Candlestick patterns date back to 17th-century Japan, where rice trader Munehisa Homma began tracking price action to understand market psychology. His work built the foundation for candlestick charting, long before any similar method appeared in the West.

These foundations lead into the study of Japanese candlestick patterns, where multiple candles are grouped to reveal market psychology in action

Modern traders began using candlestick patterns in the 1980s, thanks to analysts like Steve Nison. Since then, candlestick patterns have become a core part of forex technical analysis. Each formation shows how buyers and sellers shift control, like a visual map of market intent.

This guide is your ultimate way to learn how candlestick patterns form, what each pattern means, which ones are the most powerful, and how to use them to trade Forex like a pro.

While understanding Candlestick Patterns is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

First, Let’s Understand Candlestick Chart Basics

Let’s say you are about to place your first trade. You open your chart and see rectangles with lines above and below. Each one is called a candle. You wonder what they mean and how traders use them to decide when to buy or sell.

A single candlestick pattern shows what price did during one time period. It could be one minute, one hour, or one day, depending on the chart. One candle carries four key prices:

- Open

- High

- Low

- Close

Each candle has a body and two wicks. The body tells you where the price started and where it ended. If the close is higher than the open, the candle appears green. If the close is lower, it appears red. The lines above and below the body are called wicks or shadows, which reveal the highest and lowest price reached during that time. This chart type differs significantly from others, as you’ll notice when comparing line vs bar vs candlestick styles used in Forex analysis.

A chart full of candles is your map. Each candle builds on the last one and adds more context. Once you know what a single candle shows, you can group them, spot patterns, and understand the story behind the price.

A Candle Could be Bullish or Bearish. But What Does it Mean?

Before you go ahead and understand candlestick patterns, you need to know who’s in control. Every candle tells you something about buyers and sellers, right? But how do you tell if a candle shows strength or weakness?

A bullish candle forms when price closes higher than it opened. That means buyers pushed the price up. On most charts, it appears green. You often see bullish candles in uptrends or when price bounces from support.

A bearish candle forms when price closes lower than it opened. That shows sellers dominated the session. It usually appears red. Bearish candles appear in downtrends or after price rejects a key level.

Bullish and bearish momentum also shows up in candle size. A long body with small wicks shows strong control while a small body with long wicks shows indecision or rejection.

Don’t even look at patterns if you haven’t trained your eye to spot the pressure in every single candle. Once you do that, patterns will make more sense.

