is scalping?

Scalping is a trading style that specializes in profiting off of small price changes, generally after a trade is executed and becomes profitable. It requires traders to have a strict exit strategy because one large loss could eliminate the many small gains the trader worked to obtain.

What does a scalper do?

A scalper is a high-frequency trader who executes dozens or even hundreds of trades per day to profit from minimal price movements. Their goal is to accumulate small, consistent gains that add up over time rather than waiting for large, long-term trends to develop. Scalpers thrive in highly liquid markets and rely on discipline, speed, and low transaction costs to succeed.

How Forex Scalping Works?

Forex scalping relies on high trade volume, making it essential to use a trading approach that allows for rapid market entries and exits. Traders closely monitor price movements on short timeframes (1-minute to 5-minute charts) and aim to profit from small upward or downward shifts. This method requires strict discipline in setting stop-losses and profit targets, as trades are often held for only a few minutes.

Why Choose a Scalping Strategy Over Swing or Day Trading?

Scalping is ideal for traders seeking rapid and frequent gains without holding positions overnight. Compared to swing trading, which targets larger moves over several days, or day trading, which focuses on broader intraday trends, scalping captures micro-movements in the market—typically 1–10 pips per trade.

According to Investopedia, scalping’s key advantage is limited market exposure, which reduces risk from unexpected price swings. Forex.com highlights that scalpers may execute dozens to hundreds of trades per day, each aiming for a few pips. These incremental gains, when compounded, can lead to substantial profits.

A review by the Seven Pillars Institute notes that high-frequency trading significantly reduces execution costs and tightens bid-ask spreads, which can enhance cumulative returns for scalpers.

Scalping, however, demands high discipline, low-latency platforms, and consistent risk control. Due to the narrow profit margins, success depends on low-spread currency pairs, minimal slippage, and a strategy with defined entry and exit points.

