The Relative Strength Index (RSI) measures the speed and magnitude of price changes to identify overbought or oversold conditions across different financial markets. It identifies overbought or oversold conditions and provides trading signals across markets like stocks, forex, and crypto. Its simplicity makes RSI a core tool in technical analysis worldwide.

If you’re just starting out, our Forex Trading for Beginners hub explains how indicators like RSI fit into the basics of trading.

While understanding Relative Strength Index (RSI) is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- RSI is a momentum oscillator that identifies overbought and oversold conditions.

- Created by J. Welles Wilder Jr. in 1978 and introduced in New Concepts in Technical Trading Systems.

- Values range from 0–100: above 70 = overbought, below 30 = oversold.

- Best for range-bound markets, less reliable in strong trends.

- RSI divergence signals trend reversals when price and RSI move in opposite directions.

- Use RSI as confirmation, not a standalone tool—combine with MACD, ADX, or moving averages.

What is the Relative Strength Index (RSI)?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and helps traders identify overbought or oversold conditions. RSI is widely used to gauge trend strength and spot potential reversals in stocks and forex.

History and Origin of the RSI

The RSI was developed by technical analyst J. Welles Wilder Jr. and introduced in his 1978 book New Concepts in Technical Trading Systems. In this same landmark publication, Wilder also unveiled other now-classic indicators such as the Average True Range (ATR) for volatility, the Average Directional Index (ADX) for trend strength, and the Parabolic SAR for stop-and-reverse signals. Together, these tools formed a foundational framework for modern technical analysis, and the RSI quickly became one of the most adopted momentum oscillators worldwide.

What is the RSI Formula and How is it Calculated?

The RSI is calculated using a two-part formula that begins with determining the Relative Strength (RS), which is the ratio of the average gain to the average loss over a specified period. The RSI value is derived from the RS value with the following formula:

RSI=100−[100/(1+RS)].

The calculation process involves these steps:

- Calculate Relative Strength (RS): The RS is the first component needed. The formula is: RS=Average LossAverage Gain.

- Calculate Average Gain and Loss: Over a specific period, you sum the price gains on “up” days and divide by the period length. You then sum the price losses on “down” days and divide by the same period length. The standard period is

14, but traders adjust it for different strategies. Shorter periods like 7 or 9 make the RSI more sensitive, while longer periods like 21 or 30 smooth out the data. - Calculate RSI: Once RS is known, it is plugged into the main RSI formula to produce a value that oscillates between 0 and 100.

For example, assume the average gain over 14 days is 2% and the average loss is 1%.

- First, calculate RS: RS=2%/1%=2.

- Next, use the RSI formula: RSI=100−[100/(1+2)]=100−33.33=66.67.

How Does the RSI Work?

The RSI works by plotting its value on a scale of 0 to 100 to help traders identify potentially overbought or oversold conditions in a security’s price. Traders interpret these thresholds to spot potential price reversals or corrections.

The three most important levels on the RSI scale are:

- Overbought (Above 70): An RSI reading of 70 or above suggests that an asset may be overvalued and is a candidate for a price pullback.

- Oversold (Below 30): An RSI reading of 30 or below indicates that an asset may be undervalued and could be primed for a rebound.

- Neutral Midline (50): The 50-level line represents the midpoint. A cross above 50 suggests that bullish momentum is strengthening, while a drop below 50 indicates growing bearish momentum.

However, the reason these signals emerge is rooted in market psychology. An “overbought” RSI reading does not guarantee an immediate price drop, as strong trends can sustain momentum. Similarly, divergence signals a potential reversal because it reflects weakening underlying momentum even if price continues making new highs or lows. Traders also cross-validate momentum with RSI volume divergence setups, where price/RSI divergence is confirmed by volume patterns.

| RSI Value Range | Market Condition Interpretation | Potential Signal |

| > 70 | Overbought | Bearish Reversal / Sell |

| 30 – 70 | Neutral / Trending Up | Bullish Momentum |

| < 30 | Oversold | Bullish Reversal / Buy |

| Crossing 50 | Momentum Shift | Trend Confirmation |

How to Use the RSI for Trading?

The Relative Strength Index (RSI) is most effective when applied as part of a structured trading approach. On its own, it can highlight potential buy and sell opportunities, but its reliability increases significantly when combined with other confirmation tools and market context. Many traders actively follow RSI signals as entry triggers and then validate them with structure or momentum tools.

Core Applications of RSI

- Buy Signals: A bullish setup often occurs when RSI rises back above the 30 oversold level, suggesting selling pressure is fading and buyers are regaining control.