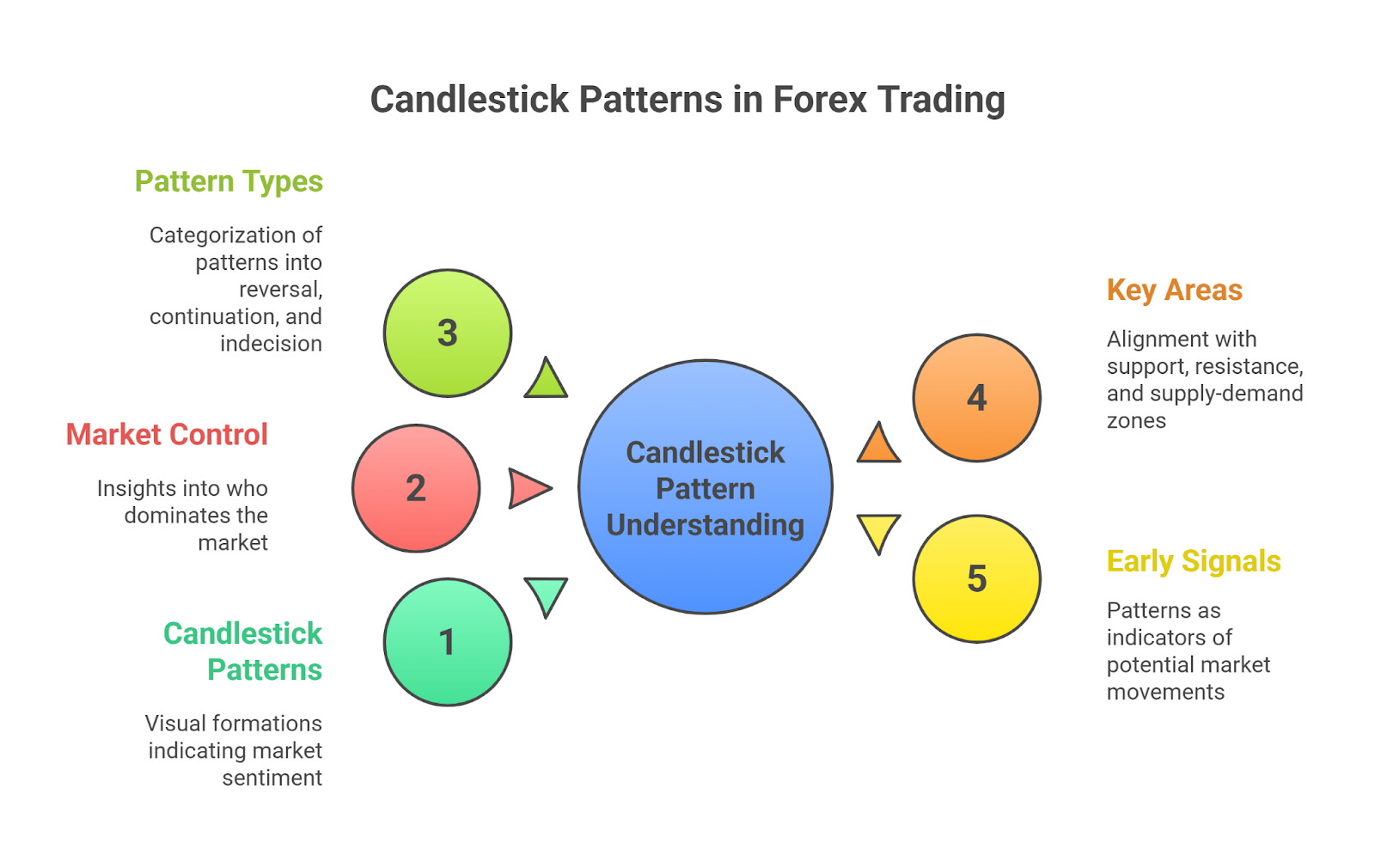

What are Candlestick Patterns in Forex Trading?

Now, you need to grasp that a candlestick pattern is a specific price formation created by one or more candles on a trading chart. Yes, it’s possible that you come across different patterns made from a single candle or from two to five candles grouped together.

Just to be clear that candlestick patterns are visual clues. Each one gives you insight into who controls the market.

There’s a wide range of candlestick patterns, but they are grouped into three broad types. For quick reference, traders often rely on a candlestick cheat sheet that condenses dozens of formations into a single visual guide.:

- Reversal patterns indicate a possible change in trend direction. These are part of the broader family of reversal candlestick patterns that highlight shifts in market control.

- Continuation patterns suggest the current trend might resume

- Indecision patterns reveal market hesitation or low conviction

According to research published in the Review of Quantitative Finance and Accounting (Cohen, 2021), even small variations in candlestick pattern strength can impact performance.

See, your goal is to observe how the candlestick patterns align with key areas like support, resistance, or supply-demand zones. For instance, a bullish engulfing pattern at the end of a downtrend sends a very different message compared to the same pattern appearing inside a sideways range.

It is best to treat candlestick patterns as early signals. For instance, a sudden spike in buying after a long decline might form a hammer or morning star. You can combine this pattern with rising volume or a break above a recent high. It will give you a stronger confirmation.

How Do Candlestick Patterns Actually Work?

Once you understand that a candlestick pattern is a price formation, the next step is to interpret what it tells you about market behavior. Each pattern reflects a battle between buyers and sellers. That battle plays out across different phases: trend continuation, reversal, or hesitation.

Now, the pattern itself is just one part of the story. Where it appears (at support, resistance, or within a trend) gives it meaning. For example, a bullish engulfing near a strong demand zone shows buyer strength. But the same pattern in the middle of a range may lead to noise instead of a move.

You need to consider two key points:

- Structure — Is the pattern complete and clear?

- Location — Does it appear in a logical place on the chart?