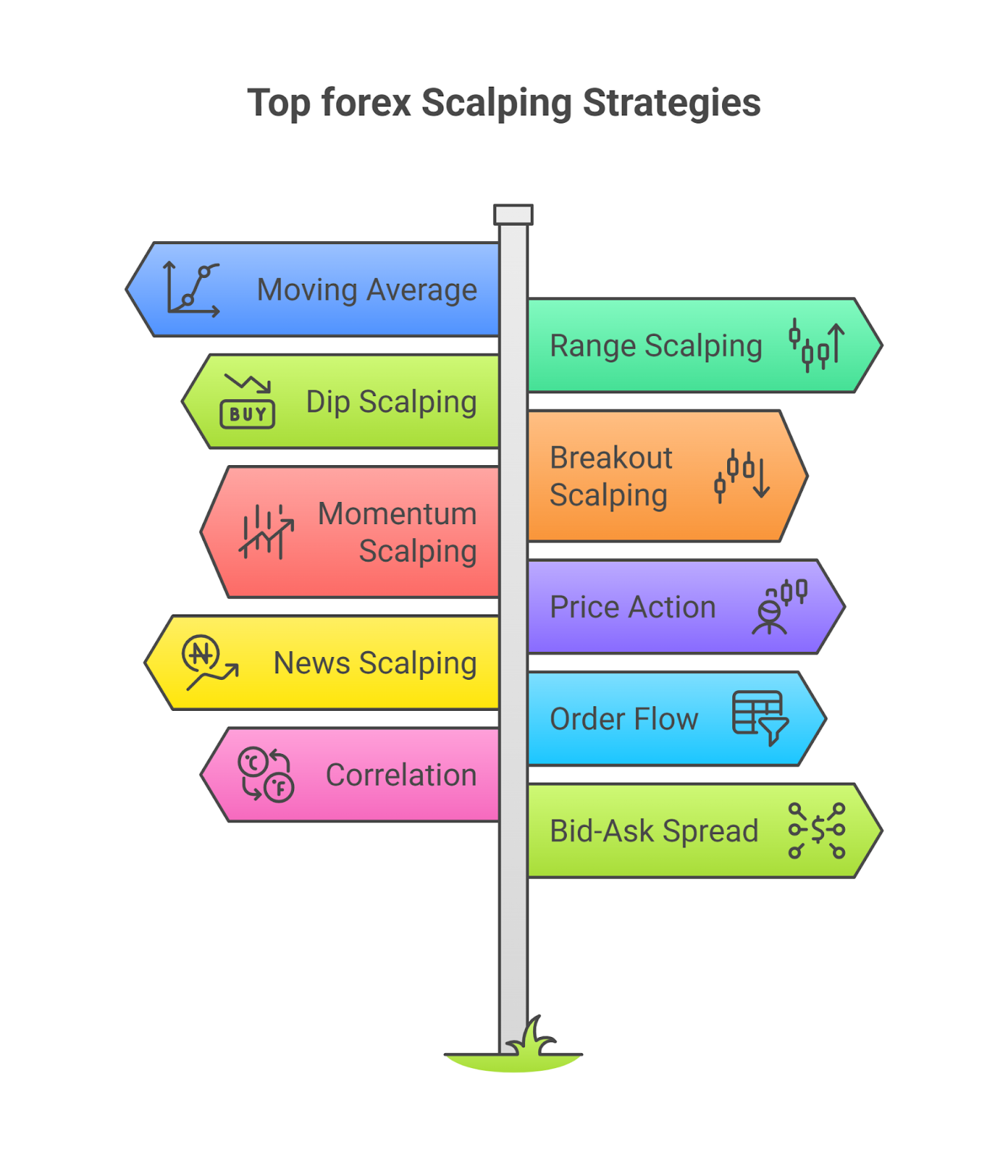

What are the Most Common Forex Scalping Strategies?

Scalping strategies range from simple indicator-based methods to advanced techniques. Here are 10 common approaches, each with a unique focus:

- Moving Average (MA) Scalping uses the crossover of a fast and slow moving average to generate quick buy and sell signals in a trending market.

- Range Scalping is used in quiet, non-trending markets, this strategy involves buying at a clear support level and selling at a clear resistance level.

- Dip Scalping (Pullback Strategy) is a “buy the dip” approach that involves entering a long position during a temporary pullback within a strong, established uptrend.

- Breakout Scalping strategy focuses on capturing the initial price surge when an asset breaks out of a consolidation pattern like a range or triangle.

- Momentum Scalping involves identifying an asset that’s already moving strongly in one direction and jumping on the trend for a very short ride.

- Price Action Scalping is a ‘pure’ method that relies on reading raw candlestick patterns on short-term charts without using lagging indicators.

- News Scalping is a high-risk strategy used to profit from the intense volatility that follows major economic news releases.

- Order Flow Scalping is an advanced technique that involves analyzing the Depth of Market (DOM) to predict immediate price movements from buy and sell orders.

- Correlation Scalping is a statistical arbitrage strategy involving trading two highly correlated currency pairs against each other to profit from temporary price gaps.

- Bid-Ask Spread Scalping is a professional, high-frequency technique used to capture the tiny spread between the bid and ask price itself as profit.

Moving Average (MA) Scalping

This strategy uses the relationship between a fast and slow moving average to generate quick buy and sell signals in a trending market.

How it works: You typically use two Exponential Moving Averages (EMAs), like a 5-period and a 20-period, on a 1-5 minute chart. A buy signal occurs when the faster MA crosses above the slower MA. A sell signal occurs when it crosses below.

Range Scalping

This strategy is used in quiet, non-trending markets where the price is bouncing between clear support and resistance levels.

How it works: You identify a clear trading range where the price is moving sideways. The strategy is simple: buy at the support level (the bottom of the range) and sell at the resistance level (the top of the range). This works best in low-volatility conditions and requires discipline to exit if the range breaks.

Dip Scalping (Pullback Strategy)

This is a ‘buy the dip’ strategy that involves entering a trade during a temporary pullback within a strong, established uptrend.

