The Tweezer Candlestick Pattern is a powerful reversal signal in technical analysis that helps traders identify potential shifts in market direction.

This guide provides a comprehensive understanding of Tweezer patterns, from their anatomy and interpretation to advanced integration into trading strategies, addressing common pitfalls and psychological factors for improved trading success.

While understanding Tweezer Candlestick Pattern is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is a Tweezer Candlestick Pattern?

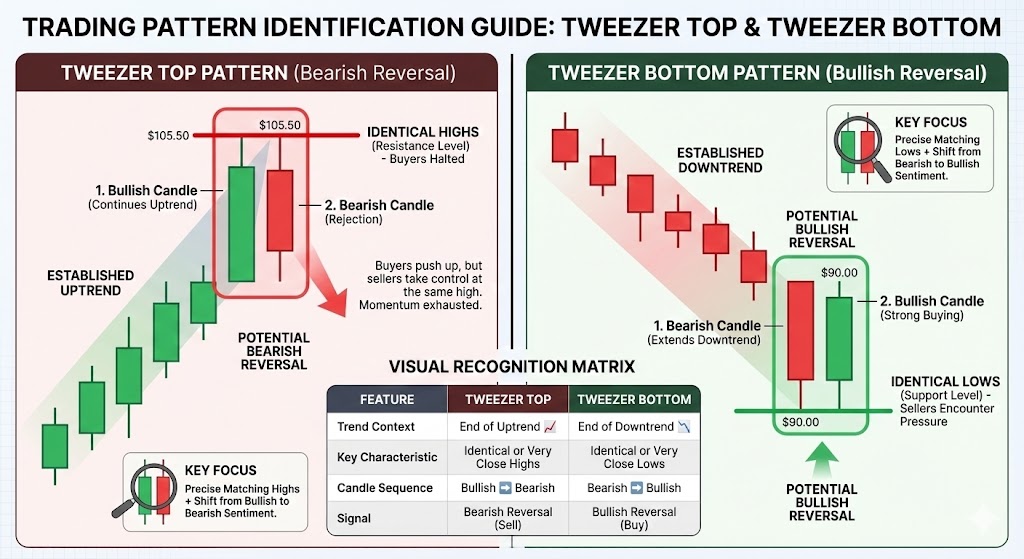

A Tweezer Candlestick Pattern signals a potential trend reversal, appearing at the peak of an uptrend or the bottom of a downtrend. It consists of two or more candlesticks that have identical or very nearly identical highs (for a top) or lows (for a bottom).

This pattern reflects a strong area of resistance or support where the previous trend has exhausted itself.

The Tweezer Candlestick Pattern is formed by two adjacent candlesticks, each with matching highs or lows. In a Tweezer Top, the first candle is bullish, and the second is bearish, sharing the same high. Conversely, a Tweezer Bottom features a bearish first candle and a bullish second candle, both sharing the same low.

This identical price point signifies a strong rejection level by market participants.

The wicks of these candlesticks are crucial, as they mark the extreme price levels reached during their respective periods. The matching highs or lows indicate a precise point where buyers and sellers reached an equilibrium before the momentum shifted. This two-candlestick formation provides a clear visual cue of market indecision followed by a potential change in sentiment.

What does the Tweezer pattern indicate in trading?

The Tweezer pattern indicates a potential reversal pattern in trading, signaling that the current market trend reversal is likely to change course. It reflects a critical moment in price action where the market reaches an extreme point and then struggles to push further in the original direction. This struggle suggests exhaustion of the prevailing buying or selling pressure.

For instance, a Tweezer Top after an uptrend shows that buyers attempted to push prices higher but were met with strong selling pressure at the same level as the prior candle’s high. Similarly, a Tweezer Bottom after a downtrend indicates that sellers drove prices lower, but buyers stepped in at the same level, preventing further declines. Tweezer patterns are often considered more reliable when accompanied by high trading volume, indicating strong conviction from market participants.

This increased volume confirms that many traders are acting on the identified price level, reinforcing the potential reversal.

What is the difference between a Tweezer Top and a Tweezer Bottom?

The primary distinction between a Tweezer Top and a Tweezer Bottom lies in their appearance within a specific market trend and their subsequent implications. Both are reversal patterns, but they signal different types of reversals. Understanding these differences is crucial for accurate pattern identification and effective trading decisions.