It is worth noting that patterns that align with strong price levels or follow a failed breakout often carry more weight. That’s exactly where trading becomes less about memorizing shapes and more about understanding intent.

Studies like Fock et al. (2005) and Cohen (2021) confirm this: candlestick patterns alone may not be statistically reliable without added context like volume, price zones, or confluence from indicators.

So when you look at a chart, stop seeing candles as isolated shapes. Start viewing them as clues to who’s acting and why at a given point in price.

Reversal Candlestick Patterns

| Pattern Name | Number of Candles | Bullish/Bearish | Visual Description | Common Context | Psychological Interpretation |

| Hammer | 1 | Bullish | Small body, long lower wick, little/no upper wick | End of downtrend | Buyers stepped in after early selling |

| Inverted Hammer | 1 | Bullish | Small body, long upper wick, little/no lower wick | End of downtrend | Buyers attempted control but faced resistance |

| Shooting Star | 1 | Bearish | Small body, long upper wick, little/no lower wick | End of uptrend | Sellers pushed back after buyer attempts |

| Hanging Man | 1 | Bearish | Small body, long lower wick, little/no upper wick | End of uptrend | Buyers lost strength; sellers tested lows. The setup gains weight if it forms near a key trend line in Forex, adding structural confirmation. |

| Bullish Engulfing | 2 | Bullish | Small red candle followed by larger green candle that engulfs it | End of downtrend | Strong buyer reversal strength |

| Bearish Engulfing | 2 | Bearish | Small green candle followed by larger red candle that engulfs it | End of uptrend | Strong seller rejection and reversal |

| Morning Star | 3 | Bullish | Red candle, small-bodied candle (gap down), large green candle | End of downtrend | Momentum shifted from sellers to buyers |

| Evening Star | 3 | Bearish | Green candle, small-bodied candle (gap up), large red candle | End of uptrend | Momentum shifted from buyers to sellers |

| Piercing Line | 2 | Bullish | Red candle followed by green candle closing above midpoint of red | End of downtrend | Buyers regained control mid-session |

| Dark Cloud Cover | 2 | Bearish | Green candle followed by red candle closing below midpoint of green | End of uptrend | Sellers took control after brief buying |

| Three White Soldiers | 3 | Bullish | Three consecutive strong green candles with higher closes | End of downtrend | Strong buying conviction over sessions |

| Three Black Crows | 3 | Bearish | Three consecutive strong red candles with lower closes | End of uptrend | Sustained selling pressure and reversal |

Continuation Patterns

| Pattern Name | Number of Candles | Bullish/Bearish | Visual Description | Common Context | Psychological Interpretation |

| Rising Three Methods | 5 | Bullish | A long bullish candle, followed by three small bearish candles within its range, ending with another strong bullish candle | Uptrend | Buyers pause but hold control, then reaffirm trend with strong push |

| Falling Three Methods | 5 | Bearish | A long bearish candle, followed by three small bullish candles within its range, ending with another strong bearish candle | Downtrend | Sellers maintain pressure through a short-term retracement |

| Bullish Flag | Multiple | Bullish | Sharp upward move followed by tight downward consolidation, forming a flag shape | Uptrend | Buyers resting before pushing price further up. A similar bullish continuation setup is the cup and handle pattern, which blends consolidation with breakout momentum. |

| Bearish Flag | Multiple | Bearish | Sharp downward move followed by tight upward consolidation | Downtrend | Sellers resting before resuming downward momentum. Consolidations can also take the form of a rectangle chart pattern, where price compresses within horizontal levels before the next breakout. |

| Bullish Pennant | Multiple | Bullish | Strong bullish pole followed by symmetrical triangle | Uptrend | Market consolidates before bullish continuation |

| Bearish Pennant | Multiple | Bearish | Strong bearish pole followed by symmetrical triangle | Downtrend | Brief consolidation before sellers continue to dominate. A wedge trading pattern often develops in similar pauses, where compression signals a powerful breakout move. |