How it works: First, you identify a clear uptrend on a 1-5 minute chart. When the price temporarily dips, you use an indicator like RSI or Stochastics to confirm an oversold condition. You then enter a buy position, aiming to profit as the price resumes its primary upward trend.

Breakout Scalping

This strategy focuses on capturing the initial price surge when an asset breaks out of a consolidation pattern, like a range or triangle.

How it works: You identify a clear support and resistance level on a short-term chart (1-5 minutes). When the price breaks through one of these levels with high volume, you enter a trade in the same direction. The goal is to ride the immediate momentum for a quick profit, with a tight stop-loss placed just on the other side of the breakout level.

Momentum Scalping

This strategy involves identifying an asset that’s already moving strongly in one direction and jumping on the trend for a short ride.

How it works: You use indicators like RSI, MACD, or Stochastics to find assets with strong momentum. Look for confirmation from strong candle patterns (e.g., long bodies with small wicks) and high volume. The goal is to enter in the direction of the momentum and exit as soon as it shows signs of slowing down.

Price Action Scalping

This is a ‘pure’ scalping method that relies on reading candlestick patterns and price behavior directly, without using lagging indicators like moving averages. It’s a very clean and direct way to trade short-term movements.

How it works: You focus entirely on the price chart, identifying key micro-support and resistance levels. You then look for specific candlestick patterns (like pin bars or engulfing candles) on 1- or 5-minute charts to signal an entry. The goal is to trade based on raw price momentum, making it a powerful technique for experienced traders who can read charts quickly.

News Scalping

This strategy aims to profit from the intense volatility that follows major economic news releases or unexpected geopolitical events.

How it works: Before a major announcement (like an interest rate decision), you prepare to trade the expected volatility. The moment the news is released, you enter a trade in the direction of the initial price spike. You then exit the trade within seconds or a few minutes to capture the immediate reaction. This strategy is very high-risk due to the potential for slippage and widened spreads during news events.

Order Flow Scalping

This is an advanced technique where you analyze the flow of buy and sell orders in real-time to predict immediate price movements. This goes beyond typical chart analysis to look at the underlying market dynamics.

How it works: You use specialized tools like the Depth of Market (DOM) or Level 2 data to see where large buy and sell orders are sitting. By identifying these large order clusters, you can anticipate where the price is likely to move or stall. This strategy is less about chart patterns and more about understanding the real-time supply and demand in the market.

Correlation Scalping (Statistical Arbitrage)

This is an advanced strategy where you trade two highly correlated currency pairs, profiting from temporary deviations in their price relationship. It’s less about predicting the market’s direction and more about betting on statistical relationships to return to normal.

How it works: You first identify two currency pairs that almost always move in the same direction (e.g., EUR/USD and GBP/USD). You then monitor them for a moment when one pair moves up or down but the other one temporarily lags. The trade involves selling the stronger pair and buying the weaker pair, betting that their normal price relationship will snap back into place (converge), allowing you to close both trades for a small, combined profit.

Bid-Ask Spread Scalping

This is a high-frequency strategy where traders profit from the small price difference between the bid and ask prices of a currency pair. This approach is typically reserved for institutional traders or those with sophisticated, low-latency setups.

How it works: You simultaneously place a buy order at the bid price and a sell order at the ask price. The goal is to capture the tiny spread as profit when both orders are filled instantly. This strategy requires extreme speed and is usually only possible with automated trading systems (EAs) and a Direct Market Access (DMA) broker.