- Sell Signals: A bearish setup forms when RSI drops back below the 70 overbought level, signaling that buying momentum is weakening and a price correction may follow.

- Trend Confirmation: The 50 midline acts as a trend filter. In an uptrend, RSI tends to stay above 50, while in a downtrend it remains below 50.

Example: A stock like Apple (AAPL) crossing above 30 after a dip may offer a long entry, while EUR/USD dropping below 70 after a strong rally could present a short opportunity.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesBest Practices for Using RSI Effectively

- Combine with Confirmation Tools: Layer RSI signals with moving averages, MACD, or support/resistance. For professional setups, integrate Wilder’s own ADX (trend strength) and ATR (volatility) for deeper validation.

- Apply in the Right Markets: RSI works best in range-bound markets where overbought/oversold signals mark turning points. In strong, parabolic trends, these levels often persist and should be treated with caution.

- Leverage Divergence: Both regular and hidden divergences are powerful signals. Regular divergence may reveal weakening momentum, while hidden divergence often signals continuation within an existing trend.

- Respect Market Psychology: RSI reflects crowd behavior — exhaustion during ranges or persistent momentum in trends. Use it as guidance, but manage risk with discipline and avoid emotional trades.

By combining RSI’s core signals with strategic confirmation and context, traders can transform it from a simple oscillator into a reliable decision-making tool across stocks, forex, and crypto markets.