Indecision Candlestick Patterns

| Pattern Name | Number of Candles | Bullish/Bearish | Visual Description | Common Context | Psychological Interpretation |

| Doji | 1 | Neutral | Open and close are nearly the same; small or no body with long wicks. The wick range of a doji is a key detail that reflects the battle between buyers and sellers. | Appears after long trends, signals potential reversal or pause | Market is undecided, equal strength from buyers and sellers |

| Spinning Top | 1 | Neutral | Small body with upper and lower shadows | Occurs within trends or at tops/bottoms, often a pause in movement | Indicates low conviction, both sides testing but not committing |

| Long-Legged Doji | 1 | Neutral | Very long upper and lower shadows with a central open/close | Seen after strong moves, especially near support/resistance | Extreme uncertainty and balance between forces |

| High-Wave Candle | 1 | Neutral | Very long shadows and small real body | Appears in volatile markets or near key decision points | Market is nervous or unstable, signals hesitation before breakout |

Most Powerful Candlestick Patterns in Forex

Now let’s discuss some of the most powerful candlestick patterns, grouped by bullish and bearish signals:

Bullish Candlestick Patterns

Three White Soldiers

The Three White Soldiers is a bullish candlestick reversal pattern that appears after a downtrend. It consists of three consecutive long-bodied candles, each closing progressively higher. The candles usually have small or no wicks, which indicates strong buying pressure throughout the session.

Key characteristics:

- Appears at the bottom of a downtrend, signalling potential reversal.

- Each candle opens within the previous real body and closes near its high.

- Indicates a sustained advance by bulls over three sessions.

- Best confirmed using volume and indicators like RSI or Stochastic Oscillator.

Traders often view this as a signal to go long, but it is important for you to confirm it before acting. High RSI after the pattern may suggest overbought conditions or impending consolidation. Caution is warranted if the pattern forms near resistance or on low volume.

It is also worth noting that the bearish counterpart of the Three White Soldiers is the Three Black Crows, which signals reversal at the top of an uptrend.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesMorning Star

The Morning Star is a bullish three-candle reversal pattern that signals a potential trend change from a prior downtrend to a new uptrend. It reflects a shift in market sentiment, where bearish pressure weakens, indecision takes hold, and bulls regain control. You can use it to anticipate bottom formations.

The Evening Star is the opposite of Morning Star, which marks the top of an uptrend and signals a bearish reversal.

You need to understand that the Morning Star candle appears after a sustained downtrend, typically 5–10 sessions. The pattern’s structure is as follows:

- First Candle: Long red (bearish) candle continues the decline.

- Second Candle: Small-bodied candle (red, green, or doji) that gaps below the first, signalling indecision.

- Third Candle: Long green (bullish) candle that closes above the midpoint of the first, confirming a reversal.

It ideally forms near support zones, oversold RSI, or lower Bollinger Band. You are very likely to get a signal when the third candle gaps up, forming visual separation.

The best practices you should follow while trading the Morning Star:

- Wait for confirmation via a fourth bullish candle or breakout above resistance.

- Combine with indicators for higher probability setups.

- Works well across timeframes and markets, especially in trending or ranging conditions.

You should also note that it also has a variant. The Morning Star Doji is a stronger version with a doji as the second candle, which indicates clearer indecision and powerful bullish reversal once confirmed.

Deliberation

The Deliberation is a bearish three-candle reversal pattern that appears during an uptrend. It consists of three bullish candles, but the shift in candle strength suggests that buyer momentum is weakening and a reversal could soon follow. You can use it to anticipate short-term exhaustion in a rally.

Here’s an interesting fact. The deliberate pattern often causes short-term sideways movement before the actual drop. That’s where the name comes from. The market is “deliberating” or “stalling” before it commits to the next move.

The stall candlestick pattern’s structure is as follows:

- First Candle: Long white (bullish) candle that continues the uptrend.

- Second Candle: Another bullish candle with a higher open and higher close, confirming upward momentum.

- Third Candle: Small-bodied bullish candle, often a spinning top, which opens near the second candle’s close and closes slightly higher, signalling hesitation.

There is no strict opposite pattern to Deliberation, but the Advance Block is structurally similar and often compared alongside it.

Bearish Candlestick Patterns

Three Black Crows

The Three Black Crows is a bearish reversal pattern made of three long red candles that appear after a bullish phase. It captures the moment when buyers run out of strength and sellers take full control. You can often spot it near the top of an extended uptrend or right after a parabolic rally begins to cool.