How to identify a Tweezer Top pattern?

To identify a Tweezer Top pattern, look for it appearing at the end of an established uptrend. The pattern consists of two or more candlesticks with identical or very close highs. Typically, the first candle is bullish, continuing the uptrend, while the second candle is bearish, showing rejection at the same high price.

This indicates that buyers attempted to push prices higher but were firmly rejected by sellers at a specific resistance level.

The matching highs signify that the buying pressure has been halted, and sellers are taking control, leading to a potential bearish reversal. Traders who often misidentify Tweezer patterns, especially in volatile markets, should focus on the precise matching highs and the clear shift from bullish to bearish sentiment. A strong Tweezer Top suggests that the upward momentum has exhausted, and a downtrend may begin.

How to identify a Tweezer Bottom pattern?

Identifying a Tweezer Bottom pattern involves looking for its formation at the end of a downtrend. This pattern also comprises two or more candlesticks, but they share identical or very close lows. The first candle is typically bearish, extending the downtrend, while the second candle is bullish, indicating strong buying interest at the same low price.

This formation demonstrates that sellers tried to push prices lower but encountered significant buying pressure at a specific support level.

The identical lows signal that the selling pressure has diminished, and buyers are gaining control, leading to a potential bullish reversal. For traders who struggle with misidentification, paying close attention to the exact matching lows and the transition from bearish to bullish sentiment is key. A robust Tweezer Bottom suggests that the downward momentum is exhausted, and an uptrend may commence.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesTweezer Top vs. Tweezer Bottom: A Quick Comparison

| Feature | Tweezer Top | Tweezer Bottom |

| Preceding Trend | Uptrend | Downtrend |

| First Candle | Bullish | Bearish |

| Second Candle | Bearish | Bullish |

| Key Characteristic | Identical or near-identical highs | Identical or near-identical lows |

| Implication | Potential bearish reversal | Potential bullish reversal |

| Market Psychology | Buyers exhausted, sellers take control | Sellers exhausted, buyers take control |

How to incorporate Tweezer patterns into a complete trading strategy?

Incorporating Tweezer patterns into a trading strategy requires more than just identifying the pattern; it involves developing a comprehensive plan that includes confirmation, precise entry and exit points, and robust risk management. A complete trading strategy makes sure that Tweezer signals are not traded in isolation but as part of a well-defined approach to the market. This holistic view helps traders maximize potential gains while minimizing exposure to losses.

Developing a Tweezer-Based Trading Plan

Developing a Tweezer-based trading plan involves outlining a structured approach for identifying and acting on these reversal signals. First, always confirm the preceding trend (uptrend for Tweezer Top, downtrend for Tweezer Bottom). Second, verify the Tweezer pattern’s formation, paying close attention to the identical highs or lows.

Third, seek confirmation from other technical analysis tools, which significantly enhances the pattern’s reliability.

Fourth, define your entry point immediately after the confirmation of the Tweezer pattern and subsequent price action in the new direction. Fifth, establish clear exit point targets, often at significant support and resistance levels. Finally, always set a stop loss to protect your capital.

A well-defined plan helps to reduce emotional decision-making and makes sure consistent execution.

How to trade Tweezer patterns with other indicators (e.g., RSI, MACD)?

Trading Tweezer patterns with other indicators significantly improves their reliability by providing confirmation of the reversal signal. For example, when a Tweezer Top forms at the peak of an uptrend, look for the Relative Strength Index (RSI) to be in overbought territory (above 70) and then turn downwards. This confluence of signals strongly suggests that the upward momentum is waning.

Similarly, for a Tweezer Bottom, look for the RSI to be in oversold territory (below 30) and then start to move upwards. The Moving Average Convergence Divergence (MACD) indicator can also provide confirmation. A bearish crossover on the MACD (signal line crossing below the MACD line) coinciding with a Tweezer Top reinforces the bearish reversal.

Conversely, a bullish MACD crossover with a Tweezer Bottom strengthens the bullish signal. Studies suggest candlestick patterns like Tweezer patterns have a success rate of 60-70% when combined with 2-3 other confirming indicators. This multi-factor approach leverages the power of different technical analysis tools to validate the Tweezer signal, including volume analysis.