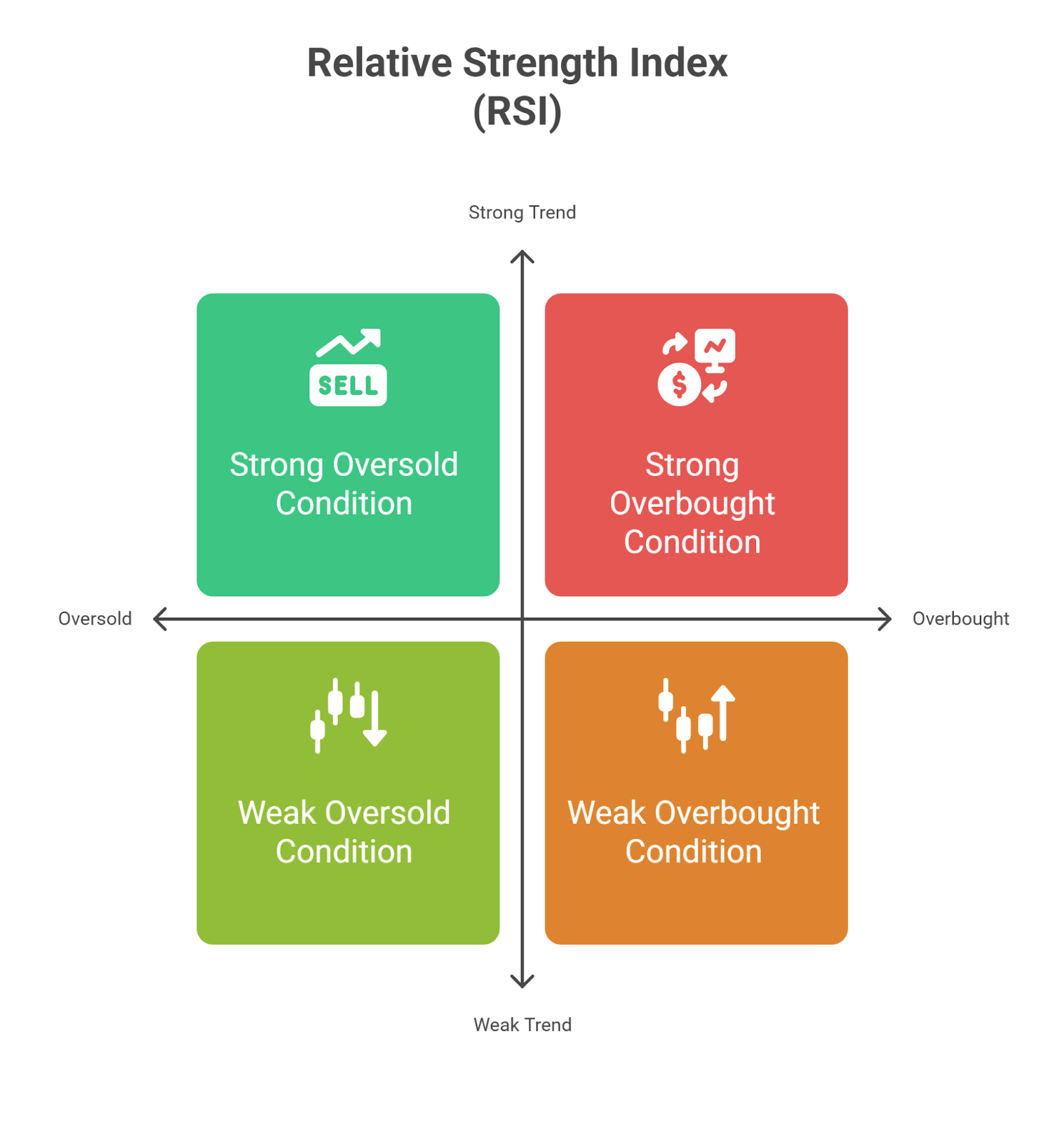

How Does the RSI Behave in Different Market Conditions?

The RSI’s reliability changes with market conditions; it is most effective in range-bound or oscillating markets and less reliable in strong trending markets. Understanding how it behaves in different environments is key to using it effectively.

The following table summarizes RSI behavior in various market states:

| Market Condition | RSI Range | Key Signal Behavior | Example |

| Uptrend | 40–90 | RSI repeatedly hits 70+ but the trend continues, signaling strong momentum. | Tech stocks in a bull run |

| Downtrend | 10–60 | RSI often stays below 30 for extended periods without a significant price reversal. | A forex pair in a bear cycle |

| Range-bound | 30–70 | Overbought/oversold levels work reliably as price oscillates between support and resistance. | A sideways crypto market |