Its bullish counterpart is the Three White Soldiers, which forms at the end of a downtrend to signal a potential upward reversal.

Key characteristics:

- Forms at the top of an uptrend, often following overbought conditions.

- Each candle opens inside the previous body and closes significantly lower.

- Candles are full-bodied with little to no lower shadows, which indicates downward strength.

- Strongest signals appear with high volume or near trendline resistance.

You should be cautious if the third candle appears smaller or if the pattern forms near a strong support zone. In such cases, the trend may pause or retrace before continuing lower. It’s best to leverage tools like RSI, MACD, or trendline breaks for reliable confirmation. Traders also watch for chart formations like the head and shoulders pattern, a classic reversal signal that often strengthens candlestick evidence.

Identical Three Crows

The Identical Three Crows is a bearish continuation pattern made up of three near-identical long red candles. It signals strong selling pressure during an uptrend, where each session opens around the prior close and continues lower without hesitation. You can read it as a warning that buyers are no longer defending higher ground.

There is no formal bullish counterpart, but traders often compare it to the Three Black Crows due to visual similarity and bearish intent.

You need to recognize that the Identical Three Crows compress price action downward without much retracement. It reflects steady, methodical bearish dominance rather than aggressive rejection.

Key characteristics:

- Appears during an uptrend, signalling exhaustion or trend reversal.

- All three candles are long-bodied and bearish, with little to no lower shadows.

- The second and third candles open very close to the previous session’s close.

- Stronger when volume rises or the pattern forms near a psychological resistance.

Since the pattern is rare, you may not encounter it frequently on charts. You should always confirm it with additional signals like a break below the 50-day MA, RSI divergence, or nearby support failure. Backtests suggest it performs better in mean-reverting setups than as an immediate short trigger.

Evening Star

The Evening Star is a bearish three-candle reversal pattern that warns of a shift from bullish control to selling pressure. It shows up near the top of an uptrend and often marks the beginning of a downturn. You can think of it as a sign that buyers are running out of steam, and sellers are stepping in with force.

The Morning Star is the opposite pattern, hinting at a reversal from a downtrend into a new rally.

You need to pay attention to where the Evening Star forms. It gains strength when it appears near resistance, in overbought conditions, or after an extended run-up. Each candle in the sequence reflects the mood of the market turning from confidence to hesitation to fear.

Key characteristics:

- Appears after a bullish trend and often signals exhaustion.

- Starts with a strong bullish candle followed by a small-bodied candle (indecision or a doji).

- Ends with a bearish candle that closes well into the body of the first.

- Best confirmed with volume spikes, oscillator divergence, or a close below key support.

You should wait for confirmation before acting. Traders often look for a fourth red candle or a break below recent swing lows. It performs best on daily and higher timeframes, where market noise is reduced. Some traders also track the Evening Doji Star as a stronger variation with a doji in the middle, showing complete loss of momentum before the fall.

Concealing Baby Swallow

The Concealing Baby Swallow is a rare four-candle bearish continuation pattern that appears within strong downtrends. It shows aggressive selling pressure and signals that bears are firmly in control. You can read it as a sign that any brief rally attempt has been absorbed by sellers before price breaks lower again.

It should be clear that concealing baby shallow patterns holds more weight in high-volume markets or when accompanied by large-bodied candles and long shadows, especially in volatile phases.

Key characteristics:

- Forms in an established downtrend and indicates continuation of bearish momentum.

- The first two candles are large bearish marubozus, showing intense selling.

- The third candle opens higher but is engulfed by the second candle, hinting at a failed bullish push.

- The fourth candle confirms weakness by also closing within the second candle’s range.

- Commonly appears on daily or weekly charts during high volatility phases.

You should use this pattern in conjunction with volume spikes, momentum indicators, or news catalysts to confirm strength. Some traders also link its reliability to trend exhaustion points, where price resumes its fall after temporary pauses. It stands out as one of the few four-candle patterns studied for predictive power in academic research on continuation formations.