Strategic Entry, Exit, and Stop Loss Placement

Strategic entry point, exit point, and stop loss placement are vital components of any trading strategy using Tweezer patterns. For a Tweezer Top, a common entry point is after the second candle closes and the price begins to move lower, confirming the reversal. Your stop loss should be placed just above the high of the Tweezer pattern, protecting against unexpected upward price movements.

Profit targets (exit points) can be set at the next significant support and resistance level or based on a predetermined risk-reward ratio.

For a Tweezer Bottom, the entry point typically occurs after the second candle closes and the price starts to move higher. The stop loss should be placed just below the low of the Tweezer pattern, safeguarding against further declines. Profit targets can be established at the next major resistance level or by applying a consistent risk-reward ratio.

Always aim for a risk-reward ratio of at least 1:2 or 1:3 to make sure that winning trades sufficiently cover potential losses.

What risk management techniques should be used with Tweezer patterns?

Effective risk management is paramount when trading Tweezer patterns or any other trading strategy. No pattern is 100% reliable, making capital protection essential. One fundamental technique is position sizing, which dictates how much capital you allocate to a single trade.

A common rule is to risk no more than 1-2% of your total trading capital on any given trade. This limits the impact of a single losing trade on your overall portfolio.

Another crucial technique is setting a stop loss order immediately upon entering a trade. As discussed, this order automatically closes your position if the price moves against you beyond a predefined level. Additionally, maintaining a favorable risk-reward ratio helps make sure that potential profits outweigh potential losses.

For instance, if you risk $100, aim for a profit target of at least $200-$300. Finally, avoid over-leveraging, as it can amplify losses rapidly, especially in volatile markets.

What are common mistakes when trading Tweezer patterns?

Common mistakes when trading Tweezer patterns often stem from misidentification, ignoring market context, and failing to use confirmation signals. Many novice traders make errors that lead to false signal generation, hindering profitability. Addressing these pitfalls is crucial for improving trading accuracy and developing a robust approach to pattern-based trading.

Why Misidentification Leads to False Signals

Misidentification of the Tweezer Candlestick Pattern is a primary reason for generating false signals and subsequent trading losses. Traders often incorrectly interpret patterns by not adhering to strict criteria, such as the requirement for identical or near-identical highs or lows. Another common error is ignoring the preceding trend; a Tweezer Top is only valid after an uptrend, and a Tweezer Bottom after a downtrend.

Without this crucial context, a two-candle formation with matching highs or lows may just be noise.

Furthermore, traders sometimes see patterns where none exist, falling victim to confirmation bias. They might force a Tweezer interpretation onto ambiguous price action, especially in choppy, sideways markets. Misidentification of candlestick patterns is a common beginner mistake, leading to up to 40% of false signals for novice traders.

This highlights the importance of rigorous pattern recognition and adherence to established rules.

What are the limitations or false signals of Tweezer patterns?

The limitations or false signals of Tweezer patterns primarily arise from their standalone nature; they are not foolproof and require additional confirmation. A Tweezer pattern by itself, without supporting evidence from other indicators or price action, can often lead to premature entries or exits. For instance, a Tweezer Top might form, but without a subsequent break below a support level or a bearish divergence on an oscillator, the price could simply consolidate before continuing its original trend.

False signals can also occur in highly volatile or low-volume markets where price movements are erratic and less reliable. In such conditions, the identical highs or lows might be coincidental rather than a true reflection of exhausted momentum. The pattern’s effectiveness diminishes when it appears in a sideways or range-bound market, as there is no clear trend to reverse. Therefore, always seeking confluence with multiple technical tools is essential to filter out less reliable signals.

Overcoming Emotional Biases: The Role of Trader Psychology

Trader psychology plays a critical, yet often overlooked, role in the success or failure of pattern-based trading strategies. Emotional decision-making accounts for a significant portion of trading losses, with some estimates putting it at 30-50%. Fear, greed, and impatience are common emotional biases that can lead to poor judgment, such as misinterpreting patterns, chasing trades, or exiting positions too early or too late. For example, fear of missing out (FOMO) might cause a trader to enter a Tweezer trade without proper confirmation, while greed might lead them to hold a winning trade for too long, only to see profits diminish.