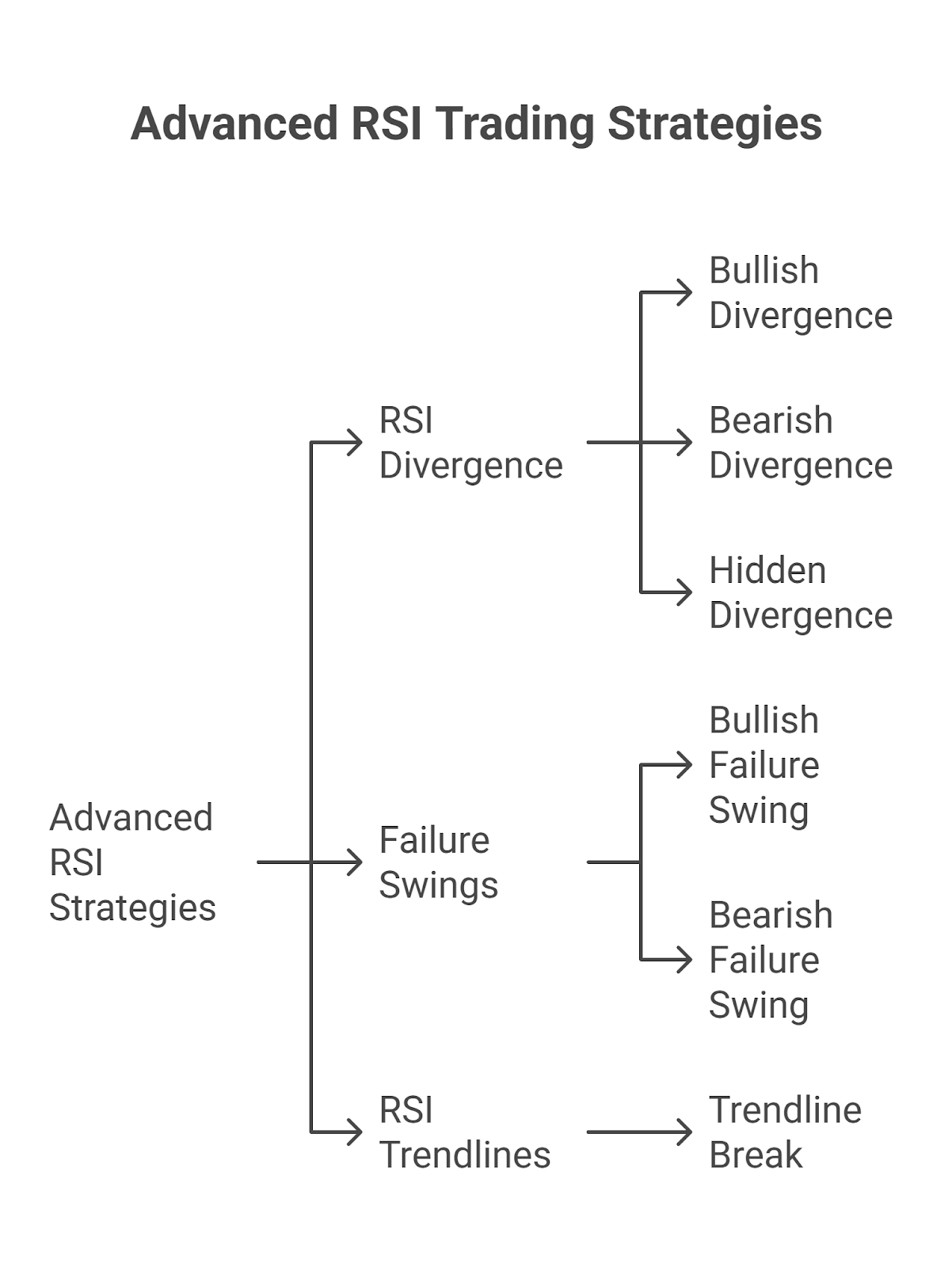

What Are Some Advanced RSI Trading Strategies?

Advanced RSI strategies focus on divergence, failure swings, and trendline analysis to provide deeper insights beyond basic overbought/oversold signals.

- RSI Divergence: This occurs when the direction of the RSI disagrees with the direction of price, often signaling a potential reversal.

- Bullish Divergence: Price makes a new lower low while RSI forms a higher low, showing weakening bearish momentum.

- Bearish Divergence: Price makes a new higher high while RSI forms a lower high, suggesting fading bullish momentum. Overlaying Bollinger Bands with RSI divergence adds volatility context, highlighting whether the price move into overbought or oversold territory has sufficient expansion to sustain or reverse. Some advanced traders also compare SMT vs RSI divergence to filter between false and genuine momentum shifts.

- Hidden Divergence: Unlike regular divergence, hidden divergence signals continuation within a trend. A bullish hidden divergence occurs when price makes a higher low while RSI makes a lower low (supporting the uptrend). Traders often study RSI hidden divergence patterns to confirm trend continuation opportunities.A bearish hidden divergence occurs when price makes a lower high while RSI makes a higher high (confirming the downtrend).

- Failure Swings (or Swing Rejections): Wilder highlighted failure swings as one of the RSI’s most reliable reversal signals, independent of price action.

- Bullish Failure Swing: RSI dips into oversold territory, rises above 30, pulls back without re-entering oversold, and then breaks its prior reaction high.

- Bearish Failure Swing: RSI pushes into overbought territory, falls below 70, bounces without crossing back above 70, and then breaks its prior reaction low.

- RSI Trendlines: Traders can draw trendlines directly on the RSI itself. A break of an RSI trendline often precedes a corresponding break on the price chart, offering an early trend-change warning.

How RSI Compares to Wilder’s Other Indicators (ADX, ATR, Parabolic SAR)

Beyond the RSI, J. Welles Wilder introduced several groundbreaking indicators in his 1978 book New Concepts in Technical Trading Systems, including the Average Directional Index (ADX), Average True Range (ATR), and Parabolic SAR. Together, these tools form a complete framework for analyzing trend strength, volatility, and reversal points.

Placing RSI alongside these indicators provides deeper context for how Wilder envisioned technical analysis as a system rather than relying on a single tool.

- RSI vs. ADX (Average Directional Index): While RSI measures momentum, the ADX measures the strength of a trend, regardless of its direction. A high ADX reading confirms a strong trend, making RSI’s overbought/oversold signals less reliable for reversals and more indicative of continuation.

- RSI vs. ATR (Average True Range): The ATR measures market volatility. A high ATR reading indicates increased volatility, which can cause the RSI to move between overbought and oversold levels more rapidly. Using ATR helps traders adjust their expectations for RSI’s behavior.

- RSI vs. Parabolic SAR: The Parabolic SAR is a trend-following indicator used to identify potential stop-and-reversal points. A trader might use a Parabolic SAR signal to confirm an entry or exit that was first suggested by an RSI divergence or failure swing.

What Are the Best RSI Settings and Adjustments?

The best RSI setting depends on a trader’s style, market, and timeframe, though the default 14-period RSI (introduced by Wilder) remains the most widely used. Changing the period length alters the indicator’s sensitivity to price movements.

Here are the most common adjustments:

- Day Trading and Scalping (5–9 periods): Shorter settings make the RSI more responsive, generating frequent signals on lower timeframes like the 1-minute, 5-minute, or 15-minute charts. Because this increases noise, traders often adjust thresholds to 80/20 instead of 70/30 to reduce false signals.