Three Line Strike

The Three Line Strike is a rare four-candle pattern that sends mixed but tradable signals. It may suggest trend continuation on the surface, but in practice, many traders use it to anticipate reversals. You can find it near key turning points when price action overextends in one direction, then sharply corrects — yet the original trend resumes with strength.

You will come across both bullish and bearish variants of this pattern, each offering a different insight into crowd sentiment. Traders often combine it with RSI, MACD, or support-resistance zones for validation before entry.

Key characteristics:

- The pattern contains four candles: three in the direction of the trend, followed by one strong candle in the opposite direction.

- The fourth candle completely engulfs the prior three bodies, creating emotional whiplash.

- Bullish version: three green candles then a large red one that opens higher and closes below the first.

- Bearish version: three red candles then a large green one that opens lower and closes above the first.

- Often appears near swing highs or lows and is best confirmed using multi-timeframe analysis.

Statistical studies show that this pattern behaves unpredictably as it sometimes reverses and sometimes continues the trend. The reversal tendency of the fourth candle reflects profit-taking, fear, or trap-setting, which makes trader confirmation essential.

It’s also one of the few four-candle patterns that frequently overlap with engulfing setups or show contradictions when volume data is considered.

What is the Most Accurate Candlestick Pattern in Forex?

We thoroughly researched trader insights across public forums, expert commentary, and pattern performance stats to understand which candlestick patterns actually hold weight in real trading.

For instance, according to a Reddit contributor referencing historical analysis, the Three Line Strike has an 84% reversal success rate when it appears at a trend extreme. While stats like this need careful context, it reflects how trusted the pattern is when used with confirmation.

In fact, on Quora, traders repeatedly pointed to the Hammer, Engulfing, and Morning/Evening Star patterns. The Hammer stood out for its ability to reveal buying strength after aggressive sell-offs, especially when paired with volume or support zones.

According to Ian Healy, the Bearish Engulfing pattern was his most reliable bearish setup. It often exposes the exact moment sellers overpower buyers, creating a clean visual transition in control.

So, there is no foolproof pattern. But you can certainly test the accuracy of any pattern by checking if:

- appears after a clearly defined trend.

- volume confirms the reversal direction.

- forms near a known support or resistance level.

- aligns with RSI, MACD, or another momentum indicator.

- past occurrences on your chart led to significant moves.

Ultimately, candlestick patterns work best as decision triggers rather than guarantees. What matters most is how well they fit into your strategy, your tools, and your market structure.

Key Differences Between Forex and Crypto Candlestick Patterns

It is important to grasp that while many candlestick patterns share the same names across Forex and Crypto markets, their behaviour and reliability can differ drastically. Yes, the market structure, volume dynamics, and psychological triggers vary between the two trading ecosystems.

| Aspect | Forex Candlestick Patterns | Crypto Candlestick Patterns |

| Pattern Examples | Doji, Hammer, Morning Star, Evening Star, Three Black Crows, Engulfing | Doji, Hammer, Morning Star, Bart Pattern, Scam Candle, Pump Wick |

| Pattern Adaptation | Traditional patterns (e.g., Engulfing, Doji, Hammer) retain classical interpretations. | Many traders modify or simplify patterns to adjust for crypto volatility or hybrid them with order block strategies. Some also prefer Heikin Ashi candles to smooth volatility and highlight clearer trends. |

| Market Environment | Structured and macro-driven; reflects national economic data, central bank policy, and geopolitical events. | Highly sentiment-driven; reacts to news, social media, developer updates, and influencer activity. |

| Pattern Reliability | Generally higher due to liquidity and institutional order flow. Patterns reflect consistent market psychology. | Less reliable due to extreme volatility and thinner order books. Patterns often fail without additional confirmation. |

| Trading Hours Impact | Patterns form in a 24/5 cycle; weekends off can create gaps at open. | 24/7 market means patterns evolve without gaps but also without cooldown periods, leading to fatigue-based errors. |

| Volume Confirmation | Volume is often broker-sourced and not centralised, making volume analysis less precise. | On-chain and exchange-level volume is transparent and decentralised, offering richer confirmation possibilities. |