To overcome these biases, developing emotional discipline is crucial. This involves sticking strictly to a predefined trading strategy, including entry, exit, and stop loss rules, regardless of market volatility or personal feelings. Practicing mindfulness, maintaining a trading journal to review decisions, and understanding that not every signal will be a winner can help cultivate a more rational and disciplined approach to the markets.

Recognizing the psychological aspect of trading is a key differentiator for long-term success.

Are Tweezer patterns reliable for predicting reversals?

Tweezer patterns are considered reliable for predicting reversals when combined with other confirming indicators and analyzed within the broader market context. Their standalone reliability is moderate, but their predictive power significantly increases with additional validation. Rigorous validation through multi-timeframe analysis and backtesting significantly enhances the reliability of Tweezer pattern signals.

What are the best timeframes to use Tweezer patterns?

The best timeframes to use Tweezer patterns depend on a trader’s strategy, but multi-timeframe analysis significantly enhances their reliability and provides stronger confirmation. Generally, Tweezer patterns observed on higher timeframes (e. g.

, daily, weekly charts) tend to be more robust and reliable for predicting reversals than those on lower timeframes (e. g. , 5-minute, 15-minute charts).

This is because higher timeframes filter out much of the market noise, making the signals more significant.

For a comprehensive approach, traders can identify the overall trend and potential reversal zones on a higher timeframe (e. g. , a daily chart shows a strong downtrend reaching a major support level, with a Tweezer Bottom forming).

Then, they can zoom into a lower timeframe (e. g. , a 1-hour chart) to look for a clearer entry signal or additional confirmation within that reversal zone.

This method helps confirm the larger trend’s reversal while allowing for more precise entry points.

Leveraging Backtesting for Statistical Validation

Backtesting is a critical process for statistically validating the effectiveness and reliability of Tweezer patterns within a specific trading strategy. It involves applying a trading strategy to historical market data to see how it would have performed. This empirical approach allows traders to move beyond anecdotal evidence and assess key metrics like win rate, risk-reward ratio, and drawdown. By backtesting, traders can identify the optimal conditions under which Tweezer patterns are most effective, such as specific market conditions, volume filters, or combinations with other indicators.

For example, backtesting might reveal that Tweezer Bottoms are highly reliable in a particular stock when accompanied by a bullish divergence on the RSI and above-average trading volume. Backtesting can improve a trading strategy’s win rate by 15-20% by identifying optimal conditions and filters. This process helps to build confidence in a strategy before deploying real capital.

Algorithmic trading platforms can automate backtesting, allowing for rapid iteration and optimization of Tweezer-based strategies across vast datasets. This data-driven approach directly addresses the user pain point of “do they actually work in real trading?” by providing quantifiable results.

Considering Market Sentiment & Volatility

Considering market sentiment and volatility is crucial for accurately interpreting Tweezer patterns and assessing their reliability. Overall market sentiment, whether bullish or bearish, can significantly influence how effectively a Tweezer pattern signals a reversal. For instance, a Tweezer Top in a strongly bullish market, driven by overwhelming positive news, might be less reliable as a bearish reversal signal because the underlying sentiment is too strong.

Conversely, a Tweezer Bottom during a widespread panic sell-off could be a very powerful bullish reversal signal as it indicates extreme overselling.

High volatility can also impact the pattern’s effectiveness, potentially leading to more false signals or whipsaws. In highly volatile conditions, price action can be erratic, and what appears to be a Tweezer pattern might quickly be invalidated by rapid price swings. Therefore, traders should exercise caution and seek robust confirmation when Tweezer patterns appear during periods of extreme market sentiment or high volatility, as these conditions can reduce the pattern’s predictive power.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBOTTOM LINE

The Tweezer Candlestick Pattern stands as a potent visual cue for potential market reversals, offering traders a clear indication of shifting momentum. By understanding its distinct structure—identical highs for a Tweezer Top and identical lows for a Tweezer Bottom—traders can better anticipate changes in trend. However, its true power is unlocked not in isolation, but through strategic integration with other technical indicators like RSI and MACD, alongside rigorous risk management techniques.

Crucially, addressing common pitfalls like misidentification and mastering trader psychology are as vital as pattern recognition itself. Ultimately, leveraging advanced techniques such as backtesting and multi-timeframe analysis provides statistical validation, transforming the Tweezer pattern from a simple observation into a high-probability component of a robust trading strategy.