- Swing Trading (14 periods): The standard 14-period RSI is well-balanced for trades lasting several days to weeks on the 4-hour or daily chart. It’s the default setting in most charting platforms and offers a good compromise between speed and reliability.

- Long-Term Investing (21–30 periods): Longer settings smooth out fluctuations, making the RSI more suitable for weekly or monthly charts. This reduces whipsaws and focuses on major momentum shifts rather than short-term swings.

- Market-Specific Adjustments: In highly volatile markets like crypto, many traders prefer shorter RSIs (7–9) for quicker signals. In steadier markets like blue-chip stocks, longer settings (21–30) are more reliable.

Some advanced traders also experiment with smoothing the RSI using exponential moving averages (EMA-RSI) or combining multiple RSI settings (multi-timeframe analysis) to refine entry and exit signals.

How Does the RSI Compare to Other Indicators?

Traders frequently compare the Relative Strength Index (RSI) with other widely used momentum indicators to decide which tool best suits their strategy. While all measure market momentum, each uses a different calculation method and provides distinct trading signals. Understanding these differences helps traders know when RSI alone is sufficient and when another indicator might be a better fit.

| Indicator | Measures | Primary Use | Signal Type |

| RSI | Speed and magnitude of price changes | Overbought/Oversold Conditions | Leading |

| MACD | Relationship between two EMAs | Trend Direction & Momentum | Lagging |

| Stochastic RSI | RSI’s value relative to its high/low range | Overbought/Oversold (More Sensitive) | Leading |

| MFI | Price and volume data | Overbought/Oversold (Volume-Weighted) | Leading |

RSI vs Price Action Analysis

The Relative Strength Index (RSI) and price action are often compared because they approach the market from two different perspectives.

Price action is the primary source of information, based directly on candlestick patterns, support and resistance, and raw price structure.

RSI, by contrast, is a derived indicator that translates price momentum into numerical values between 0 and 100.

RSI as a Confirmation Tool

RSI should not replace price action but instead serve as a confirmation filter. For example:

- If a bullish engulfing candlestick appears at a strong support level, a rising RSI from oversold territory adds extra confirmation that momentum is shifting.

- If price approaches resistance while showing a bearish reversal pattern, an RSI falling from overbought levels strengthens the sell signal.

Price Action Alone vs. Price Action with RSI

- Price Action Alone: Many professional traders rely solely on price action since it reflects supply and demand in its purest form. However, it requires more discretion and experience to interpret reliably.

- Price Action with RSI: Adding RSI can reduce false signals by highlighting when momentum supports (or contradicts) what the price structure suggests. For example, a breakout above resistance with RSI holding above 50 may indicate stronger conviction than price alone.

When RSI May Conflict with Price Action

Sometimes, RSI will diverge from price action. For instance:

- Price makes a new high, but RSI prints a lower high (bearish divergence).

- Price breaks support, but RSI fails to make a new low (bullish divergence).

These divergences can act as early warnings that the raw price action may not sustain its move.

Pros and Cons of Relative Strength Index (RSI)

The primary advantages of the RSI are its simplicity and versatility in identifying overbought/oversold conditions, while its main disadvantage is its tendency to generate false signals, especially in strong trending markets.

Here is a summary of its pros and cons:

Pros:

- Easy to Use: Its 0-100 scale and clear 30/70 thresholds make it simple for new traders to interpret.

- Provides Early Signals: It can signal potential reversals through divergence before they are visible on the price chart.

- Versatile Application: It is effective across all markets (stocks, forex, crypto) and timeframes.

Cons:

- False Signals: In strong trends, the RSI can give premature reversal signals while the trend continues.

- Prolonged Extremes: The indicator can stay in overbought or oversold territory for long periods, making it difficult to time an exact reversal.

- No Volume Data: The RSI calculation is based solely on price and does not account for trading volume, which can provide additional context about a trend’s strength.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountWhat Are the Limitations of the RSI?

The RSI is useful, but it has clear drawbacks when used alone:

- Prolonged Extremes: In strong trends, RSI can stay overbought or oversold for long periods, leading traders to exit winning trades too early.

- False Reversal Signals: Many “overbought” or “oversold” readings fail, as price can keep trending despite RSI warnings.

- Lagging in Volatile Markets: Since RSI is derived from past price data, it often reacts after sharp moves.

- Lacks Volume Context: RSI ignores volume and external catalysts, which can make signals unreliable.

Best practice: Use RSI as a confirmation tool alongside trend, volume, or volatility indicators (e.g., ADX, ATR, moving averages) rather than as a standalone signal.