| Gap Patterns (e.g., Doji Gaps) | Gaps are common due to news and market closures, making gap-based candlesticks (e.g., Morning Star) effective. | Gaps are rare due to 24/7 operation, so gap-based patterns are less common or significant. |

| Psychological Triggers | Driven by interest rates, inflation reports, and employment data. | Heavily driven by hype, fear of missing out (FOMO), fear, and speculative mania. |

| Pattern Duration | Patterns often stretch over longer timeframes (daily/weekly), aligning with institutional activity cycles. | Shorter timeframes (e.g., 15m, 1h) are frequently used due to rapid moves and shorter trend cycles. |

| Whale Influence | Market size limits the influence of individual traders. Patterns hold more collective significance. | Large holders (‘whales‘) can single-handedly invalidate patterns through massive buys/sells. |

| Technical Clarity | Clean charting environment, especially in major pairs. | Chart noise is higher due to frequent wicks, flash crashes, and lower liquidity in altcoins. |

How to Read Candlestick Patterns?

If you’re staring at a candlestick chart and wondering what those coloured bars mean, you’re not alone. Every trader starts there. The good news? You can decode those candles quickly with a few key ideas.

1. You must understand the candle’s body

Each candlestick captures price action within a chosen time frame — like 5 minutes, 1 hour, or 1 day. The thick part of the candle, known as the real body, shows where the price opened and where it closed during that period.

- A green candle means price increased. It opened lower and closed higher.

- A red candle means the price fell. It opened higher and closed lower.

- A longer body shows strong directional momentum.

- A short body signals indecision or consolidation.

For example, if EUR/USD opened at 1.0800 and closed at 1.0870 on the H1 chart, you’ll see a tall green candle. If it opened at 1.0800 and closed at 1.0810, the body would be short — possibly hinting at weak conviction.

2. You need to spot the candle’s wicks

The thin lines extending above and below the body are called wicks (or shadows). These show the highest and lowest prices reached during the candle’s time period.

- The upper wick shows how high the price reached.

- The lower wick shows how low the price dropped.

For example, GBP/JPY opened at 188.20 and closed at 188.60, but dipped to 187.90 and spiked to 188.90. The candle body shows the open-close movement. The wicks show the full range of volatility.

3. You should pay attention to the sequence

One candle gives you a snapshot. A sequence of candles reveals market psychology — who’s in control, buyers or sellers, and whether that control is shifting.

Some of the most useful patterns include:

- Bullish Engulfing: A small red candle followed by a larger green one that wraps around it. Suggested buyers are taking over.

- Bearish Engulfing: The opposite — a strong red candle swallows a smaller green one, showing rising selling pressure.

- Doji: Very small body, often with long wicks. Reflects indecision — and can hint at a reversal.

- Morning Star / Evening Star: Three-candle formations signalling potential trend changes.

So there is no foolproof pattern, but you can surely check the accuracy of signals by:

- Backtesting on historical Forex charts

- Looking for patterns near key support and resistance zones

- Checking if volume increased during the pattern

- Pairing patterns with tools like RSI, MACD, or trendlines

- Reviewing pattern statistics (e.g. Three Line Strike shows high reversal accuracy in EUR/USD, as discussed in Forex forums)

Final tip? Always zoom out. A candlestick only has meaning when seen in context — within a trend, near a breakout level, or around important zones.

Proven Strategies Using Candlestick Patterns

You have now understand the basics of how to read candlestick patterns. But the real question is: do candlestick patterns work in live markets?

We have compiled real-time performance data and trader success stories from 2020–2025. The results show that candlestick-based strategies, when used with discipline and context, can deliver consistent results in Forex trading.

In fact, according to trading data shared by Pocket Option, the following candlestick types showed impressive win rates and average returns in volatile currency pairs:

| Pattern Type | Trading Period | Success Rate | Average Return |

| Doji | 2020–2021 | 67% | 12.3% |

| Hammer | 2021–2022 | 71% | 15.7% |

| Bullish Engulfing | 2022–2023 | 73% | 18.2% |

You must understand one thing here and that is: all these patterns worked because traders combined them with strong confirmation tools — such as volume spikes, support/resistance zones, and momentum indicators like RSI. This significantly improved their risk-to-reward setups.