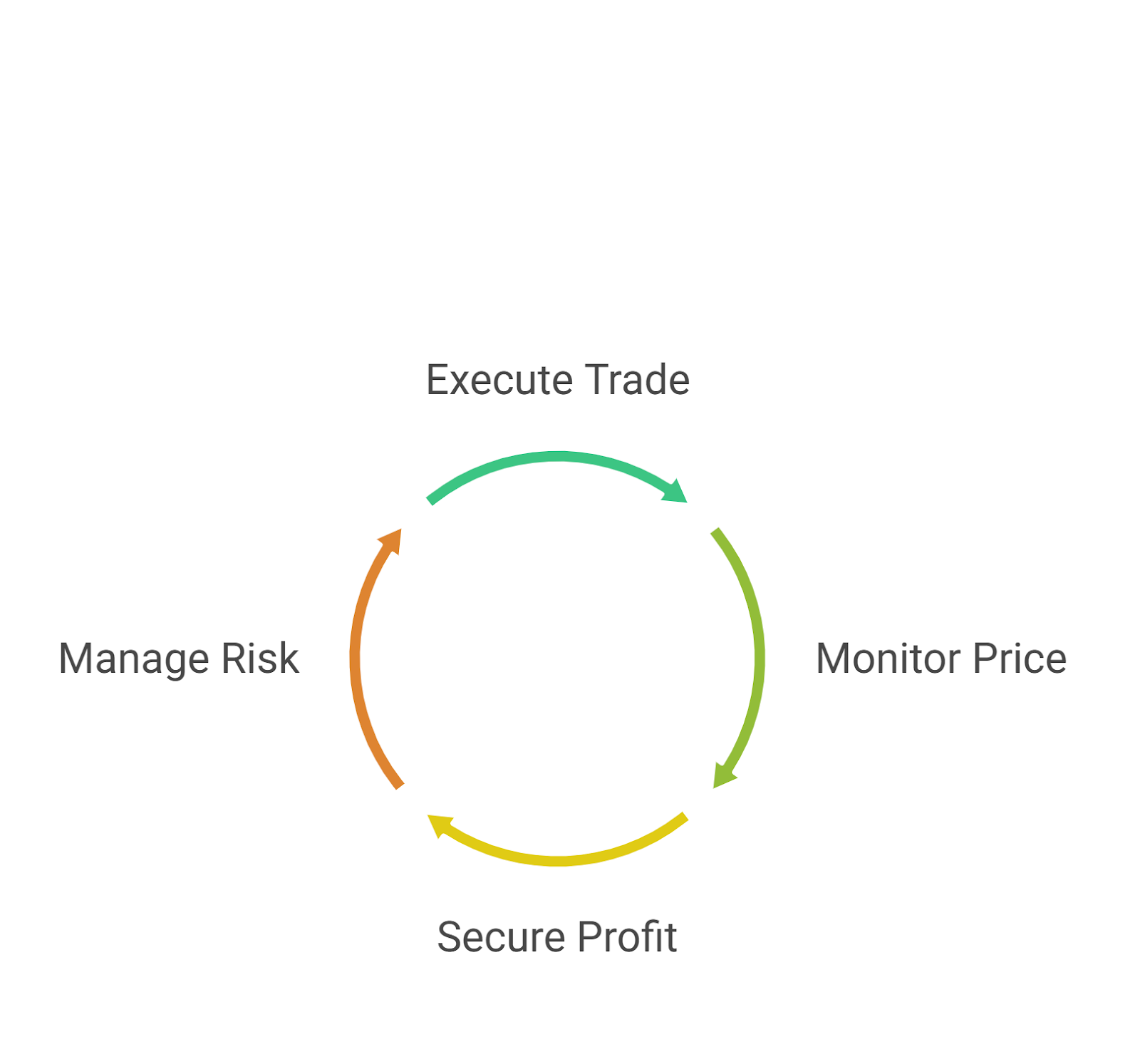

How to Quickly Take Profit when Scalping in Forex?

Applying a forex scalping strategy requires a disciplined, step-by-step approach that covers your setup, strategy, and risk management. It’s a high-speed endeavor where a clear framework is essential for success.

Here’s a simple 6-step guide to get you started:

1. Get the Right Setup (Broker & Platform): Your success starts with your tools. You need a fast ECN/STP broker with razor-thin spreads and a reliable trading platform that offers low-latency execution. For a strategy that relies on speed, this is non-negotiable.

2. Choose One Specific Scalping Strategy: Don’t try to do everything at once. Pick one strategy that fits your style, whether it’s trading breakouts, using moving average crossovers, or playing ranges. Master that single approach first.