Let’s walk through what actually worked:

Strategy 1: Reversal Patterns at Key Levels

Traders who used patterns like Morning Star, Evening Star, and Engulfing around trendline breaks or horizontal support/resistance saw a clear edge.

For instance, Marcus Chen, a retail trader featured in the Pocket Option report, turned $10,000 into $127,000 over 18 months by:

- Trading reversal patterns on the H4 chart

- Confirming entry with volume spikes and confluence indicators

- Using tight stop-loss and trailing exits

- Keeping a trading journal to refine strategy rules

Strategy 2: Risk Management First

According to the same study, risk management accounted for 40% of successful strategy performance. High-performing traders used 1:2+ reward setups consistently and cut losses fast.

Here’s how real traders applied it:

| Pattern | Win Rate | Avg. Risk–Reward |

| Morning Star | 76% | 1:2.5 |

| Evening Star | 72% | 1:2.3 |

| Bullish Engulfing | 68% | 1:2.1 |

These setups are known to create reliable entries, especially after retracements. Only when used in trending pairs like EUR/USD and GBP/JPY.

Strategy 3: Multi-Timeframe Confirmation

The most consistent traders avoided rushing in. So, you should also wait for patterns to appear on higher timeframes (H4 or Daily), and then use M15–H1 for precise entries.

Here’s a proven routine:

- Spot pattern on Daily chart

- Confirm trend with moving average or structure

- Drop to H1 for candle confirmation and entry

- Exit based on reward target, not emotions

Strategy 4: Systemized Pattern Recognition

Pro traders also used tools like TradingView’s pattern alerts or built automated trading rules based on candle criteria, which made it possible to:

- Catch setups in real time

- Remove bias from trades

- Track edge through strategy performance logs

Pocket Option’s institutional desk even reported that real-time pattern recognition + automation improved execution speed and reduced human error.

Now , what can you take away from all this?

There’s no magic in a single candle. But if candlestick patterns appear at the right place, in the right context, with solid risk rules, they can be powerful signals. All backed by decades of data and real trader performance.

So next time you come across a Doji or Engulfing setup on your EUR/USD chart, don’t guess. Step back, confirm the structure, check the volume, and measure the risk. Only then you’ll be able to pull the trigger in the right direction and at the right spot.

What Research Says: Do Candlestick Patterns Really Work?

A study published in the Review of Quantitative Finance and Accounting (Cohen, 2021) showed that pattern strength varies based on surrounding price action. The same pattern, when confirmed by support zones or volume spikes, can outperform random entry by a significant margin.

Another paper published by IEEE (Li et al., 2008) focused on the Morning Star pattern in the Shenzhen Stock Market. Researchers used a Radial Basis Function Neural Network (RBFNN) trained with a Localized Generalization Error Model. Their model reduced false positives by up to 69% when the pattern was quantitatively defined and applied with market context. See, this means patterns work better when interpreted with structure and confluence.

In fact, earlier studies like Fock et al. (2005) also concluded that candlestick patterns could outperform baseline strategies, especially when used with volume data and technical filters.

You can take two key insights from this:

- A candlestick shape alone means little without the right context

- The statistical edge grows when patterns align with broader price dynamics like support, resistance, or failed breakouts

Common Mistakes When Trading Candlestick Patterns

- Ignoring the overall market trend when spotting a pattern

- Trading patterns without waiting for candle confirmation

- Relying on patterns alone without volume or support/resistance zones

- Misidentifying patterns due to improper chart timeframes

- Entering trades before the pattern is fully formed

- Overtrading due to seeing patterns everywhere

- Using patterns without backtesting their historical performance

- Failing to consider risk-to-reward ratios before trade entry

- Applying stock-based patterns directly to forex without adjustment

- Skipping context checks like supply/demand zones or news impact

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

Now, if you are ready to pull off your first trade, make sure to take a moment and read the chart like a map. Start by asking what the candles are trying to show.

Look at the pattern, then look around it. Is it forming a strong support? Has volume increased? Does it align with a larger trend?

Once everything lines up, you move with clarity. But remember that you are not supposed to guess. You simply respond. That’s exactly how you trade with confidence, using candlesticks as decision-makers.