3. Define Your Exact Entry and Exit Rules: Based on your chosen strategy, define your trading rules with 100% clarity. Know the exact technical indicator signal, candlestick pattern, or price level that will trigger your entry and your exit. No guessing allowed.

4. Implement Iron-Clad Risk Management: Before you place a single trade, set your risk rules. This means always using a tight stop-loss order (e.g., 5-10 pips) and defining your position size so you’re only risking a small percentage (e.g., 1%) of your account per trade.

5. Practice on a Demo Account: Before risking real money, test your entire setup and strategy on a demo account. Practice executing trades quickly and following your rules until it becomes second nature. This builds confidence and exposes any flaws in your plan.

6. Execute with Discipline and Stay Informed: When you go live, your only job is to execute your plan with discipline. At the same time, stay aware of major economic news on the calendar, as these events can cause unexpected volatility and disrupt your technical setups.

Risk Management in Forex Scalping (Tools and Techniques)

The high trade frequency of scalping increases the risk exposure for traders, as frequent trades can lead to cumulative losses. Effective risk management helps to mitigate these risks, protecting the trader’s capital while still allowing room for profitable opportunities.

Effective risk management tools are essential in forex scalping due to its rapid trade execution and heightened risk exposure. Key techniques include:

- Stop-Loss Orders: Setting tight stop-loss levels on each trade automatically limits potential losses if the market moves against the position.

- Position Sizing: Controlling the size of each trade helps prevent overexposure. A common approach is risking only a small percentage of capital per trade (e.g., 1-2%).

- Risk-Reward Ratios: Using a favorable risk-reward ratio (such as 1:2 or 1:3) ensures that potential profits outweigh potential losses, helping to offset losses from quick trades.

- Real-Time Market Analysis: Employing tools like Moving Averages and RSI provides quick insights into market momentum, helping scalpers make informed, data-driven entries and exits.

These tools help scalpers balance risk and reward, maintaining capital stability while pursuing frequent trades in volatile markets.

Common Mistakes in Forex Scalping and How to Avoid Them?

Here’s your content transformed into a clear, SEO-friendly table format:

| Mistake | Description | How to Avoid It |

| Trading on Impulse (No Plan) | Making trades based on emotion, FOMO, or gut feelings instead of a clear, pre-defined strategy. | Create a trading plan with specific entry and exit rules based on chosen indicators — then follow it without deviation. |

| Neglecting Risk Management | One large, uncontrolled loss can wipe out many small wins; many scalpers fail because they don’t protect their capital. | Use a tight stop-loss on every trade and never risk more than ~1% of your account per position. |

| Underestimating Trading Costs | Spreads and commissions from dozens or hundreds of trades can quickly erode profits. | Trade with a true ECN/STP broker with razor-thin spreads and factor costs into your profit targets. |

| Scalping in Poor Market Conditions | Trading in low liquidity or during chaotic news events leads to slippage and losses. | Trade during the high-liquidity London–New York session overlap and avoid trading around major news announcements. |

| Using a Slow or Unreliable Setup | Laggy internet or slow broker platforms can cause order delays and worse execution prices. | Maintain a fast, stable internet connection and use a broker with proven rapid execution speeds. |

Bottom Line

Forex scalping is a high-speed discipline that requires a solid strategy, strict risk management, and a focus on minimizing costs. It’s not about finding one big win, but about accumulating many small ones.

To succeed, remember these core principles:

- Have a clear strategy. Whether you’re trading breakouts, reversals, or mean reversions, use technical indicators like Bollinger Bands or RSI to define your exact entry and exit points.

- Control your risk. Always apply tight stop-losses. Since you’re targeting small gains, you can’t afford a single large loss wiping out dozens of profitable trades.

- Focus on efficiency. This means choosing low-spread currency pairs to keep costs down and considering automated systems (EAs) to execute trades with the speed and precision that scalping demands.

Mastering these elements is the key to turning small, frequent trades into consistent results.